Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Backing and Filling Before the Election

Earnings season kicked off this week. However, the real focus for the markets seems to be the second wave of growth in COVID cases, the upcoming elections, and conversations around fiscal policy and a new stimulus package. The capital markets seem to churn from headline to headline.

As re-openings began and people started to resume their lives at the start of flu season, it was to be expected that we would see a spike in cases. Of obvious concern is the possibility that policymakers will institute a second wave of lockdowns that will cause even more damage to the global economy. Perhaps the economic damage is bad enough that, as a society, we will begin to question the wisdom of new lockdowns. Perhaps forgoing family Thanksgiving celebrations is a bridge too far.

Regarding the elections, although the aggregate polling according to Real Clear Politics suggests a growing lead and decisive win for Biden, anything is possible – as we saw in 2016. Further, the likelihood that we will have a clear victor on election night or the day after is low given mail-in voting and the possibility that the results will be contested. Just as a reminder, in the disastrous market year of 2000, the worst month was November after “hanging chads” left the election outcome uncertain. As a broader market comment, we think that, thematically, M&A is going to be a continued focus for investors as a shrinking global economy has further necessitated scale.

Precious metals had a challenged week. Gold was off 1.54 percent as it continued to digest and churn around the $1900 level. The HUI Arca Exchange Gold Bugs Index was down 1.97 percent. We are beginning to get operational updates from many companies, including some within our portfolios. Generally speaking, we are encouraged to see how companies are recovering operationally from the COVID-related shutdowns. The junior miners, after a very big year, did not fare as well. They were off 3.1 percent. According to S&P Market Intelligence, there has been roughly $1 billion in financing per month for the last few months within the junior mining sector. Often it can take time for the market to digest these issuances. Silver had a challenged week and was off 4.2 percent. Platinum was off 3 percent.

Natural Resources and related stocks also fared poorly. The S&P Global Natural Resources Index was off 1.6 percent. Bucking the trend for change was energy, as Kamala Harris vehemently expressed that Biden would not ban fracking. Crude was up 89 basis points, and natural gas was up 1.2 percent. The S&P Oil and Gas Exploration and Production Index was up 38 basis points, and the OIH Oil Service Index was off 46 basis points. There seems to be some early recognition that underinvestment today in exploring for and producing hydrocarbons will lead to higher future prices, and that the United States has reached peak oil production due to issues with reservoir quality. While ultimately we can’t disagree, we think that this theme will take time to play out. Other commodities did not fare well. Copper was off 21 basis points, iron ore was off 3.8 percent, and lumber was off 3.5 percent after being the best performing commodity year-to-date. Nickel bucked the trend and was up 1.3 percent.

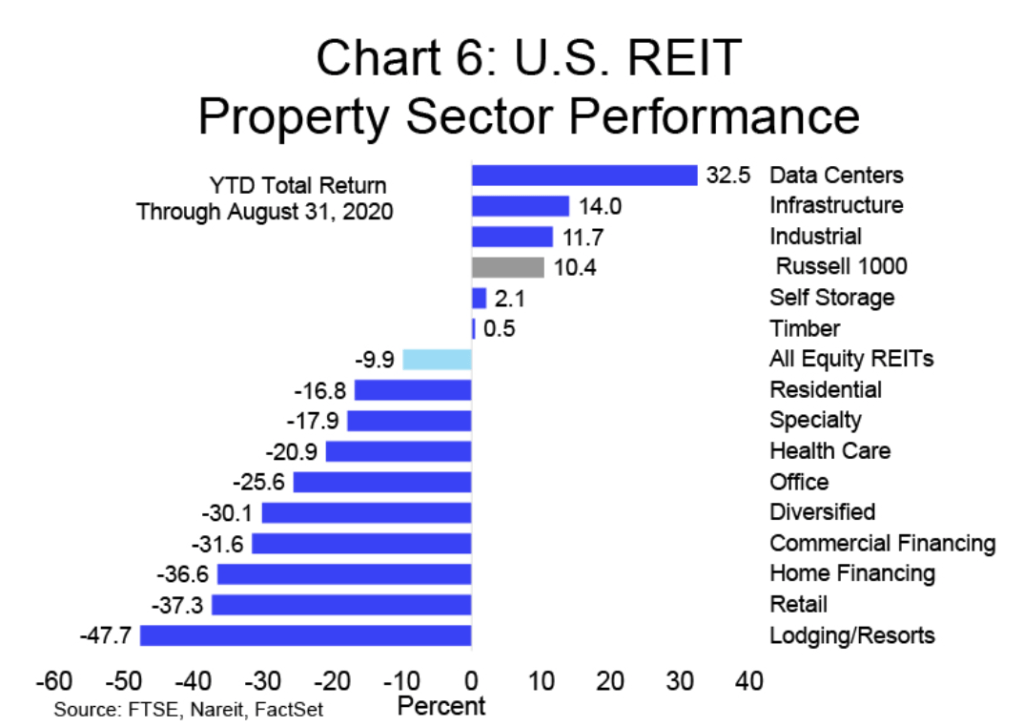

Real estate also had a bad week. The Dow Jones Equity REIT Total Return Index was off 2 percent and was led lower by multi-family and shopping center REITs. We think a picture is worth a thousand words as we continue to observe a growing chasm between haves and have-nots in real estate.

Despite the national CMBS delinquency rate being lower by 29 basis points month-over-month, given that forbearance and relief windows have been extended it is likely that delinquencies will rise in the future. Again, this is highly variable by property type, and, unsurprisingly, retail and hotels were most challenged. It is possible that many of the ways we use real estate have structurally shifted for the medium term, as some companies are allowing workers to work from home permanently. Flight from large cities may have implications for multi-family real estate, casting a shadow over such properties long thought to be “Class A” in those areas.

Infrastructure had a relatively good week, led by energy infrastructure. The US Infrastructure Index was up 49 basis points. Utilities were off 7 basis points. The Alerian MLP index was up 2 percent, along with the recovery in energy stocks. We saw a fascinating statistic this week – the market capitalization of Tesla is larger than the entire market cap of the North American midstream universe. While the sector is not without challenges, we think there are interesting values in this space (Warren Buffett seems to agree), and our pencils are sharp.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC