Here’s our weekly report on the price moves of precious metals for May 8. As of this recording, here is where precious metals stand:

Gold is currently $2,308, down slightly after a mild correction and bounce.

The silver price is at $27.32, a strong week following a 50% retracement.

The platinum price is at $976, continuing a strong rise from the week before and beating palladium.

The price of palladium is at $953, holding steady at the time of recording, but remaining below platinum.

The S&P 500 is at 5,189, up about 170 points, and a volatile rise over the last two weeks. It is still below April’s highs.

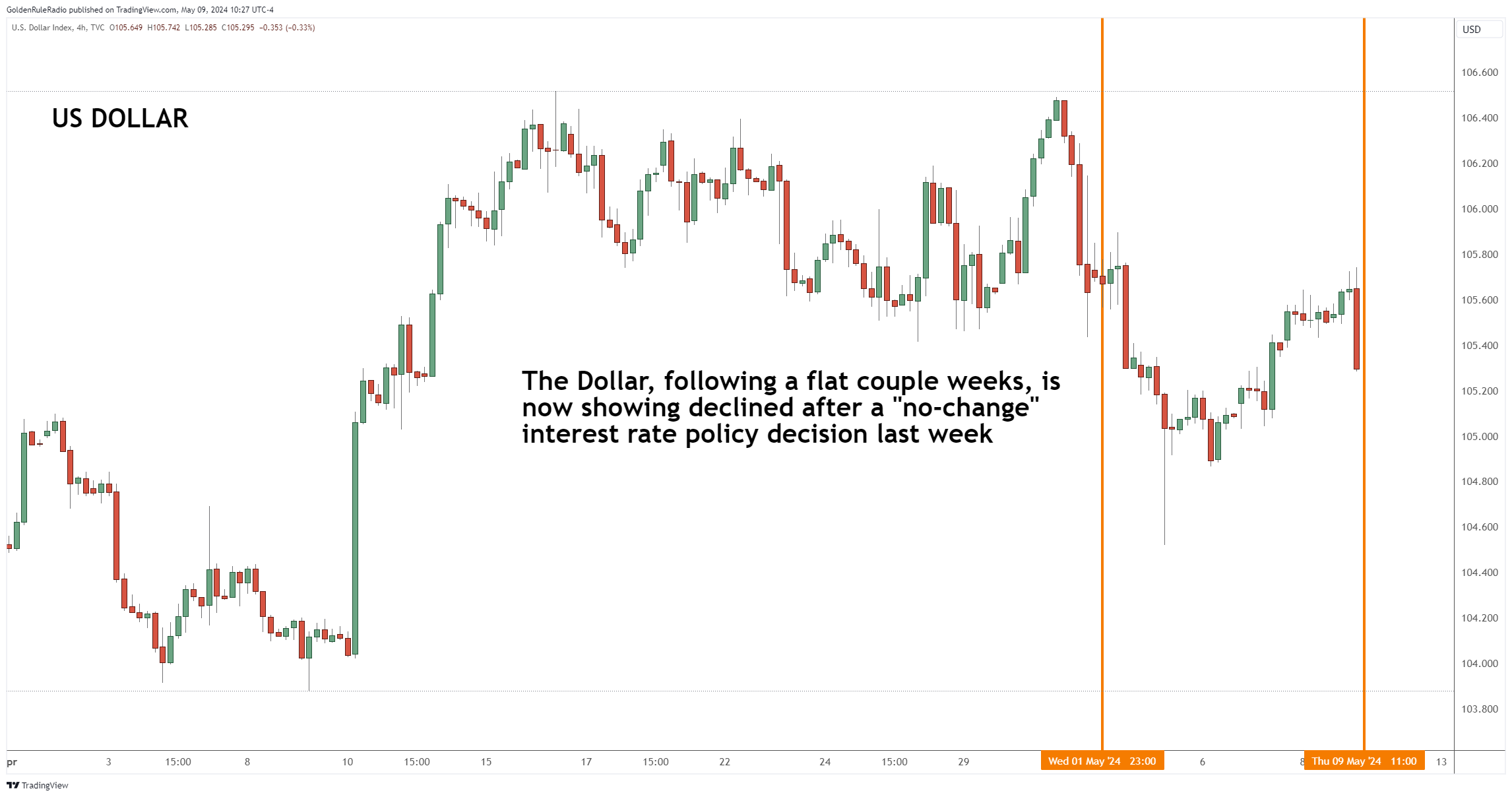

The dollar is sitting at around $105.5, slightly down this week.

Watching the platinum-palladium ratio shift

Platinum had a pretty firm ceiling around $1,000 per ounce over the last year. But its lows have been trending higher for the past few months, from around $840 up to $880. Meanwhile, the price of palladium has been trending lower. The platinum-palladium ratio is moving into platinum’s favor.

Markets rally on lower-than-expected jobs data

Looking at underlying fundamentals, the non-farm payrolls data had worse-than-expected employment numbers. There were 175,000 jobs added, with an expectation of 240,000 jobs added. This is a statistic that the Federal Reserve looks at when trying to determine whether to raise rates or cut rates. Weaker jobs data point to a greater chance in a future rate cut.

Silver shines brighter in the gold-silver ratio

Silver has had a solid growth period this spring, rising from around $22.40 to just under $30 in April. While it had a 50% retracement, the price of silver still remains strong. It looks like the price could test $29 or $30 in the next few weeks.

Listen to the full episode to get all the details of our team’s analysis.

Should you make a gold-silver ratio trade?

If you have been holding gold that you purchased anywhere from 12-15 years ago, now could be the perfect time to trade some of their gold ounces in for a significant increase in silver ounces.

Get in touch with a trusted McAlvany advisor to see if a gold-silver ratio trade is right for you.