Here’s our weekly recap of the precious metals markets for July 31. As of this recording, here is where precious metals stand:

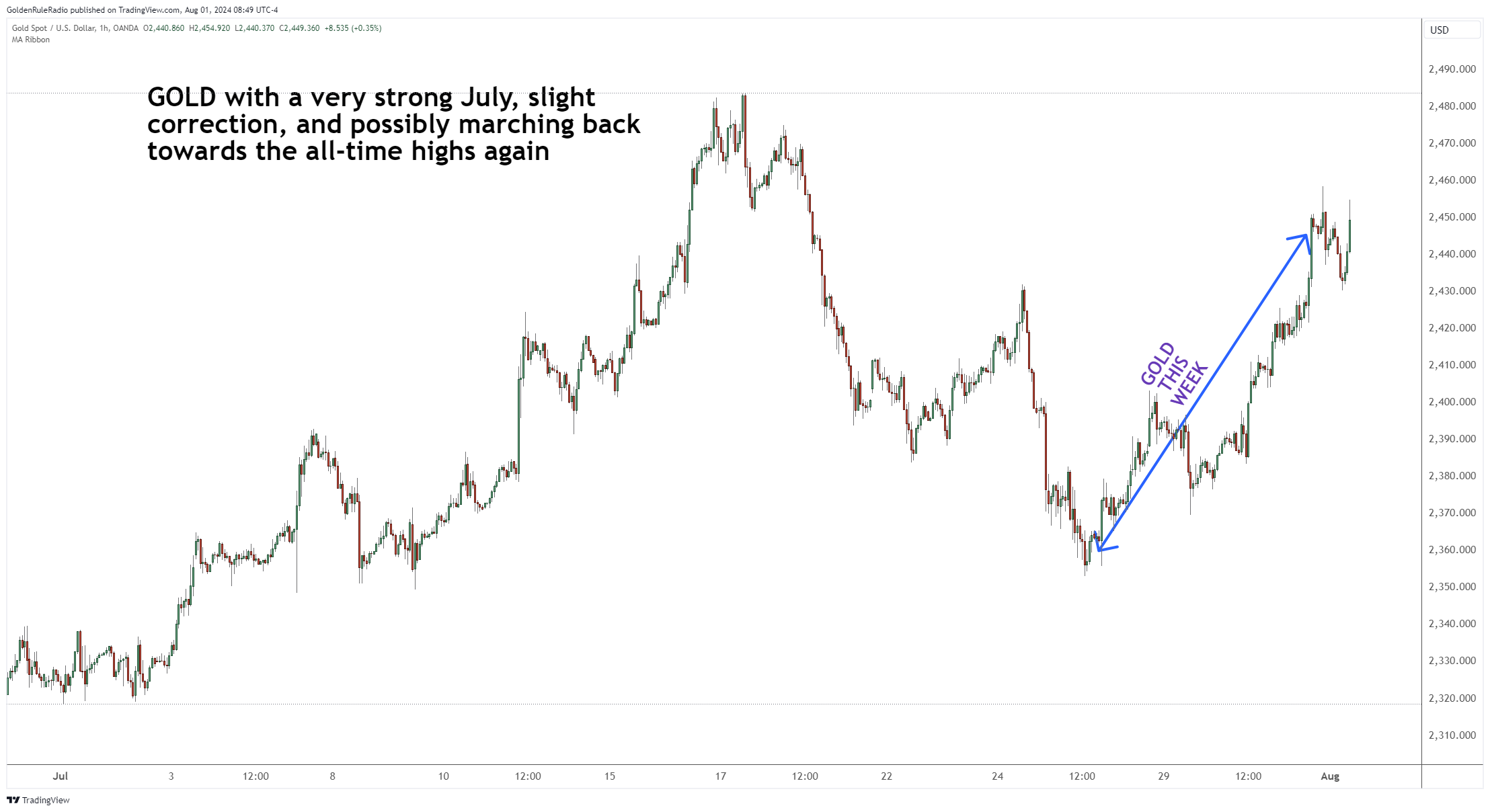

The price of gold is up to $2,450, or about 3% for the week. However, most of those gains happened within the last few hours of this recording.

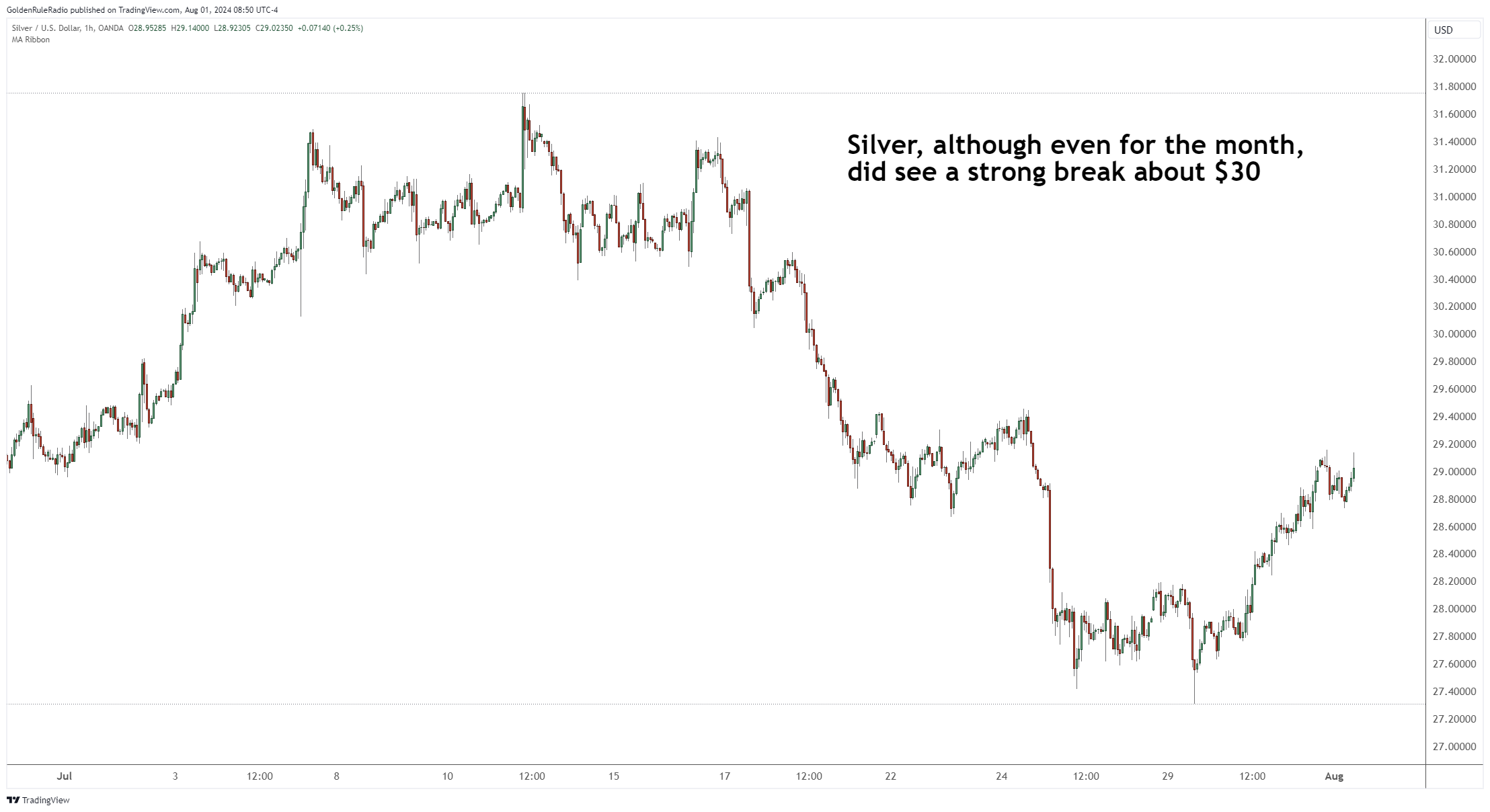

The price of silver is just above $29, up around 3.8% from the week before. Still under $30, but it is increasing.

