Podcast: Play in new window

Gold surged 4% since last week, while silver has risen 1.6%, maintaining a gold-to-silver ratio near 90:1. Platinum and palladium also saw gains, up 1.7% and 1%, respectively. Meanwhile, the stock market remains under pressure, climbing back up in small increments, but all staying below their 200-day moving averages. Let’s take a look at where prices stand as of our recording on March 19:

The price of gold is up 4% to $3046 from a week earlier. Gold is starting to look a little bit parabolic.

The price of silver is up 1.6% from our recording last week to $33.80. As we’re recording, we’re flirting with that 90 to one gold to silver ratio.

Platinum is up 1.7% to $1,005 an ounce. and a little bit behind it.

Palladium is up about 0.85% to $955 per ounce, just about flat from a week earlier.

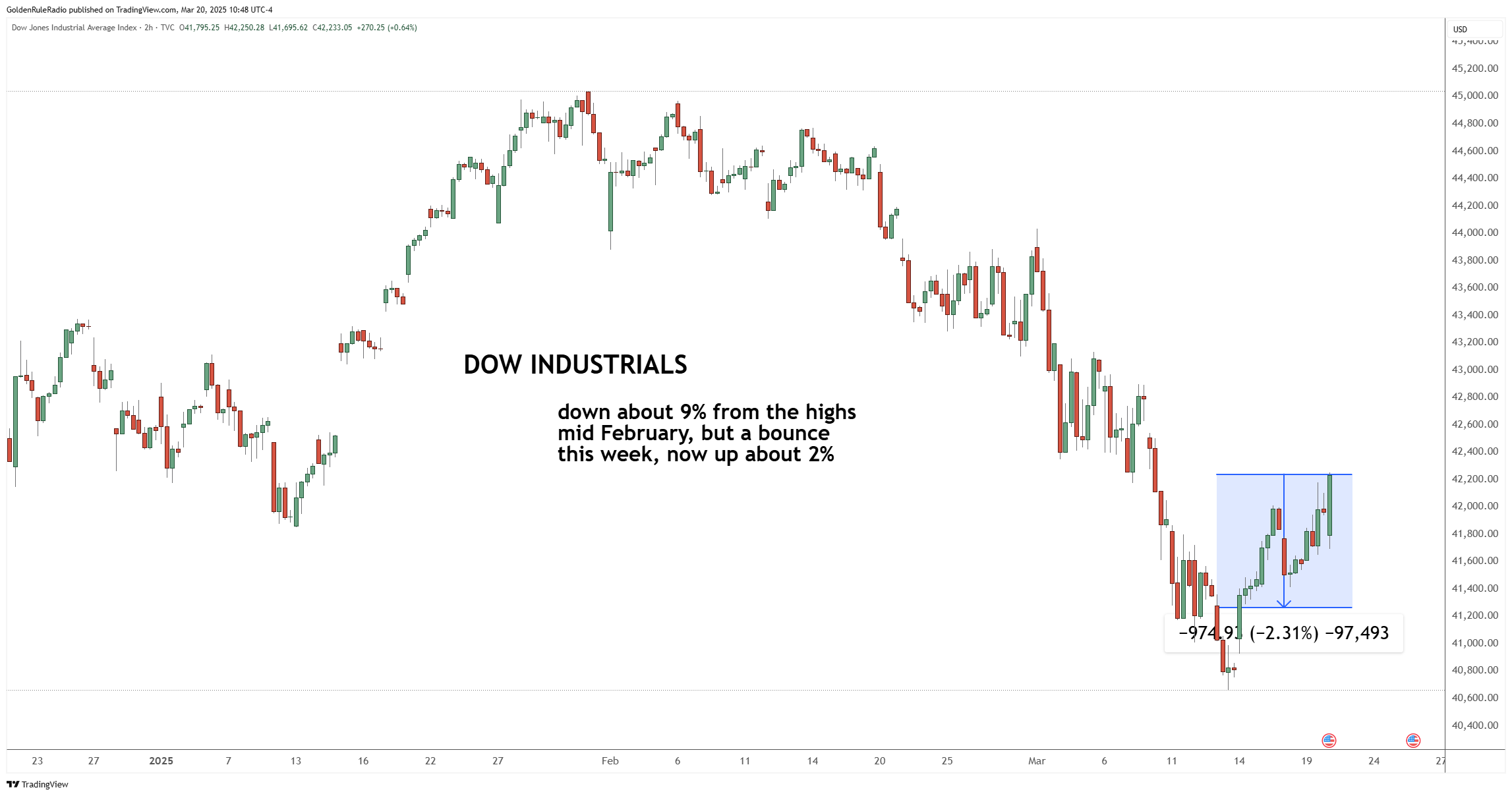

Looking at the paper markets, which are still in correction territory and about 9% from where they topped…

The DJIA is up 1.6% sitting just under 42,000.

The S&P 500 is up 1.5% to 5,680, a small bounce up from last week.

The NASDAQ is up about 0.2% to 19,580 — pretty much flat from a week earlier.

Now all three of those paper markets have been sitting below their 200-day moving average now for about the last week or so.

The dollar index is sitting flat around $103.05 after falling off a cliff over the last week or two.

Going Long on Gold

As we discussed a few weeks ago, the commitment of traders report shows more of the institutional investors betting long on gold. There are about 215,000 long contracts compared to about 33,000 short. So at least as of last week, the long contracts keep flowing.

Institutional investors are repatriating gold from abroad and unwinding their short positions. The gold carry trade has been circling about the precious metals industry for 25 years as a mechanism to borrow gold at a very cheap rate and use the proceeds to invest in whatever the institution wanted to, and then keeping the price of gold low, replacing it at the end of the year or end of the contract at a cheaper price.

Well, that’s not working right now. Institutions are leading this short covering rally. It’s not the retail investor driving into the gold market. Most of the retail customers are enjoying the direction the country is in right now.

More broadly, there is a paradigm shift happening with the markets. The new administration is lending credence to the gold market by talking about it for the first time in 40 years, giving it significance rather than just trying to minimize its significance.

Tariffs Add Pressure to Equities

The mainstream media continues to attack the economy, raising red flags about tariffs and the trade war concerns, and the expectations for continuing inflation.

At Wednesday’s FOMC meeting, Chairman Powell got a little political, indicating that they would withhold any cuts because they’re uncertain about the effect tariffs would have on driving inflation higher.

Main Street feels like the economy is great. I don’t think that Main Street feels like the economy is terrible, but they may not feel secure that it is great. And the president’s focus is on making Main Street USA great. The risk to that could be that the equities go beyond the recent correction into bearish territory or a recession.

The Latest Gold Opportunity

Right now, you can buy certified 100-year-old old Saints and Liberties — MS 62, MS 63, MS 64 — for less money per coin than Gold Eagles right now.

The prices on these Saints and Liberties have gone up to two or three times the price of gold in the past. But now you can get them for less than the price of a gold bullion coin. We have never seen this happen.

If you’re ready to add more real gold ounces to your portfolio, please give McAlvany a call. You can call us at (800) 525-9556, and one of our trusted advisors will help you get started.