Podcast: Play in new window

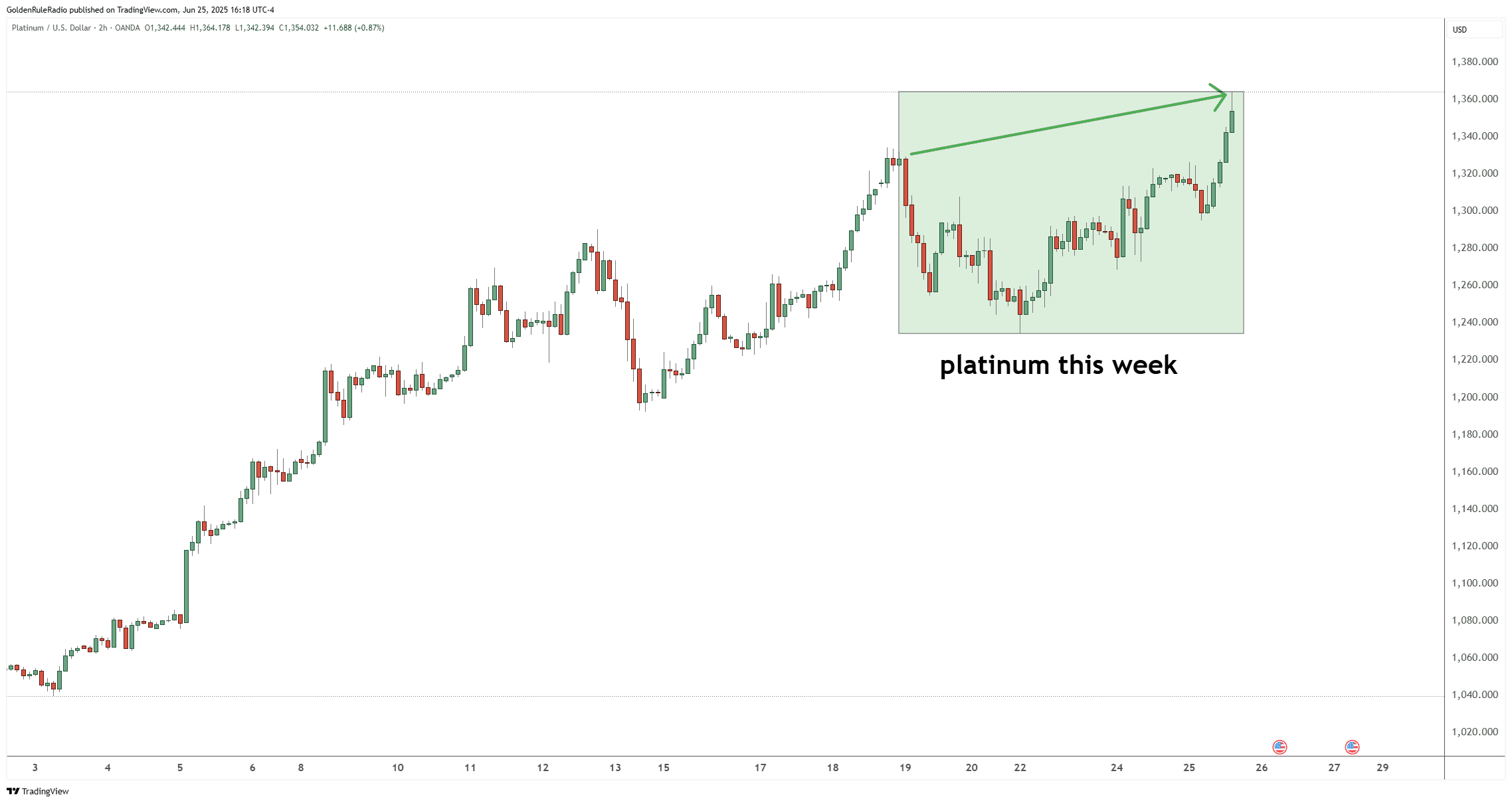

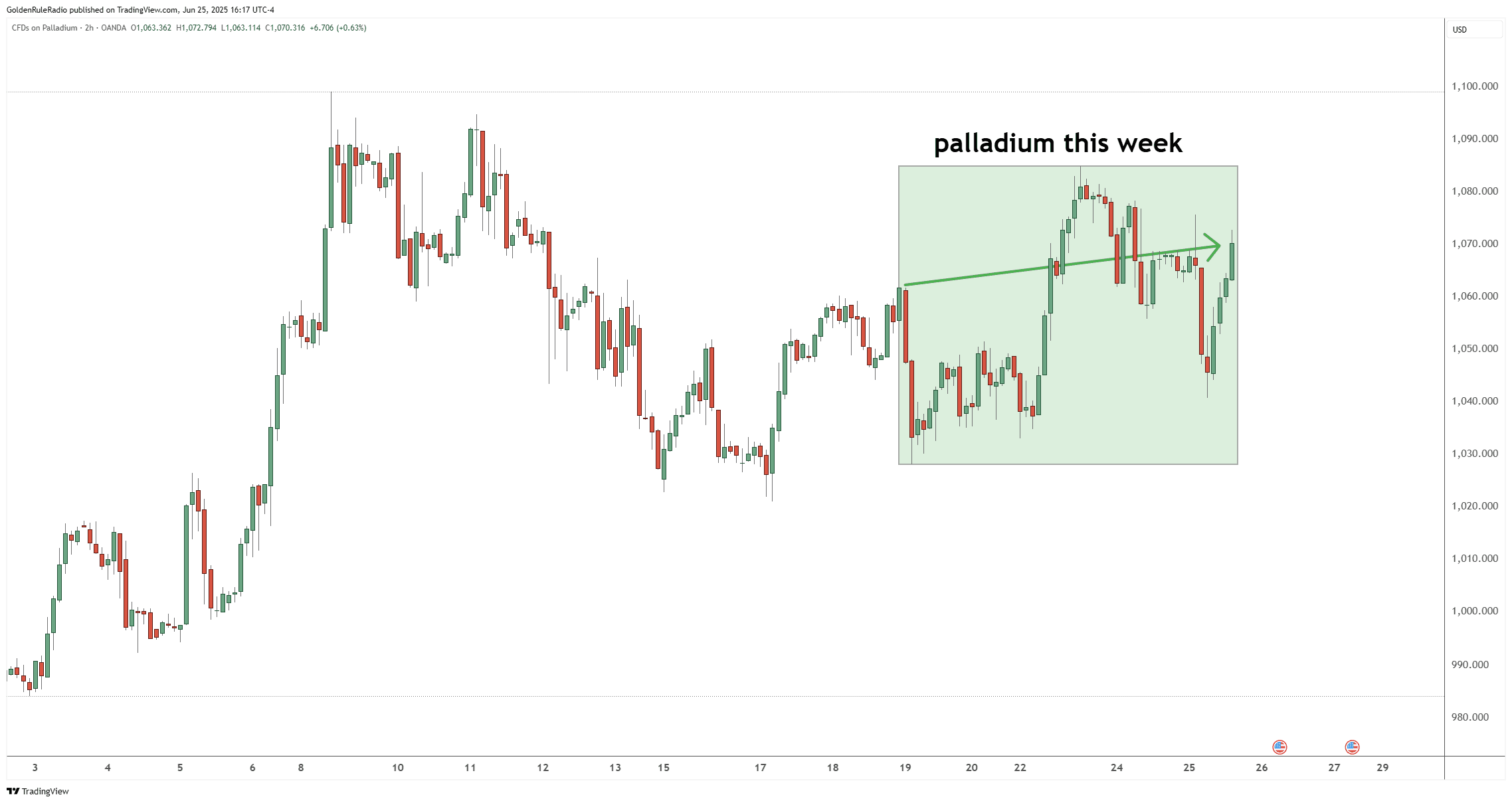

This week saw modest declines in gold and silver. Platinum, however, bucked the trend, rising to its highest level in 11 years. Palladium also managed a 1% gain.

