Mining For Long-Term Opportunities

This week, the precious metals mining stocks outperformed the price of gold. Gold closed the week nearly flat at $1,757, but gold miners, finally showing some life, outperformed gold prices and closed up 5.35% on the week. While this week’s outperformance is a good sign from the mining sector, it’s been a long, painful stretch for the miners since the summer of 2020 all-time high in gold prices. Since that high, the mining stocks have underperformed the metal by around 25%. So, for this week’s Hard Asset Insights, let’s dig a bit deeper into the gold mining space and try to establish where we’ve been in the sector, where we are now, and what potential the sector may offer in the future. The terrifying tale of the gold mining stocks is a story going back decades, but this journey down the yellow brick road is a good one and outlines the possibility for a happy ending. This week’s HAI is long, but it is hoped those interested in precious metals mining stocks will find what follows to be a worthwhile read.

Readers seeking an update on this past week’s crucial developments, as well as key news and insights on events in China, should access Doug Noland’s latest Credit Bubble Bulletin.

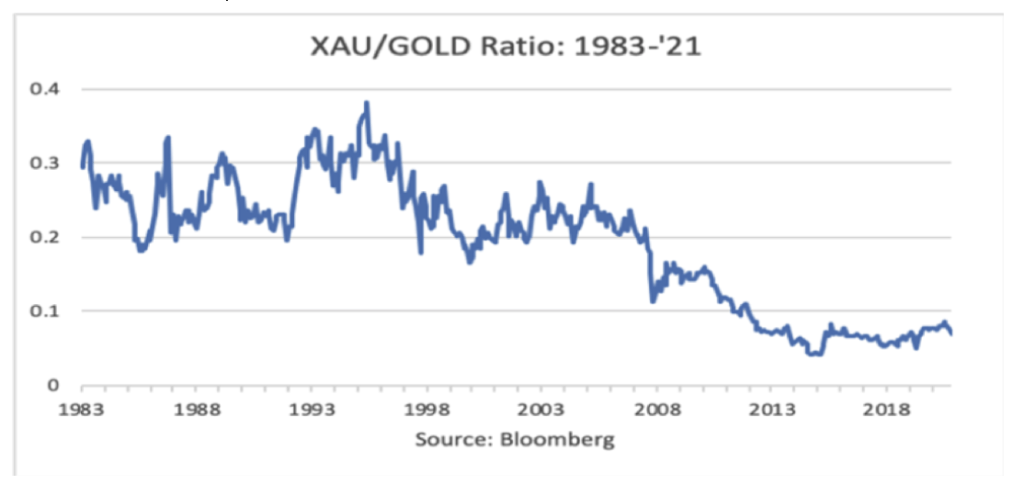

Let’s start our journey with a ratio chart of the XAU precious metal miners index, divided by the price of gold. When the line of this ratio on the chart is rising, precious metals mining stocks are outperforming the price of gold. When the line of the ratio drops, precious metal miners are underperforming the price of physical gold. The ratio below highlights the devastating breakdown from the pre-2007 historical range of PM mining companies’ market values relative to the price of gold.

In the case of this long-term chart of the XAU vs. Gold, there are three points to specifically highlight. 1) For over 20 years, from 1983 until about 2006, the ratio was much higher than where it is today, indicating that mining stocks were given much more market value relative to physical gold. Prior to 2006, the ratio tended to fluctuate over time, mostly in a range between .2 and .3, as displayed on the left side of the chart above. 2) In the late 2000s, the ratio broke decisively below .2 and continued to drop dramatically lower. 3) The last observation is that more recently, despite this last year’s weakness, the ratio has been stabilizing at present historically low levels and has even started to turn back higher since 2015.

What caused the collapse of this ratio to all-time lows? What went wrong with the mining stocks? Why did they lose so much value relative to physical gold? A big part of the answer to this mystery resides in undisciplined mining company management teams pursuing the misguided strategic approach of chasing earnings growth at all costs.

In the 2001 to 2011 gold bull market, the price of gold increased by 652%. The dramatic 10-year increase in the price of gold should have translated into the best of times for gold mining stocks that typically have upside leverage to metal in a rising price environment. Following the many years of falling gold prices that preceded the bull market, however, many mining company management teams got overly excited by rising prices and lost their discipline.

Too many mining companies let costs balloon, ramped up debt levels, and heavily diluted their existing share base in a chase after growth. The result of this misguided industry behavior was dramatically compromised balance sheets and increasingly poor financial health. In other words, the companies on top of the gold reserves became value-destructive liabilities, diminishing the market value of the underlying assets.

With that said, mining companies were still successful at driving earnings growth. Using data from S&P Global, a sum of 13 top industry companies grew EBITDA earnings throughout the 2001–2011 period at an exceptional 30% annual rate. That 30% annual earnings growth rate was better than the 22% annual rate at which the price of gold was rising.

Nevertheless, the surprising result was that despite the typical upside leverage to rising gold prices and earnings growth that outpaced gold price increases, mining industry share prices in the XAU index managed to underperform gold by 41% from 2001–2011. That was certainly not the result investors and mining company CEO’s were hoping for or expecting.

Mining management teams were offsetting the benefit of excellent earnings growth with dramatic increases in other, more problematic, categories. Again, using summed S&P Global data from the same 13 top industry companies, the miners destroyed value by growing cap-ex spending at a 27% annual rate, debt loads at a 23% annual rate, and the number of shares outstanding at a 13% annual rate.

In a particularly egregious example of mismanagement, one of the largest gold mining companies in the world increased its debt 672% to a total of $13.9 billion from just 2005 to 2012. Not surprisingly, investors revolted and increasingly favored physical gold ownership over owning shares in mining companies. All of these dynamics are reflected in the breakdown of the XAU miners to metals ratio.

In 2011, the price of gold began to drop, and mining company earnings suffered. High debt loads are never good, but the debt becomes an acute problem when earnings fall away. Without strong earnings, the sins of reckless mismanagement and industry balance sheet destruction came home to roost, and the stock price value of the XAU precious metals mining index fully collapsed. By 2015, despite the fact that gold prices were still over 300% higher than at the start of the 2001 bull market, the XAU mining index had imploded below 2001 levels.

In the wake of mismanagement and tremendous value destruction, mining company shareholders were irate, and management teams were under the gun. Many investors swore off the space for good, but those that didn’t demanded action. Management executives that had abandoned discipline and destroyed value were thrown out in numbers. Only the very best, successfully battle tested management teams in the business survived. After the industry collapsed, out of the 13 top precious metals mining companies sampled, 9 new CEOs and 11 new CFOs were brought in to change strategy and impose financial discipline.

So far, the change demanded by shareholders and the lessons learned from this industry dark age are bearing fruit. Looking at data from the same 13 top industry companies, this time for the 2015 to present period of rising gold prices, highlights key positive developments both at the corporate level and in terms of market pricing.

During this 2015 to present period, the annual increase in the price of gold has been 9%. While that amounts to a very strong price environment, it is, to date, less than half of the 22% annual gold price increases seen in the 2001 – 2011 period. So far, in this cycle, miners have been able to grow earnings at a 23% annual clip. That is very strong, but not as strong as last cycle’s 30% growth. So, gold is not going up quite as fast as the last cycle, and miners are not growing earnings quite as fast as the last cycle. Yet, so far this cycle, XAU mining stocks are outperforming the rising price of gold by 91% as opposed to the XAU underperforming gold by 41% from 2001 – 2011.

Hope for a continuation of this outperformance trend lies in what’s most obviously different today over yesteryear. To date in this cycle, at the same 13 sample miners, the balance sheet is being prioritized. Spending cap-ex is increasing, but at a much more reasonable 8% annual clip than last cycle’s overly aggressive 27%. In fact, over the last 12 months, spending is only increasing by 2%. Rather than adding debt and net debt at annual rates of 23% and 22%, respectively, as the miners did last cycle, management teams are cutting debt so far in this cycle. Debt and net debt have been declining in this cycle by annual rates of 4% and 30%. Similarly, if we look at the annual rate of growth in shares outstanding this cycle, it’s around half of last cycle’s rate of 13%, and has been dropping. In the last 12-months, shares outstanding have decreased by 8% as companies have built up enough cash to start buying their stock back. The other crucial development is that companies are also putting that cash ever more aggressively into dividend streams to shareholders. The current 3.6% dividend yield at the 13 miners dwarfs yields from the previous cycle, and, in fact, the 3.6% dividend yield is 159% higher than the 1.39% yield of the S&P 500, according to S&P Global data.

In this cycle so far, the mining companies are growing earnings robustly, paying down debt, and controlling both spending and the number of shares outstanding. This is no mistake, as management teams throughout the industry, both old and new, speak constantly about maintaining discipline. The result of combining a favorable gold price environment with widespread managerial discipline is an industry as healthy as—perhaps healthier than—ever before.

