Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Implications of the Shutdown for Real Estate

A walk down Main Street in Anytown, USA paints a very tragic picture. Entrepreneurship, the lifeblood of the economy and the backbone of the American spirit, is struggling mightily. Although Congress has provided some relief in the form of the CARES Act and Paycheck Protection Program loans, it is simply not enough to support covering the expenses of running a business. At this point, according to the National Bureau of Economic Research, more than 100,000 small businesses have permanently closed since the COVID-19 pandemic began. During that walk down Main Street, you will notice the consequences of the stay-at-home and social distancing orders. Many of those businesses are closed, and although a re-opening has begun in many states, it is very slow, and the stringent regulations are often such that it doesn’t make economic sense for the owner to open their business at this time, if at all, ever again.

Impacted businesses both large and small are struggling to find ways to cut costs to try and right size their businesses given that so many are only able to operate at 25 to 50 percent of capacity, if at all. One of the major line items for any brick and mortar business, of course, is rent. As an example, for a restaurant, the typical guideline is for your occupancy cost to come in at around 6-10 percent of your gross sales, and net profit margins are on average a razor-thin 5 percent. Clearly, even the most well capitalized businesses cannot afford to endure any significant decline in revenue for very long, and businesses are looking for ways to reduce any cost that they can.

The largest blue-chip tenants are requesting significant concessions in order to support their operations, and it is likely that small business will follow. This is a significant, fundamental shift, as we tend to think of a lease as a contract. But often we forget that there is credit and counterparty risk, often a significant one, inherent in the terms of the agreement. It may very well come down to “reduce our rent or we will close permanently” and the lessor will have to then try to release the property, likely having to accept a lower rate in order to maintain occupancy.

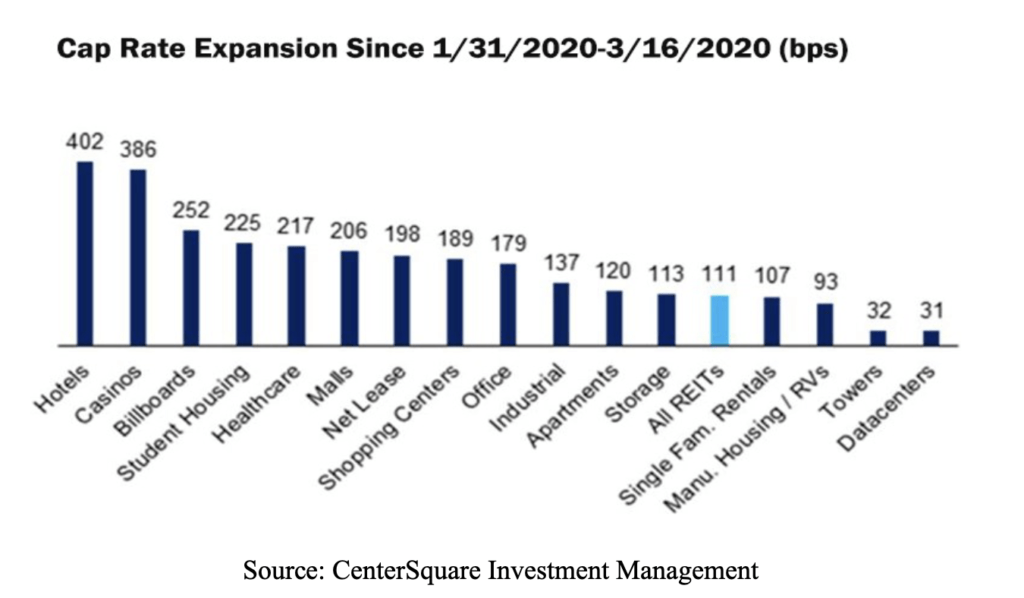

The implications for real estate valuations are obvious. Most investors value real estate on a Net Asset Value, or NAV, basis. The numerator is net operating income, or NOI, which is all revenue minus all expenses, not including debt service or capital expenditures. If a lease is ultimately not a contract, which is an assumption clearly at risk, you begin to have an impairment of the value of the property vis-à-vis declining NOI. This has serious implications for real estate values and it is clear that asset values, at least in the private market, will undergo a serious reset. What’s more, there are also issues with the denominator of the NAV equation, the capitalization rate, or, more commonly, cap rates, or the annual rate of return you would receive on your investment. The chart below indicates the expansion in cap rates across a variety of property types and you can see that some are far more resilient than others.

Source: CenterSquare Investment Management

Normally we think of real estate as being a stable income business. However, in many cases, this assumption has been called into serious question. Forbearance, in some cases mandated, has given us the illusion that income streams from leases are still somewhat stable, however, this is a temporary dynamic and one that will likely reverse itself in a few months time if loans are unable to be restructured. But if the underlying valuation assumptions have been reduced, so, presumably, is the amount of money the property owner will be able to borrow against the asset, particularly in the event that there is little or no equity at the reduced value.

We believe that there is a likely reset of asset values across many property types coming in the second half of 2020, and that it will be a very tough fall for commercial real estate as well as for commercial mortgages. Equally, we believe that this will present investment opportunities, as not all property types will be equally impacted.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC