Podcast: Play in new window

Precious metals start their climb again as gold reaches back up above $4,200 and silver surges up 10.5% to just over $58. Following the pre-holiday spike, the S&P remains relatively flat. Meanwhile, volatility in the crypto markets appears to be pushing sentiment back towards precious metals. Between the chaotic crypto markets and ongoing global demand for metals, this bull market may be just beginning.

Let’s take a look at where prices stand as of Wednesday, December 3:

The price of gold is up about 1.5%, currently sitting at $4,210.

The price of silver is up a whopping 10.5%, sitting at $58.50 as of recording.

Platinum is up 3% to $1,655.

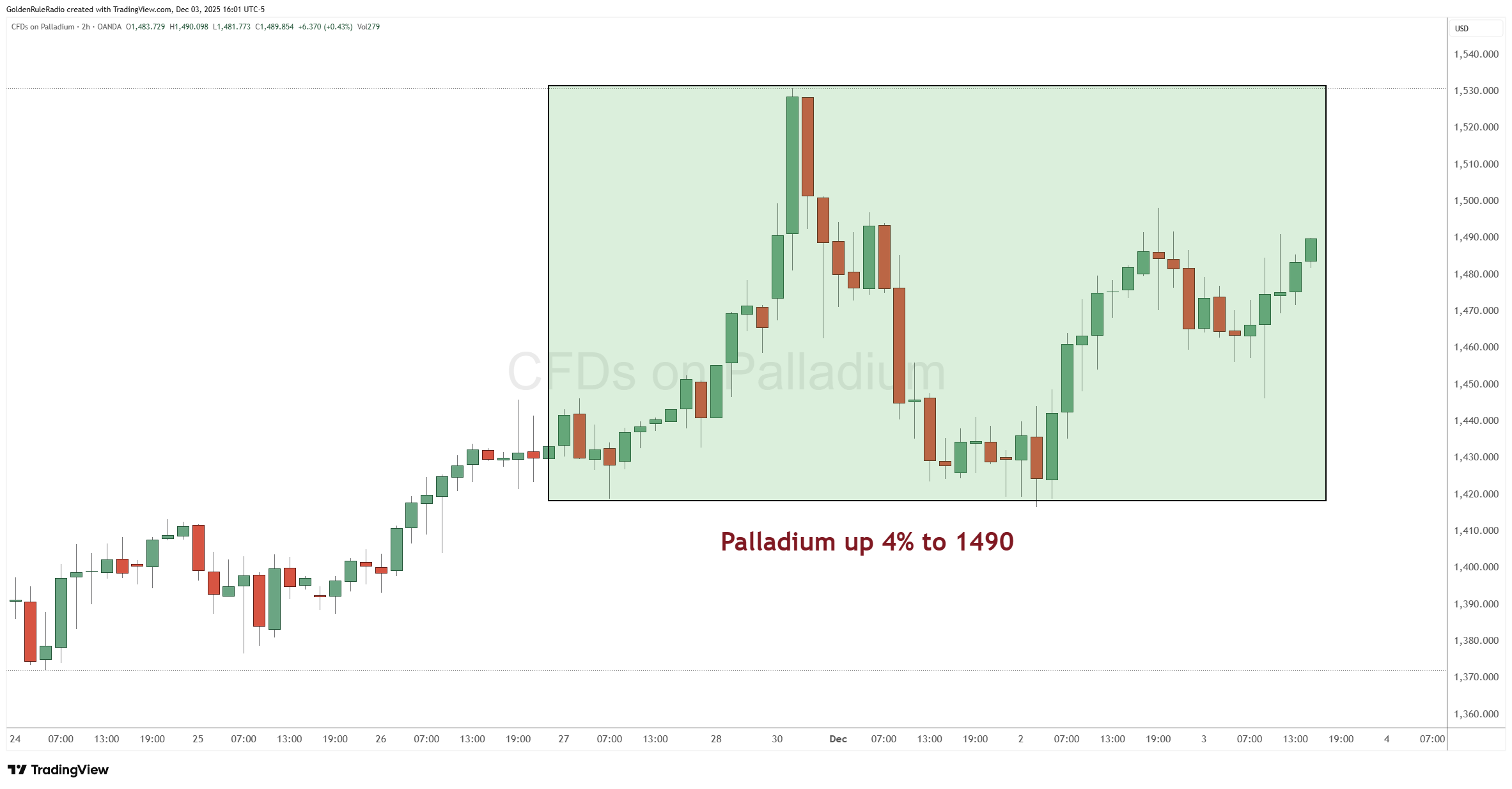

Palladium is up about 4% to just around $1,490. It is now lagging just a little behind its sister metal.

Looking over at the paper markets…

The S&P 500 is about flat week over week at 6,840. It had a nice run up just before Thanksgiving.

The US Dollar Index is down about 0.5%, sitting at 98.8.

Silver’s Surge and The Falling Gold‑Silver Ratio

Since Thanksgiving, gold has pushed to roughly 4,200 per ounce while silver has jumped to about 58.5, giving silver a weekly move nearly seven times larger than gold in percentage terms. That has driven the gold‑to‑silver ratio down from extreme levels above 100 earlier this year to roughly 72 today, a clear sign that silver is finally outperforming gold after years of lagging.

This ratio shift is typical of a strengthening precious‑metals bull market: gold generally leads early, and silver plays “catch‑up” later with outsized percentage moves once the narrative broadens from institutional hedging to a broader inflation and monetary‑debasement story. We think a near‑term resistance area for silver in the high 60s is plausible, but the magnitude and speed of this year’s move have caught most analysts by surprise. The trend can overshoot traditional targets in a strong bull phase.

Investors Shift From Crypto to Metals

While gold and silver have been climbing, Bitcoin has been stepping down from highs above 120,000 into the 80,000s, with a series of lower highs and higher floors that highlight just how speculative and volatile that market remains. We’re seeing clients who made money in crypto over the last several years now “take chips off the table” and move a portion into gold, treating gold as the long‑term store of purchasing power that sits underneath their higher‑octane.

This is part of a broader top‑down pattern: central banks and large institutions began accumulating gold aggressively several years ago as a hedge against dollar debasement and geopolitical risk, while the general public has yet to flood into metals the way it did after the 2008 crisis. In that sense, 2025 in gold looks more like the 2002–2006 “building phase” than the 2011 “mania phase,” with strong fundamental drivers (debt, deficits, easing expectations) but without the emotional, panic‑driven retail buying that typically marks a final blow‑off top.

A Rare Window: Old Coins and Junk Silver Near Melt

What’s striking is how badly premiums have compressed on older, semi‑numismatic U.S. gold and silver coins compared to modern bullion products. In some cases, investors can buy 90 percent “junk” silver coins and common‑date Morgan dollars at or even slightly below their melt value per ounce, while 100‑ounce silver bars and modern bullion coins carry higher per‑ounce pricing.

We’ve seen the same anomaly in gold: certain circulated or mint‑state $5 and $10 U.S. gold pieces from the late 1800s and early 1900s are trading at a discount of 100–150 per ounce to modern quarter‑ounce American Eagles. This is despite their age, scarcity, and historical track record of carrying meaningful premiums in past cycles. For investors, that creates a dual‑benefit opportunity: if spot metals prices keep rising, you participate in that move, and if (or when) collector and semi‑numismatic premiums normalize, you have an additional 20–30 percent upside in premium alone based on historic ranges.

Using premiums and ratios to add “free ounces”

It’s important to note this isn’t just a story about price, but about structure and strategy. Spreads and premiums are tools that can be used to increase total ounces over a full cycle without adding new cash. When semi‑numismatic products such as old U.S. gold pieces, Morgan dollars, or proof American Eagles are temporarily cheap relative to plain bullion, investors can accumulate them with very little “premium risk,” and later, when premiums spike, swap back into low‑premium bullion at a better ounce‑for‑ounce rate.

In prior cycles, we’ve seen investors trading out of proof Eagles or high‑premium junk silver when premiums were 20–30 percent above melt into standard bullion coins or bars. This effectively can turn 10 ounces into 13 or 14 ounces solely by capturing the premium gap. Today, the same logic works in reverse: with proof Eagles priced similarly to regular Eagles in IRAs, and with old U.S. gold and silver coins sitting near melt, the opportunity is to buy or swap into the underpriced category now, anticipating a later reversal when public demand and collector interest push those premiums higher again.

How to Invest Now

The trend in gold remains up, with central banks, deficits, and expectations of further rate cuts continuing to support higher prices even after a big multi‑year run; regular, disciplined accumulation (such as biweekly or monthly purchases) still makes sense as a way to build a core position without trying to time every wiggle.

Silver’s recent leadership and the sharp drop in the gold‑silver ratio argue for considering some incremental silver exposure—especially for those who are heavily skewed to gold—while recognizing that silver’s volatility will be greater both up and down.

Finally, the unusual pricing in older U.S. coins and junk silver suggests this is a genuine buyer’s market in select physical products, even at all‑time‑high spot prices. That’s because investors can acquire historically “premium” material at close to bullion pricing.

Here to Help

The team at McAlvany Precious Metals has a collective 75 years experience investing in the precious metals market. We are happy to speak with you about your goals on a no-obligation, complimentary consultation. Reach out to us at 800-525-9556.