Despite these moves, overall volatility was limited. The technical picture shows a sideways-to-slightly-down trend in the short term, but the long-term bull market remains intact. Let’s take a look at where precious metals stand as of Wednesday, June 25:

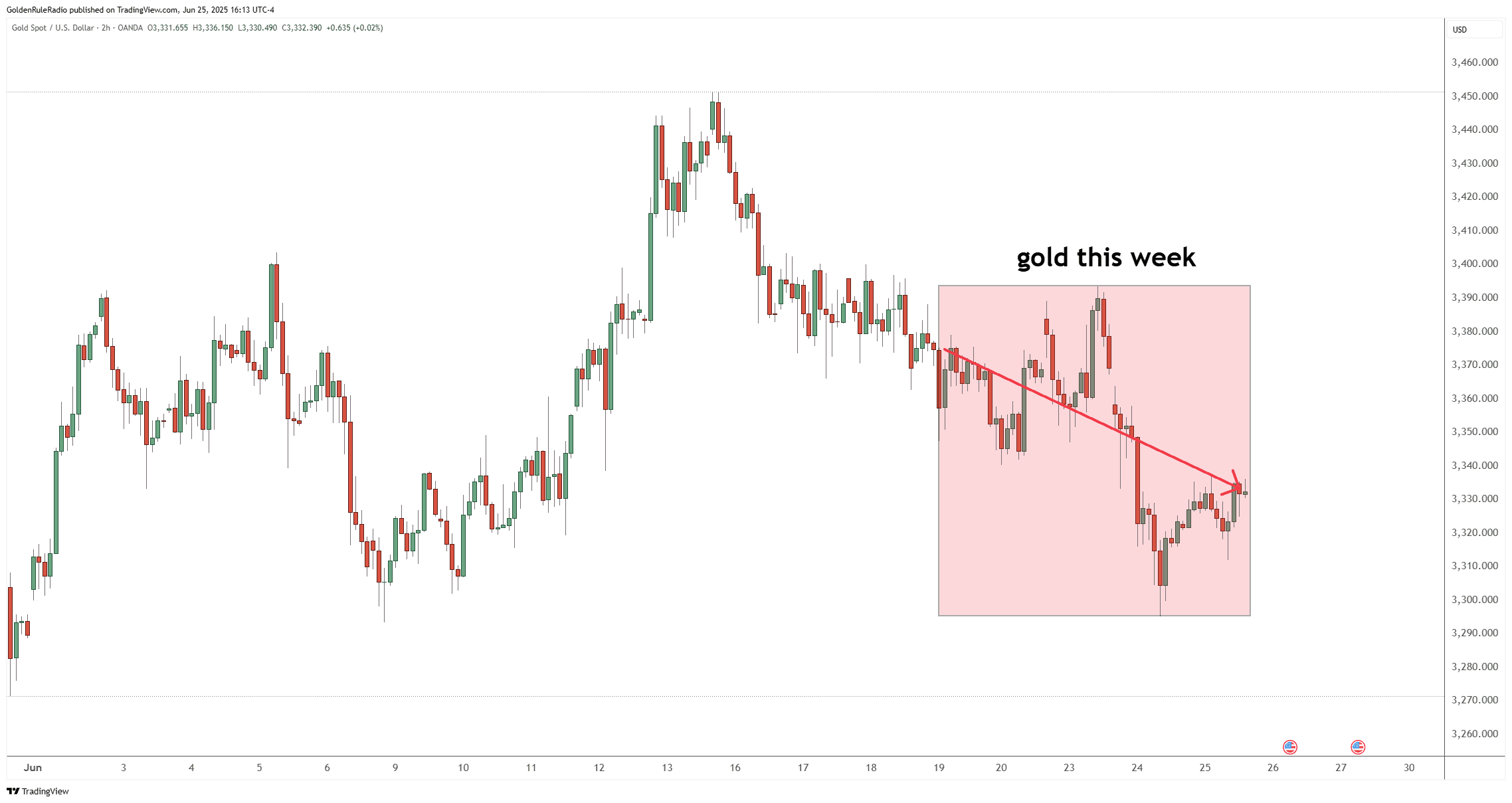

The price of gold is down just over 1% to $3,335.

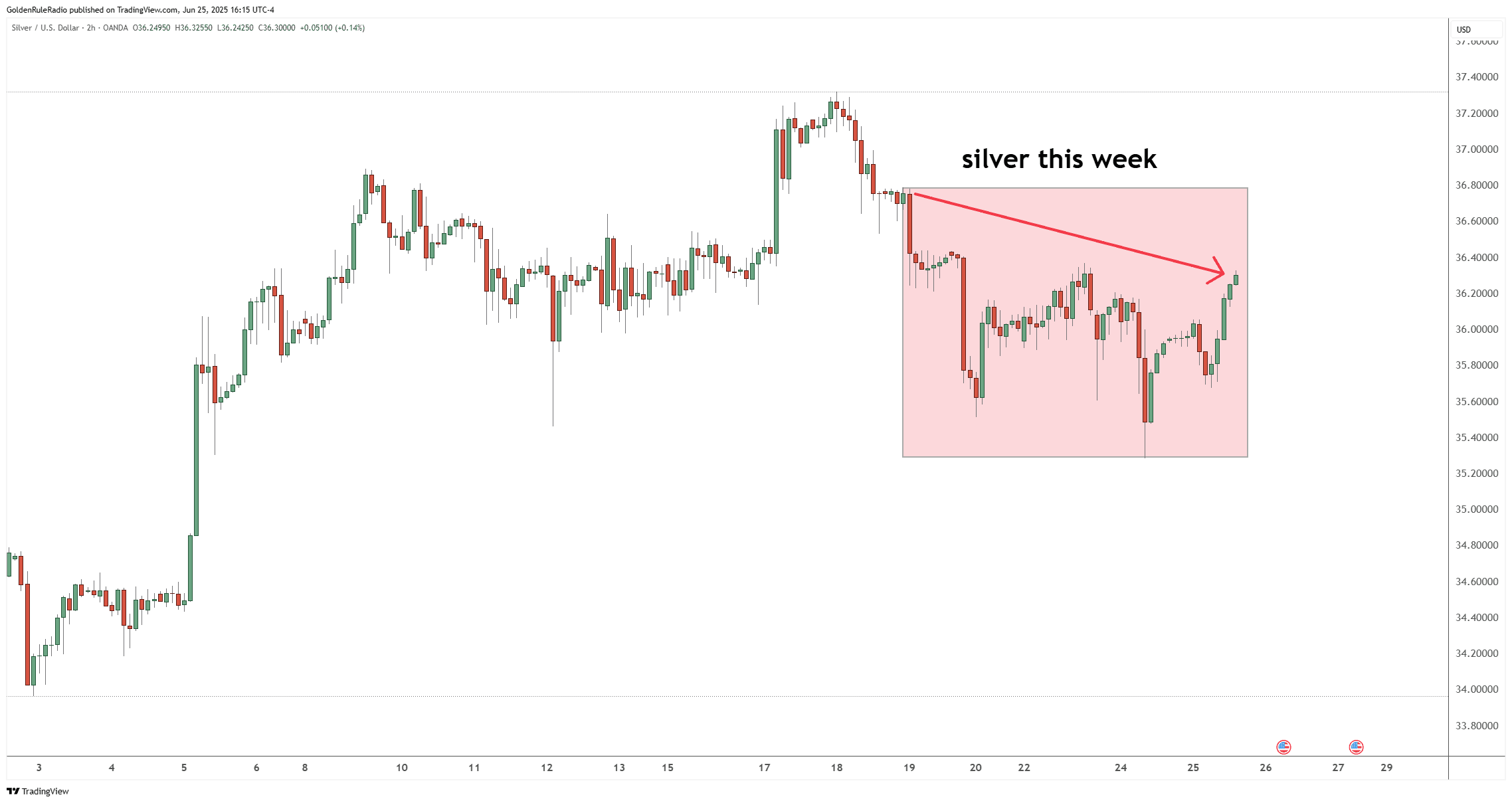

The price of silver slipped 1.25% to $36.30.

Platinum, however, bucked the trend, rising 2.7% to $1,363—its highest level in 11 years.

Palladium also managed a 1% gain, reaching $1,070.

Taking a look at the paper markets…

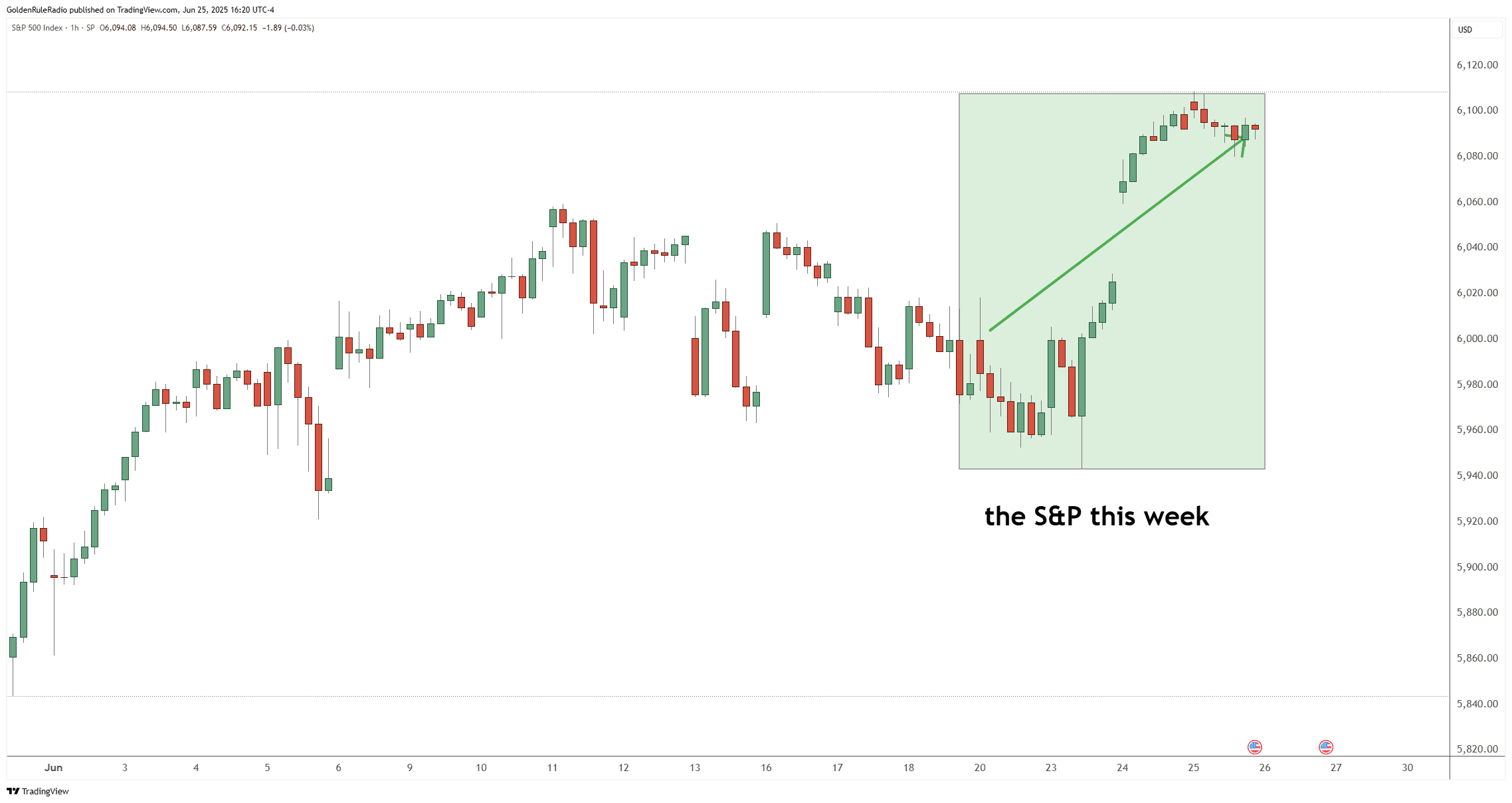

The S&P 500 is up 1.6% to 6,094 — and that’s also the highest price in 14 years.

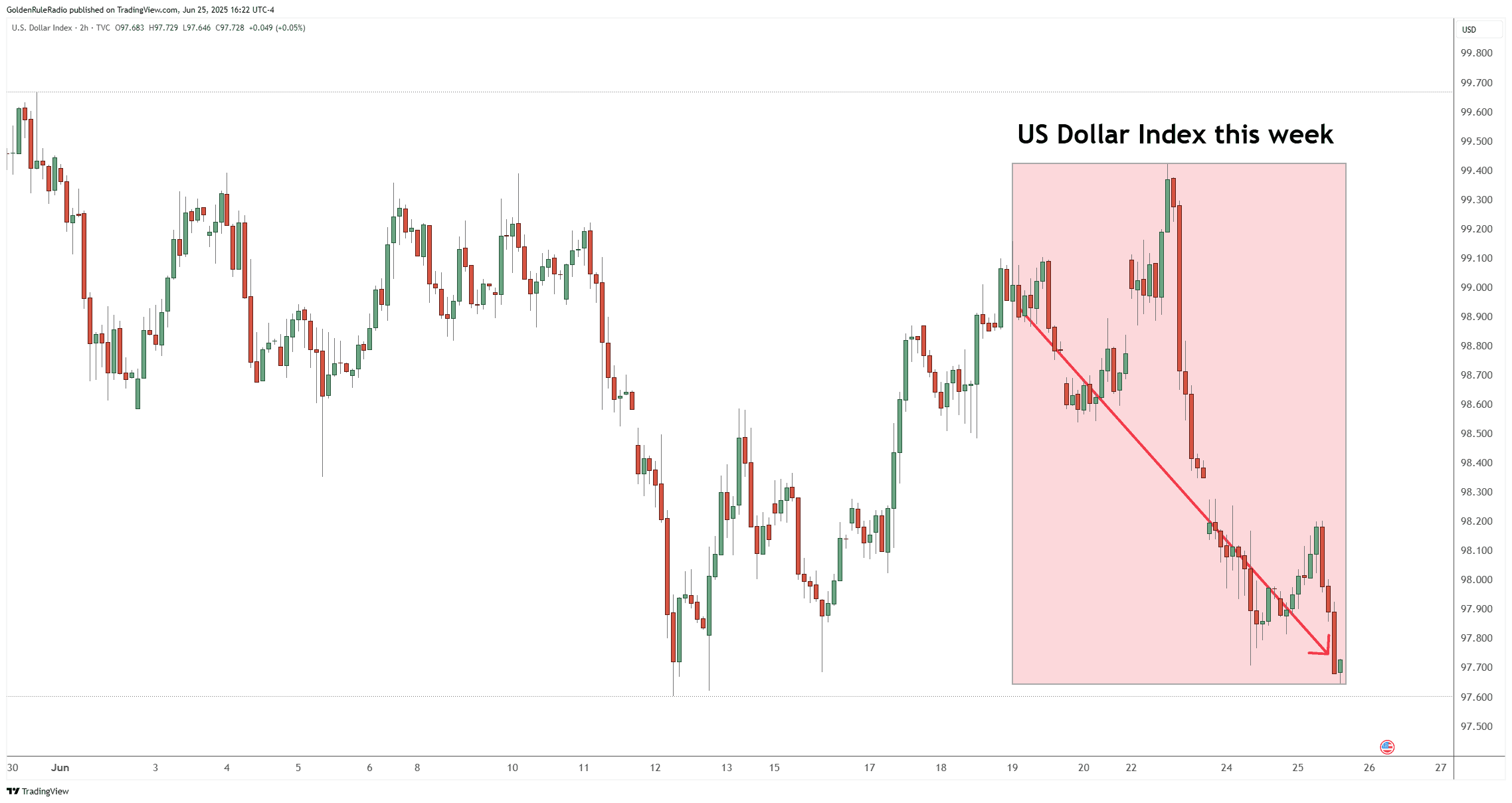

And the US dollar is down about 1.25% to 97.71.

Dollar Weakness: Global and Domestic Implications

The US Dollar Index fell 1.25% this week to 97.71, extending its drop below the psychologically important 100 level. Since its January peak, the dollar has declined 11%, while gold has surged more than 23% in the same period—a testament to gold’s role as a hedge against currency devaluation.

This dollar decline is a global phenomenon, not just a US issue. Policy preferences for a weaker dollar are partly aimed at boosting US trade competitiveness, but they also erode the purchasing power of American consumers. The interplay between a falling dollar and rising gold underscores the metal’s value as a store of wealth in inflationary and uncertain currency environments.

Fed Policy and Political Pressure: A Brewing Storm

President Trump has publicly criticized Chair Jerome Powell for being too slow to lower rates, even suggesting Powell’s resignation may be imminent. While the Fed still aims for two rate cuts, internal dissent and political wrangling have created uncertainty around the timing and magnitude of any policy moves.

Despite a weaker dollar and unchanged rates, the US real estate market remains under strain. There are currently half a million more homes for sale than there are buyers, and prices are starting to soften.

This disconnect suggests that lower rates alone may not be sufficient to revive housing—a key sector for broader economic health.

Macro and Geopolitical Drivers

Recent gold price action was influenced by geopolitical tensions, particularly the Iran-Israel conflict, but these effects proved short-lived.

If you look at Hedgeye’s macro analysis, they predict a shift to “Quad Four” in the coming quarter—a scenario characterized by slowing GDP and inflation. Historically, this environment is favorable for gold but less so for silver and platinum, suggesting a possible pause in the white metals while gold remains resilient.

From a technical perspective, gold appears to be consolidating within its trading range, with no imminent threat of breaking below the May lows. We expect sideways movement in the near term, but the long-term uptrend remains strong as macro conditions evolve.

Semi-Numismatic Gold Coins: A Rare Buying Opportunity

Your best bet to add more gold to your portfolio is in pre-1933 $20 gold coins. These semi-numismatic coins are currently trading at their lowest premiums in decades—sometimes even cheaper per ounce than modern gold eagles. They offer unique downside protection due to collectible value and limited supply, which makes them a compelling diversification option.

With premiums unusually low, these older coins offer both intrinsic and potential numismatic upside, providing a rare opportunity to add value and protection to a gold portfolio. While there are definitely bad days to buy collectible coins, this isn’t one of them.

Buy Gold Today

If you’d like to take advantage of this rare collectible coin opportunity, we’re here to help. Our precious metals advisors have decades of investing experience, and they can help you find the best strategy to meet your unique needs. They are happy to speak with you about your strategy for investing in gold and other precious metals. Reach us at 800-525-9556.