Meanwhile, scars from the capital destruction of last cycle run deep in the memory of the institutional investment community. Many still shun the sector despite the above-mentioned improvements. Accordingly, the sector remains largely in the penalty box as investors are either not paying attention yet or are in wait and see mode. As a result, valuations in the space are extremely compelling. The EV/EBITDA multiple at the sample 13 companies is now 5.5x. That compares to a 16.2x multiple for the S&P 500 according to S&P Global data.

So, the industry is on the right path. However, to keep things moving in the right direction, management teams need to maintain strategic discipline and a laser focus on balance sheet health. Specifically, management needs to continue to check cap-ex spending, debt, and net debt levels, as well as the numbers of shares outstanding. Similarly, as opposed to last cycle, where plans for cap-ex spending and acquisitions were frequently made based on assumptions of higher future gold prices, management needs to make sure capital allocation and acquisition decisions still make sense even at lower gold prices.

Sustainable growth that prioritizes strong margins will also be crucial to keeping miners headed in the right direction. High profit margins maximize financial returns, but they also act as shock absorbers. If the miners have more cushion to better absorb price shocks and business disruptions and can withstand rough patches for longer periods of time, they will significantly stabilize their financial volatility and in turn greatly reduce market price volatility.

Strong dividends that continue to increase, when possible, will also help to stabilize investor returns in the sector and help reduce share price volatility. Lower volatility will be key to re-opening the door to more institutional investment. For over 25 years, the volatility of monthly share price movements in the gold mining sector has averaged an excessive 11.5% vs. about 3.8% for the S&P 500. This exceptionally high volatility is simply too much for many institutional investors to tolerate.

If managements can stabilize financial performance, reduce share price volatility, offer clean balance sheets with a compelling dividend proposition in one of the very few sectors offering truly attractive valuations in this market; it will allow companies to offer shareholders added value on top of the underlying gold reserves. Under these conditions, institutional investment flows will return to the space and work towards reflating mining sector valuations back towards their far higher historical relationship to physical gold prices.

With the right strategic approach, management teams can redefine and unlock the value of an asset class with absolutely unique characteristics and correlations. Gold is insurance against many of the great risks of our time. In this macroeconomic environment, if managed correctly, gold miners have unique appeal. The sector allows investors the opportunity to buy a productive business literally backed by gold. Gold miners are businesses in which growth is not directly correlated to GDP, and the underlying asset base is the purest inflation hedge in the hard asset universe. In the hands of the right management teams, gold miners can be the unique brand of insurance that actually pays shareholders for the benefits of protection.

So, again, many management teams in the sector have learned the painful lessons born from the sins of the past. Many of these companies are demonstrating discipline and applying the strategies that will allow them to reclaim historical valuations vs. physical gold. If this continues, the opportunity for the sector and its shareholders over time is exciting. Current gold prices are highly profitable for the vast majority of miners. With the right management approach, miners don’t even need further increases in the price of gold to potentially catalyze a re-rating of shares to much higher prices, indeed, even multiples of current levels. Multiples of current prices would be the result of a simple reversion back to previous levels of miners-to-metals ratio valuations.

These potentially outstanding industry returns would not require a historically unprecedented reappraisal of mining stock values to the price of gold. Rather, it’s the current value of the XAU to gold ratio that is historically unprecedented. The Barron’s Gold Mining Index is the oldest index tracking gold mining shares. It has data all the way back to the early 1940s, and its story is the same. Mining stocks, outside of this last decade, have never been so undervalued relative to gold. With management teams focused on righting the ship, and gold mining companies now in about as good fundamental shape as they’ve ever been, the compelling argument is that rather than a discount, a premium valuation is more warranted. While many risks remain, the best management teams in this sector have the opportunity to deliver something special for shareholders over the years to come.

As for weekly performance: The S&P 500 closed the week up 0.79%. Gold was nearly flat (-0.06%) while silver gained 0.73% on the week. Platinum gained 5.61%, while palladium was the best performing PM, up 8.89%. The HUI gold miners index also put in a good week, up 5.35%. The IFRA iShares US Infrastructure ETF was up 1.53% for the week. Energy commodities were volatile. WTI crude oil gained 4.57%. Natural gas was down 0.98% on the week. The CRB Commodity Index was up 1.72%, while copper gained by 2.03%. The Dow Jones US Real Estate Index ended the week down 0.02%, while the Dow Jones Utility Average Index gained 1.36%. The US Dollar Index was flat this week (0.01%) to close the week at 94.08. The yield on the 10-year Treasury surged further, gaining 13 bps to close the week at 1.61%.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC