Podcast: Play in new window

We’re looking at primarily increasing prices in the major precious metals indicators. Let’s take a look at where prices stand as of October 16:

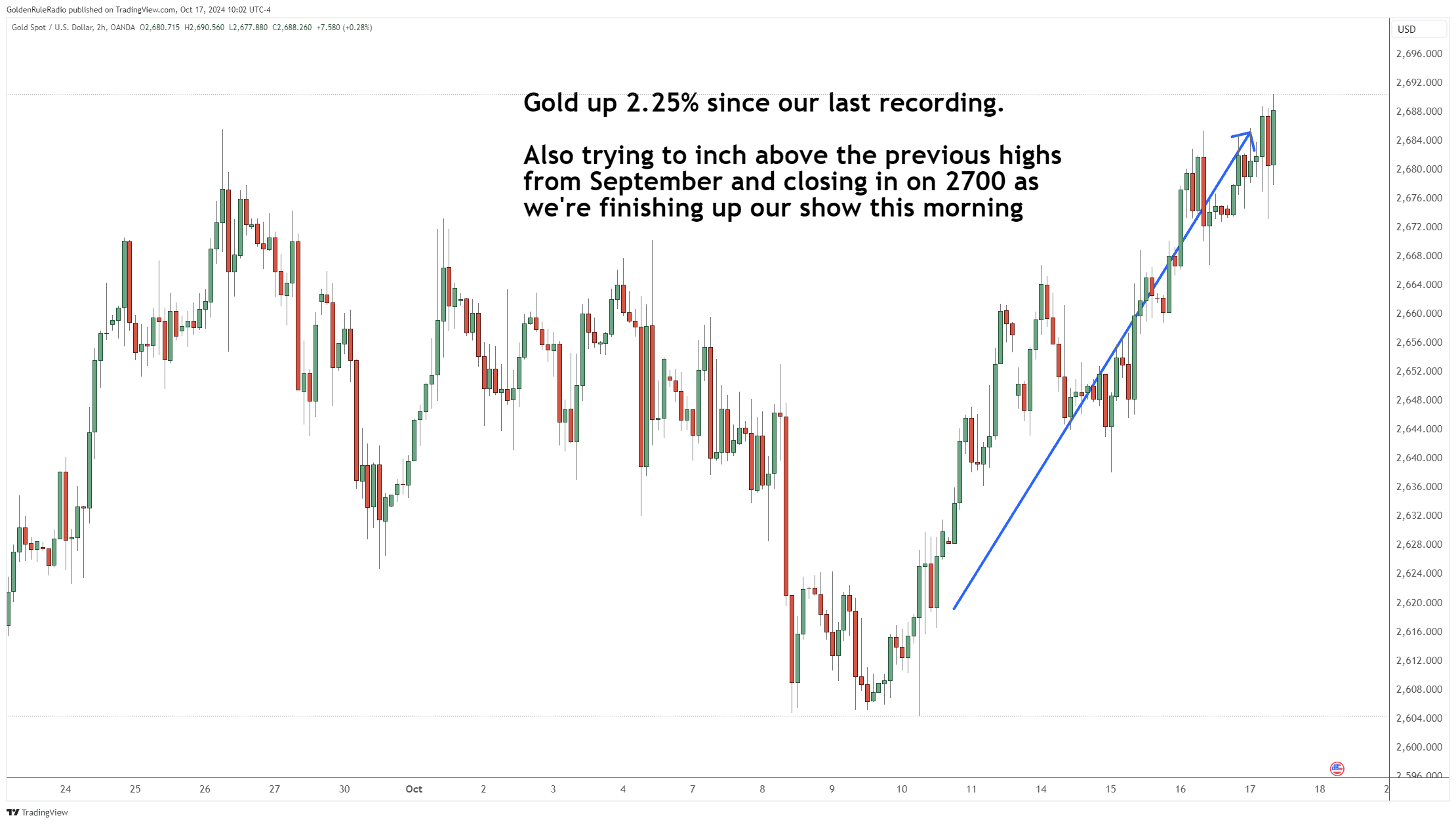

The price of gold is up about 2.25%, a $60 rise this week and flirting back with those all time highs again at $2,685.

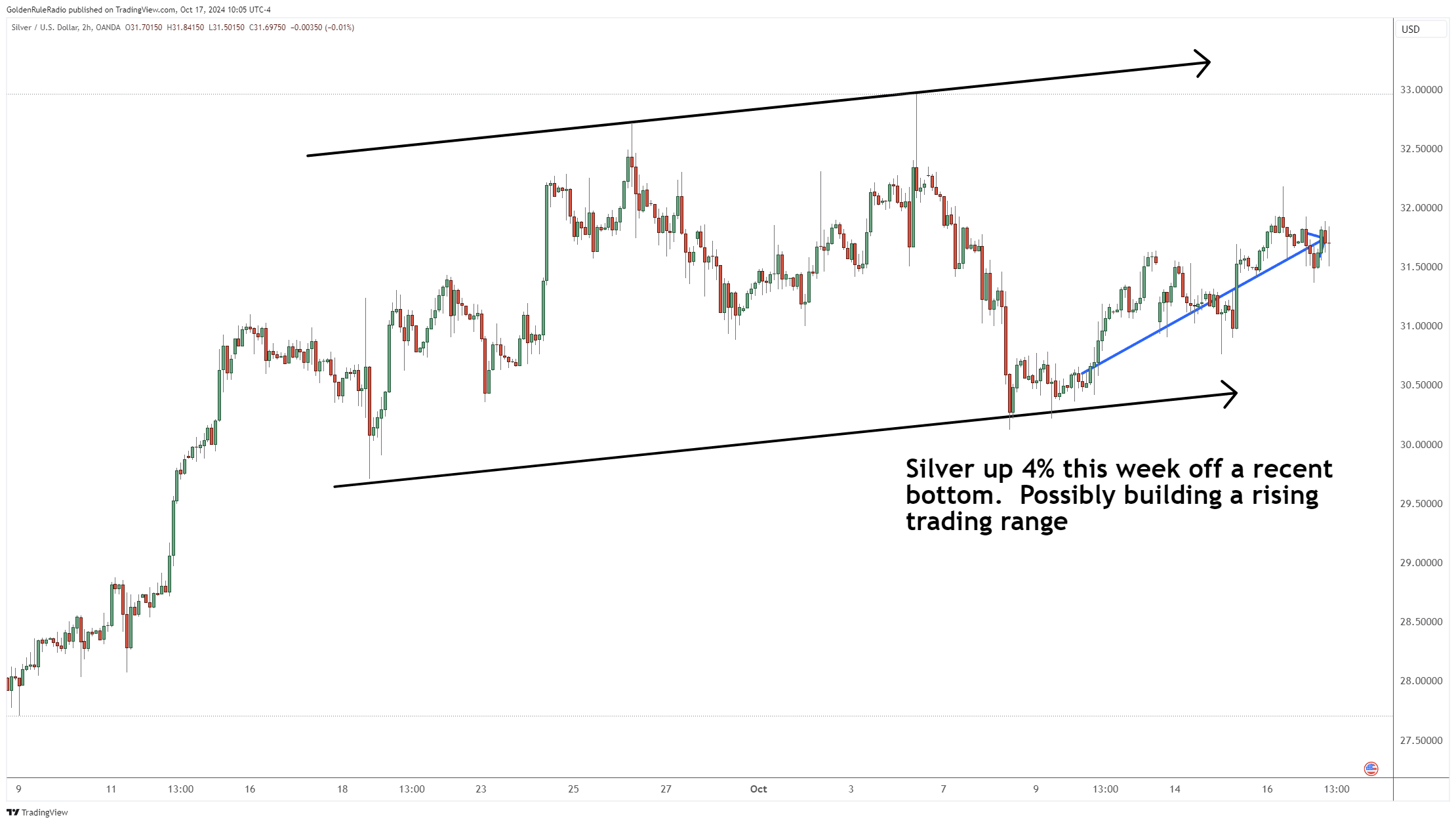

The price of silver is up about 4%, or $1.25 to around $31.60. It is still lagging behind gold as a whole in the market, but having a pretty strong week.

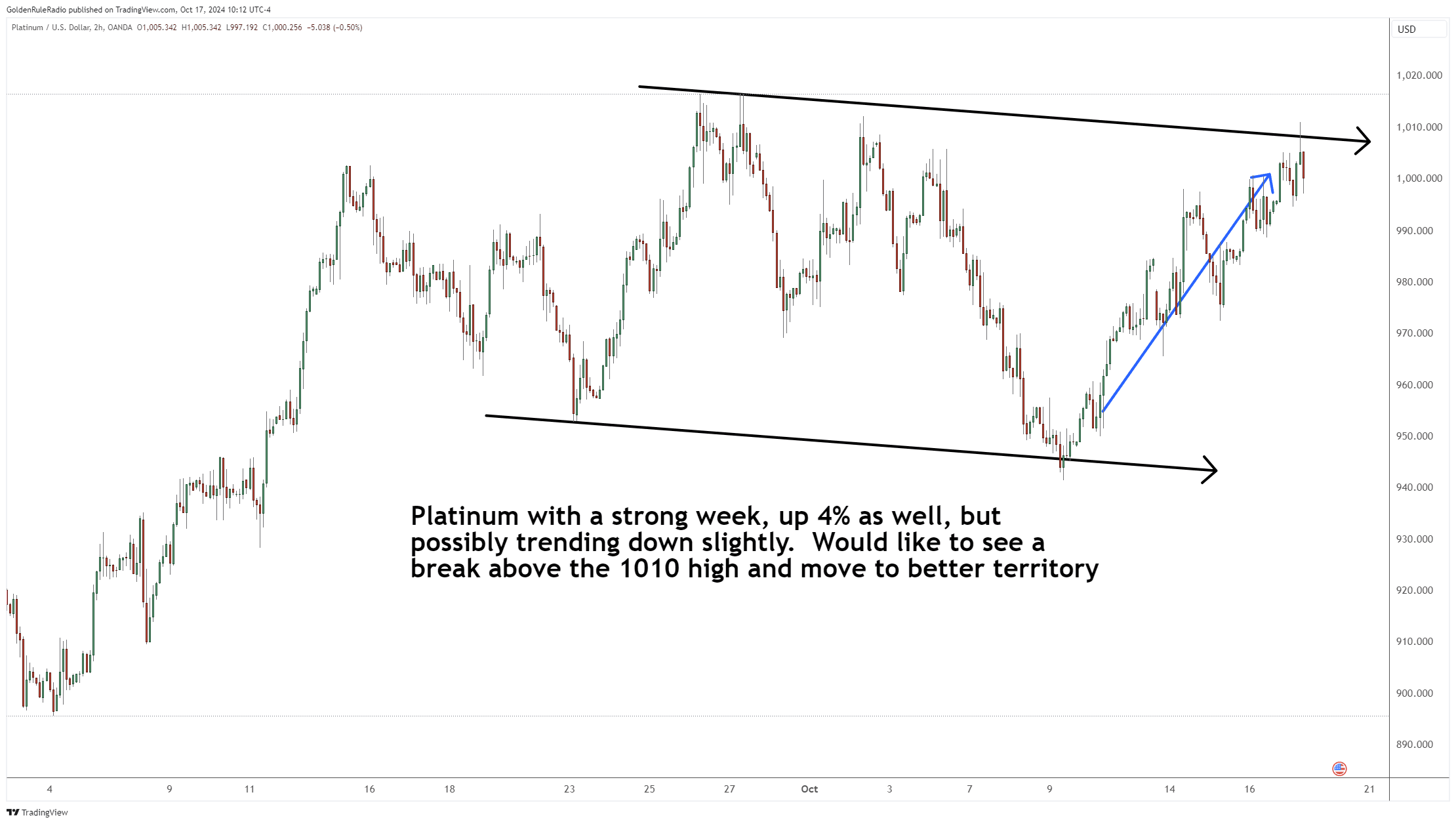

Platinum even a little bit better, up 4.5%, or around $42 to just over $1,000. Would like to see it break above $1,010 and move to better territory.

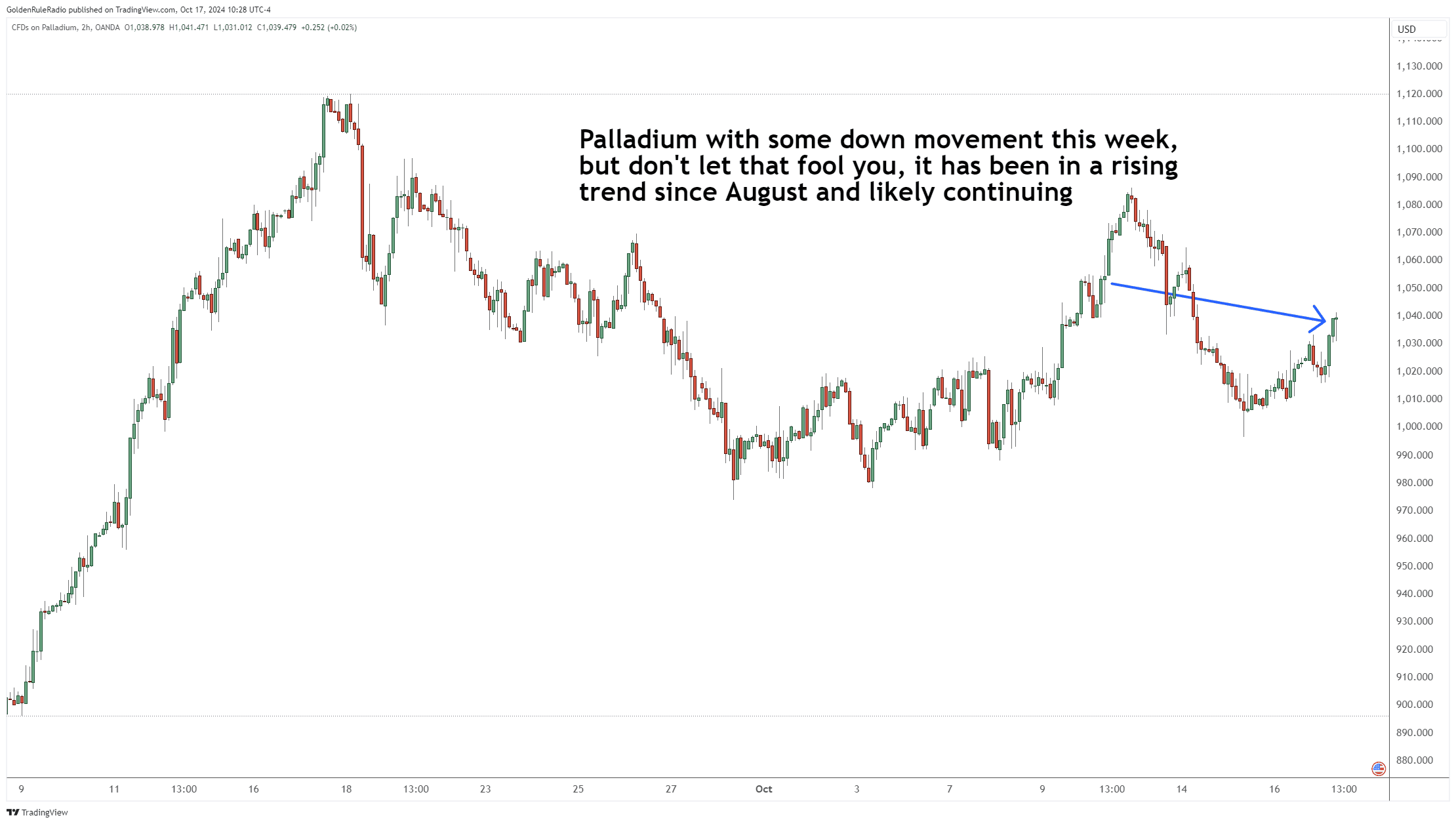

Palladium is down about 3% on the week, but 5% from the intraweek high, about $60.

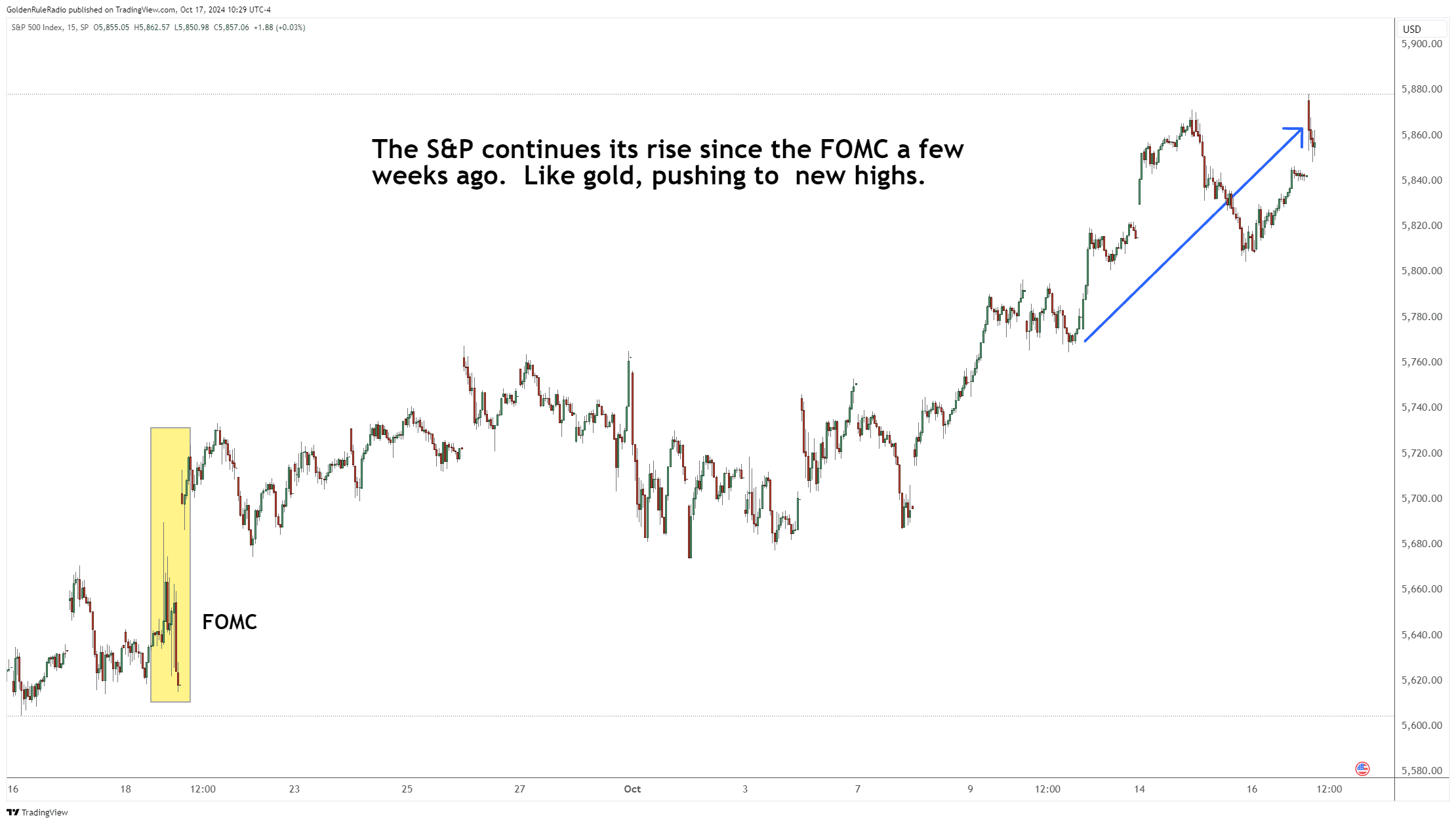

Looking at the broader markets…

The S&P 500 is up about 1% from a week prior.

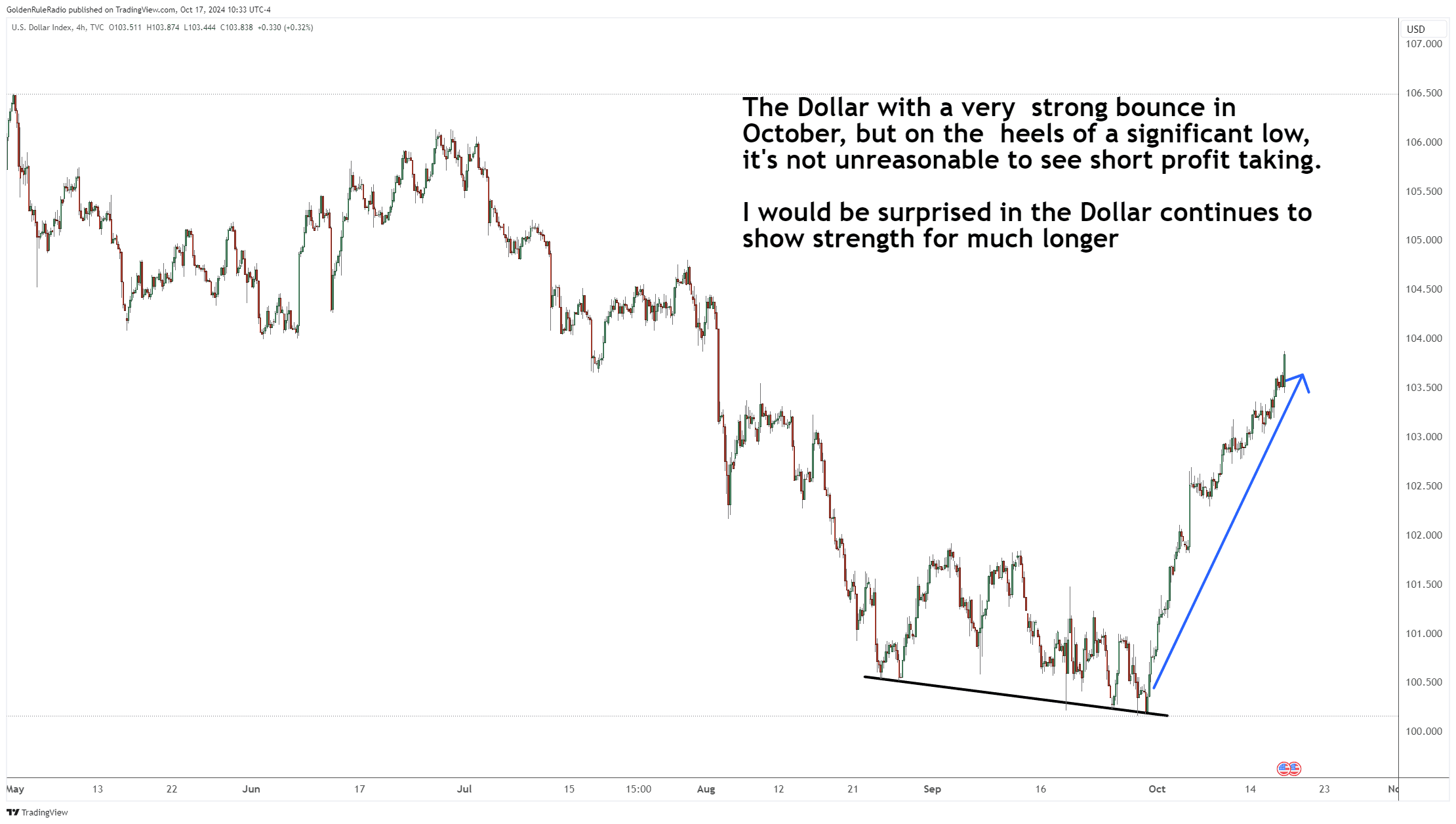

The dollar is up about 0.5% for this week, compared to the prior week.

Reading Gold’s Trading Ranges

Gold has been skipping along this mid range in the $2,660 – $2,665 range. What is it signaling? Could the $2,600 level be the move backward? Is that our pullback?

Most likely not, and that’s because this is only in a short time frame of about 30 days. Since the breakout move in September where gold jumped up to the next level, the price of gold has had a 50% retracement. However, there is not enough time to indicate a trend.

Charting gold back earlier in the year, the yellow metal had a big run up from February until about April. There was a shallower percentage decline from peaking out at around $2,430 and pulling back to around $2,080.

If we’re seeing any trend in the price of gold, it is moving more in a stair-step pattern. The price will have a runup and then move sideways for a while.

Slow and Steady Wins

Investors always want to know the best time to buy gold. Where is the best entry point for the next purchase of ounces?

Of course, it’s human nature to want to wait for the perfect storm — finding the right time and the right price. You could ask all the right questions, like:

- What is the outlook for the dollar?

- What about the US debt and balancing the budget?

- How will international conflicts affect the US?

- How will the next US president affect the economy?

Truthfully, you’d need a crystal ball to find the perfect timing.

It’s not about timing the market. Investing in gold is about consistency. We’re in an uncharted territory in the precious metals markets. If you want to leave a little couch cushion money on the side for a pullback, go for it. But your best bet would be to make consistent, regular purchases of ounces.

Plan Your Precious Metals Buy

The best time to buy precious metals was 20 years ago. The second best time is right now. One of our trusted McAlvany advisors can help determine your strategy for purchasing gold. You can schedule a no-obligation consultation with one of them by calling our office: 800-525-9556.