Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

“Is It Time to Buy?”

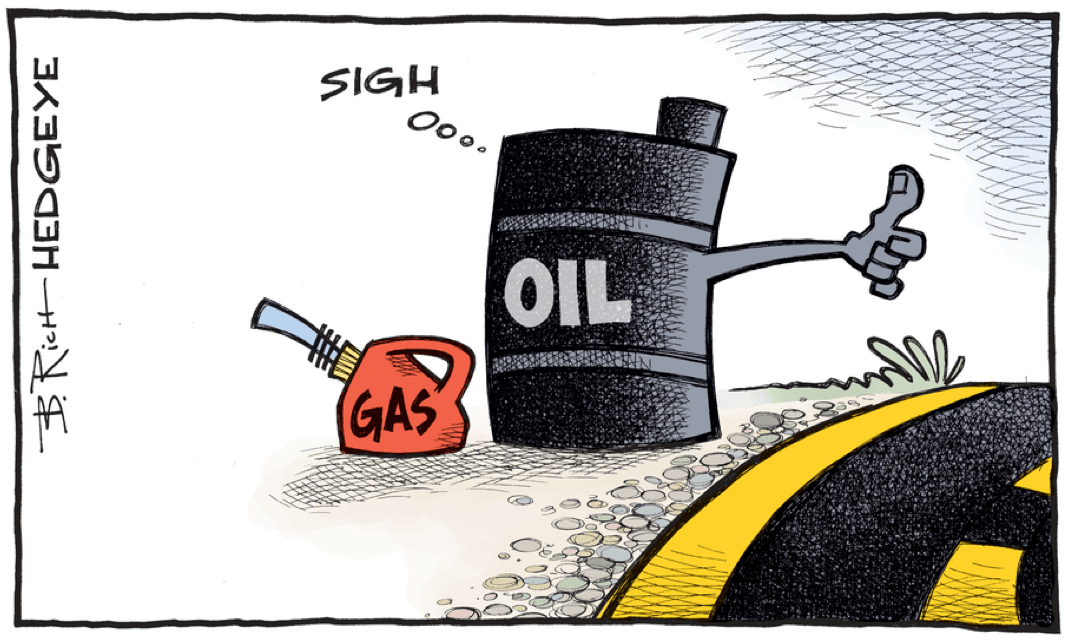

Photo: Hedgeye.com

We’d like to preface this piece by saying that we in no way wish to minimize the impact of COVID-19 on the economy, the financial markets, on confidence, and on society. The impacts are far-reaching and lasting. We are already in a recession, and there is no way to accurately assess the economic damage that the virus has wrought upon the global economy. The reported infections per 1 million people continue to rise in every single developed country. Most of us in the United States are already either voluntarily social distancing or have mandatory shelter in place orders. Earnings are likely to be down at least 15 to 20 percent year over year as a direct result of the virus. The virus has changed human behavior completely, the lasting impact of which has yet to be seen. The data is likely to be far worse a month from now in terms of number of cases than it is today, further muddied by the fact that we do not have any real idea of what the denominator (total number of those that are or were COVID-19 positive) might be.

However, is this the whole story for the capital markets? A somewhat contrarian and out of the mainstream view is that the effective dissolution of OPEC+ has had a far greater impact in terms of lasting financial market damage and systemic risk. The sector was already leverage-challenged before the impact of COVID-19 was well understood, and prior to the Saudi/Russia OPEC+ price war. As of January, energy companies had already accounted for the bulk of debt in the broader high-yield market and 13 percent of bonds rated triple C.[1] As of a few weeks ago, there was over $400 billion in triple B energy debt, and, as pricing declines, the threat of downgrade looms large. There is not an energy company that can produce oil over a full-cycle for $25/barrel. This is a huge problem for not just energy credit, but the credit markets as a whole. If you have a continued crisis in the credit markets, the equity markets will remain in disarray.

There may be, as the late Jude Wanniski would say, some “events on the margin” developing in that regard that could serve to prop up energy prices. A few days ago, Senator Kevin Cramer of North Dakota sent a letter to President Trump outlining a case and historic precedent for national security and US supply, as well as making a plea for an embargo.[2]Trump has acknowledged the issue, and indicated a willingness to deal with Saudi and Russia at “an appropriate time.” Trump has no problem invoking Section 232 on other matters, and while he recognizes low gas prices for consumers are very much a good thing, he also likely recognizes the near-term economic damage and job losses that the death of the domestic industry might bring about. He has expressed interest in a “medium ground.” We can debate the merits of a de facto bailout of an industry that, as a whole, has not earned a cost of capital return during the entirety of the shale revolution – a revolution that has largely been propped up by capital availability. Nonetheless, if cruise ships are considered a strategic asset worthy of a bailout, surely domestic energy can be considered one as well.

One of the calls we seem to be getting here and there – and frankly an obvious question given what we have seen unfold – is, “is it time to buy?” Given the state of the credit markets, it is important to draw upon our early lessons in finance and remember exactly how the capital stack works. Debt holders get paid first. Next are any preferred equity holders. Any residual income goes to the equity stakeholder. We cannot even begin to talk about the equity market until we solve the unfolding crisis in the debt markets. So much of what we have seen unfold in the last several weeks is a crisis of confidence. The psychology out there has never been worse in our collective careers. Ultimately, restoring confidence in the credit markets may go some way toward restoring faith in the financial system. As we have seen to the downside, momentum begets momentum. If we begin to see positive momentum in credit, with the help of news flow as the worst of the crisis passes, the psychology will change – as will the market landscape.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC

[1] https://www.ft.com/content/55f74150-4225-11ea-a047-eae9bd51ceba

[2] https://www.cramer.senate.gov/sen-cramer-calls-president-trump-embargo-crude-oil-imports-russia-saudi-arabia-and-other-opec