Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Market Is Climbing a Wall of Worry Over a Second Shutdown

Animal Spirits continue to roll on as the financial markets continue to price in a “V-shaped” economic recovery from the COVID-19 crisis. “Don’t Fight the Fed” is the clear battle cry from speculators as it is clear that the Federal Reserve is willing to take whatever measures necessary to backstop the economy, fueling speculative excess in the process. The S&P was up 2.3 percent for the week, the NASDAQ Composite was up 50 basis points, and the Dow Jones Industrial Average was up 1.4 percent. It is interesting to note that the S&P is now within 9.1 percent of the old high made on February 19 of this year. Even more amazing is that the NASDAQ is trading near all-time highs. The general sentiment is that the dramatic recovery in the market reflects that the damage done to earnings going forward will be muted. However, we are inclined to think that the historic measures that the Fed has undertaken to backstop the financial system are the key driver for what is happening in the capital market. The Fed, in buying corporate debt, has in essence used its balance sheet to make loans to corporations. Every business is different, but we can see significant risk that collateral values will fall in the future.

It was a mixed week for at least some things cyclical, and this was true within resources. The S&P Global Natural Resources Index was up 68 basis points for the week. Sentiment has clearly improved around the oil markets, with WTI Crude trading back at around the $40 level. Companies that had deferred well completions via shut-ins are beginning to resume completion activity. Fortunately, according to what we have heard come out of the JP Morgan energy conference, companies have continued their commitment to capital discipline, and favor deleveraging their balance sheets over trying to grow production despite the recent rise in prices. Coupled with continued OPEC discipline and make-up cut for those who have not complied, this has buoyed prices near-term. Energy stocks, having priced in something of a recovery in the oil market over the last several weeks, sold off on the news. The S&P Oil and Gas Exploration and Production Index was off 3.7 percent, and the Oil Services Index, 4 percent. Copper was effectively flat for the week.

Precious metals had a good week. Gold was up 87 basis points as fears of a resurgence of the COVID virus began to manifest, along with the possibility of a second-wave shut down of businesses and the economy. Additionally, Fed Chairman Powell has a clear mandate to avoid a depression, and this massive liquidity injection is likely to be a future positive for precious metals. Precious metals producers, developers, and explorers had a good week, with the NYSE Arca Exchange Gold Bugs Index up 1.8 percent for the week and the VanEck Junior Gold Miners Index up 2.2 percent.

Real Estate was off 68 basis points. There was a ruling – the first of its kind to our knowledge, since COVID – in an Illinois Bankruptcy Court this week that force majeure provisions are indeed applicable. A force majeure is when an extraordinary event occurs beyond the control of both parties that nullifies the terms of a contract. In this case, it was argued that an executive order shutting down businesses qualified as a force majeure, and therefore a significant portion of the rent would not be owed. This has obvious negative implications for both retail and triple-net commercial real estate. Malls had a particularly tough week, with the Bloomberg REIT Mall Index off 10.3 percent.

Infrastructure was also a mixed bag, but was positive overall. Utilities performed poorly after solid year-to-date performance and a rotation into riskier sectors; the Dow Jones Utilities index was off 2.8 for the week. On the other hand, energy infrastructure performed well as the Alerian MLP Index was up 2 percent.

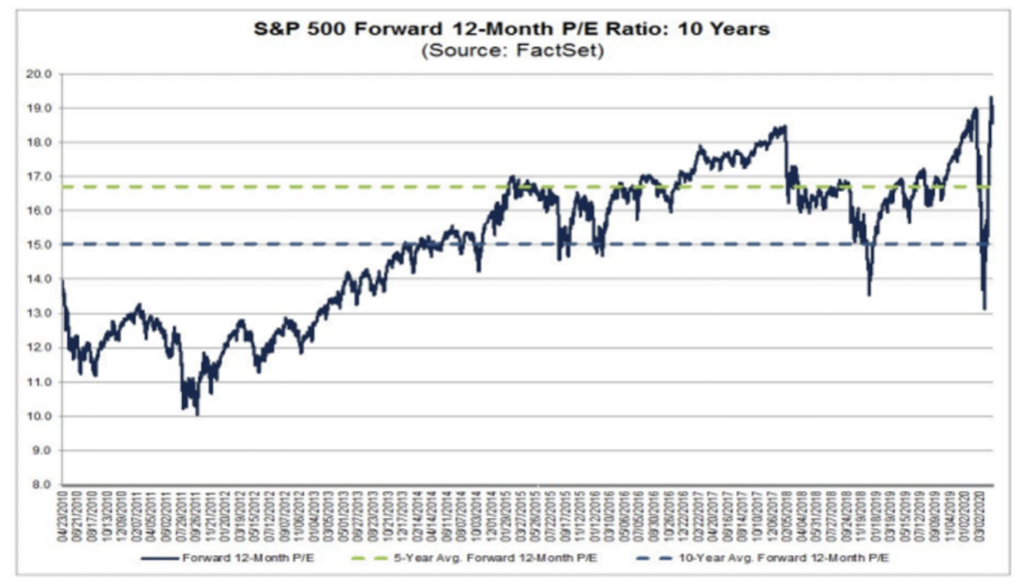

The market continues to climb the so-called “wall of worry” around the possibility of a second wave of shutdowns due to COVID-19 despite the additional damage this would do to the economy. We believe that ultimately the policy accommodation by both the Federal Reserve and Congress is what is driving this market as we see challenges to forward earnings estimates. Although there are always opportunities, broadly speaking, paying more for a dollar of earnings today than prior to the COVID crisis, as reflected on the chart below, is a difficult risk-reward proposition for us to get our heads around as investors.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC

1 https://www.lexology.com/library/detail.aspx?g=2b9dcaa5-b1b8-47b4-b292-9b95452be759