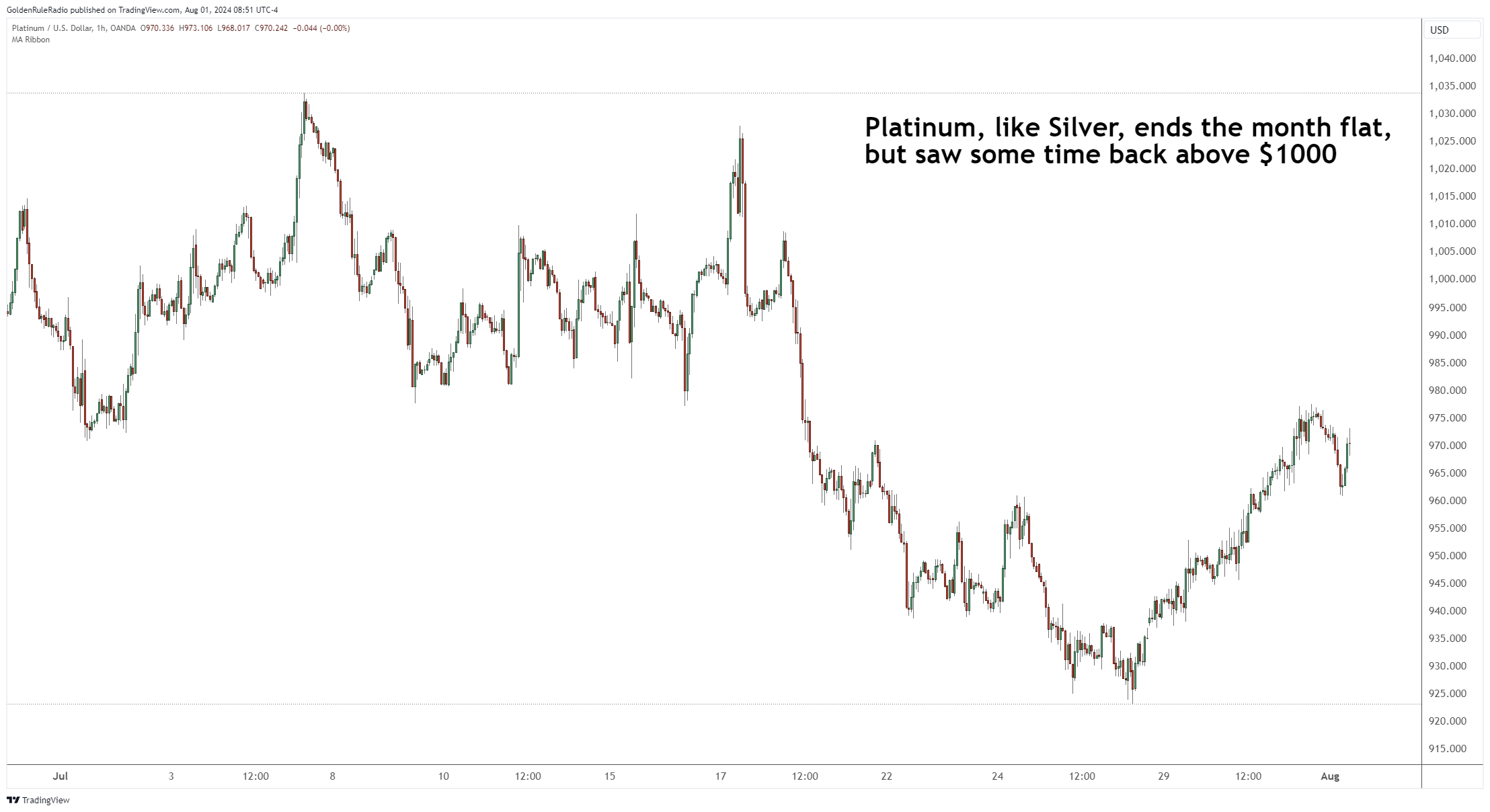

The price of platinum is up to $977, a gain of 4.3% from a week prior. It’s doing the best this week of the metals.

The price of palladium is up at $913, about 2% and still sitting a little below platinum.

The price of palladium is up at $913, about 2% and still sitting a little below platinum.

Looking at the US equities markets…

The DJIA is up 2.5%, S&P 500 is up about 1.7% and the Dow Transports is up 3.8%, although still lagging behind the other indicators.

The US dollar is down 0.25%, sitting just above $104.

Sideways Move for Gold

The market can cool itself off one of two ways. It can either reverse and correct off some of the highs when it has been overbought. Or it can sit sideways for three or four months.

Gold is proving to remain strong with its sideways chopping. It has been choppy throughout the summer, but its price has been steadily increasing — with higher highs and higher lows. The way it looks now, we predict gold won’t dip below $2,000 for a long time — if ever again.

Rates Remain Steady

For the July 31 meeting of the Federal Open Market Committee (FOMC), there was about a 7% chance of an interest rate cut — and it didn’t happen. The market is looking out to September for a potential rate cut.

Meanwhile, there is political instability in the US, concerns in the Middle East and eastern Europe, and the China and Taiwan issue. With all the geopolitical uncertainty stirring up, we see bigger moves for gold in the fall as investors seek stability.

Take Action Today

If you’re ready to secure your portfolio with precious metals, get in touch with a McAlvany precious metals advisor. Your trusted advisor is available to help you find the right investments to meet your personal financial goals.

If you haven’t talked to your ICA broker in a while, it’s time to do so. We can be reached at 800-525-9556.