Here’s our weekly recap of the precious metals markets for June 19. As of this recording, here is where precious metals stand:

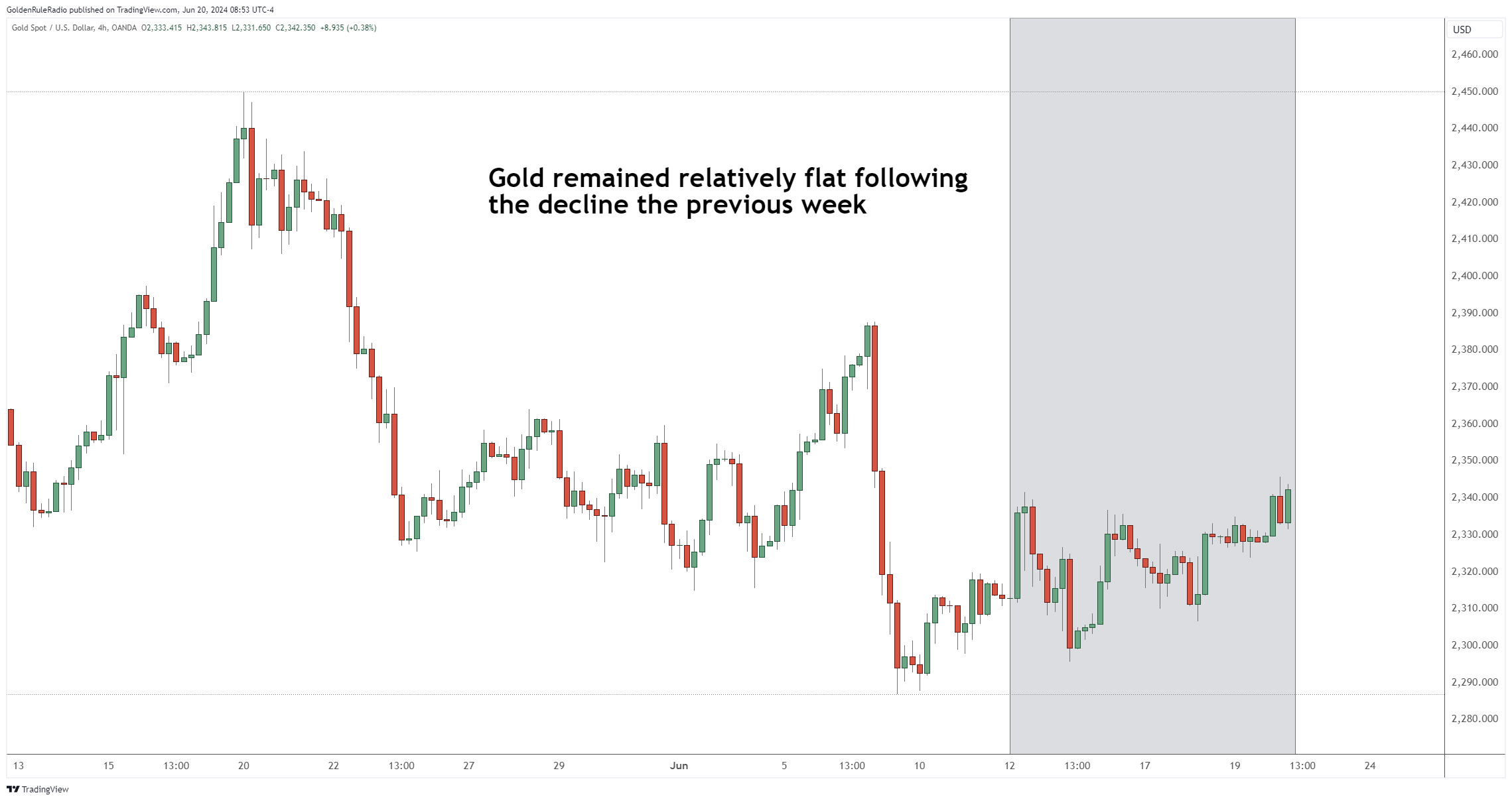

The price of gold rose to $2,330, up slightly from $2,326 last week.

The price of silver is flat at $29.71 per ounce.

Platinum is currently $988, up slightly from $967 last week.

Palladium is at $924, up $1 from a week before.

Over on the equity market….

The S&P 500 rose up about 2.5% almost hitting 5,500.

The Dow Jones Transportation Average Index had a very volatile week last week. The total range from top to bottom was about a 5% move up and down in a week.

The Magnificent Seven

Looking at the overall equities markets, the vast majority of the gains have been in tech sector stocks: Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla. Also known as the Magnificent Seven, these stocks have a combined market value of over $15 trillion, and they’re now equal to 50% of the GDP.

It may feel reminiscent of the dot-com days of the late 1990s, even if they are founded on legitimate, long-term technology. And it’s no surprise, because these stocks are up about 60% in the last 12 months — which is bubble behavior.

BRICs Spectre

Could this be the end of the US Petrodollar? Let’s look at the geopolitical landscape.

The BRICs countries will meet in the next couple of weeks. There are now over a hundred countries that want to join the BRICs, and shift away from the US and European market into their own currency. Gold is a very strong drive into the BRICs revolution.

What is the best way to prepare for a changing world where the United States is no longer what it was 10 years ago?

Follow The Money

What are the ultra wealthy doing? They are moving more of their money out of equities and purchasing land and gold. They are reducing their paper exposure to geopolitical instability, runaway inflation, and outsized government pending.

Prep Yourself

How much gold should you have to protect yourself from geopolitical uncertainty? The best way to plan is to work with a trusted McAlvany advisor. You can book a free, no-obligation consultation call with an advisor to discuss your personal situation.

Advisors are available Monday through Friday, 8 am to 5 pm Mountain Time at 800-525-9556. You can also get in touch through our website.