Here’s our weekly recap of the precious metals markets for July 3. As of this recording, here is where precious metals stand:

The price of gold is up 2.7% since our last recording, and it was up 4.7% over the quarter. Year to date, with today’s move, gold is up over 15% so far this year.

The price of silver is up 6% this week. It was already up 17% for the second quarter, and up 23% for the year.

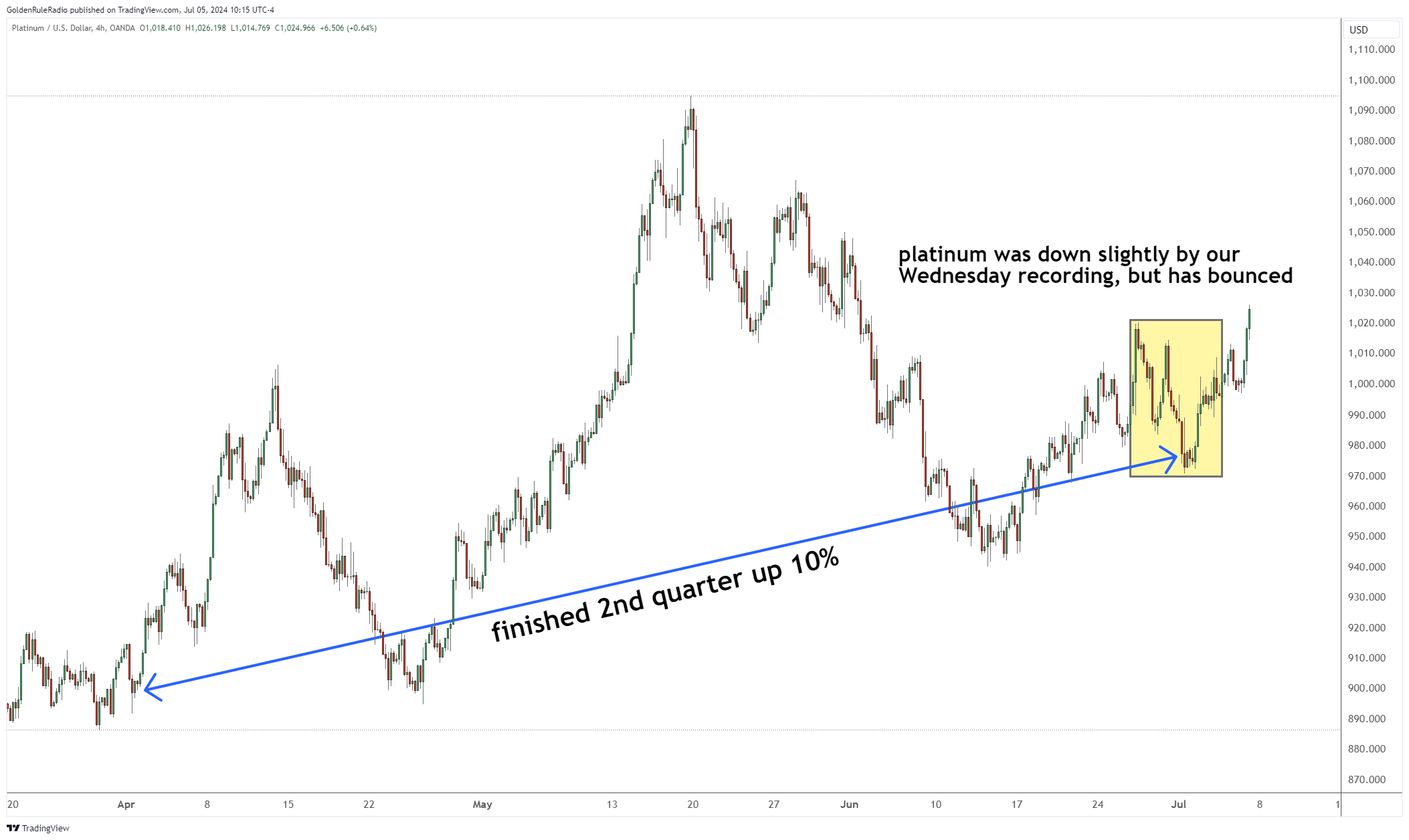

The price of platinum is down 1.5% for the week, but it had a strong quarter — up almost 10% at 9.7% for the second quarter. Looking at the year-to-date performance, platinum is actually down about 1% as of this recording.

The price of palladium had a rally as of this recording, up 10% at $1,050. It was down 4% in the second quarter and down 11% year to date. So now it’s almost flat.

The two industrial metals are bringing up the rear, but they are trying to flirt with positive territory.

Gold to Silver Ratio

Looking at the quarterly and annual numbers, let’s take a look at the movements in the gold to silver ratio.

The gold to silver ratio was 92 in February. It then declined to 72 in May, and then bounced back up to 80 at the end of June. As of this recording, the gold to silver ratio is back down to around 76 today.

Because silver is up by 6% today while gold is up by 3%, it is narrowing the trade range — which means that gold is becoming more favorable.

Far more important than the spot price climbing is that ratio contracting because it opens up opportunities for ratio trades that help produce the compounding ounce effect. Making an effective gold-to-silver ratio trade is what gives you exponential growth in your metals portfolio over time.

Where is Gold Going?

With the most recent decline in gold back in the end of May, there was a declining floor to ceiling trend line. Gold has broken above that today, and it has put in a higher high double bottom at that 382 fib.

Gold has made one of the first stair step moves that start arguing gold could be moving to a higher price. If you look back at June 21 when gold was around $2330, the price of gold is about to push above that high. So it is moving into new territory where the price could be potentially closer to $2,500 per ounce in the fall.

When to Buy Gold?

There is no better time to make an investment move than when the waters are quiet. It’s the best fishing. It’s the best time to get out there. It’s summer and the waters are quiet.

If you haven’t talked to your ICA broker in a while, it’s time to do so. We can be reached at 800-525-9556.