Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Sorrows Come Not Single Spies, but in Battalions

The World Bank projects that global growth will decline by 5.2 percent in 2020. Their base case scenario suggests that this will be the deepest recession since the Second World War, and that the recovery from COVID-19 will come at a much slower pace than anticipated.

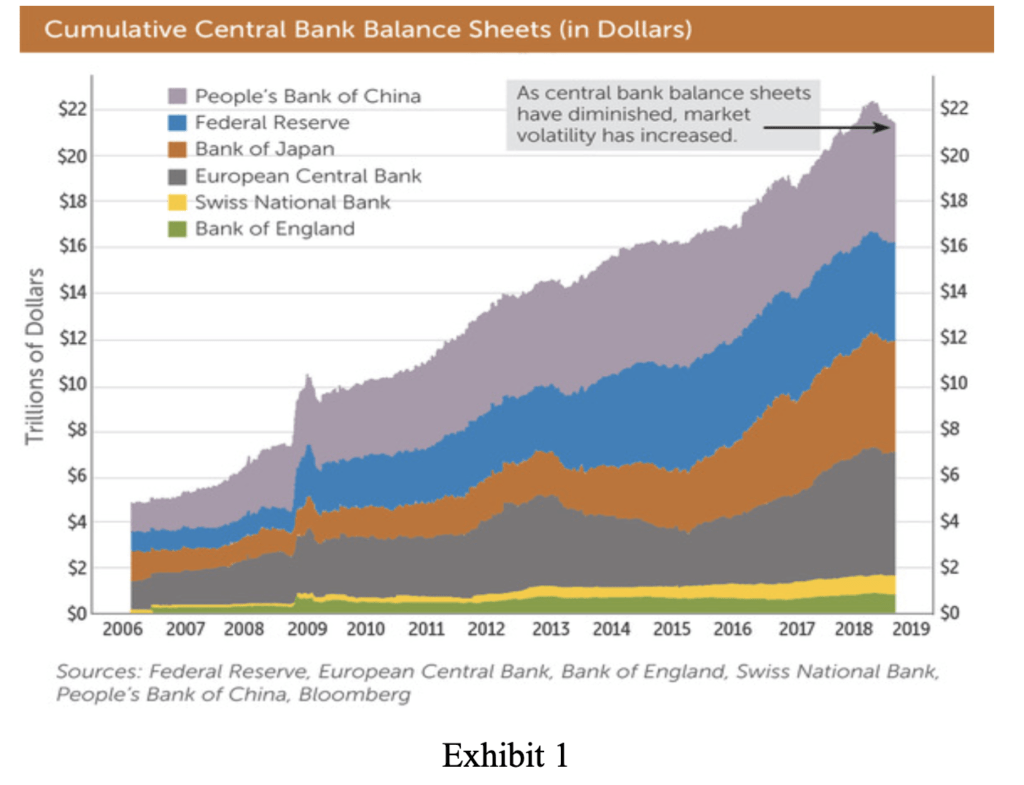

Central Banks around the world, in response to COVID-19 and the economic impact of lockdowns, have expanded their balance sheets dramatically in an effort to supply liquidity to a stressed financial system.

Despite incredible injections of liquidity globally in an attempt to halt and reverse an economic crisis, it is clear that liquidity is not reaching the parts of the economy where it is needed most – small businesses. Fortune 500 companies generally have no issues with accessing liquidity, both from the debt and equity markets. Main Street, however, is an entirely different story. Small and mid-size businesses, according to the United States Chamber of Commerce, are dealing with significant challenges. Seventy percent of those polled are worried about financial stress due to long periods of closure or operating significantly below capacity. Fifty-eight percent of those polled are worried about permanent closure.

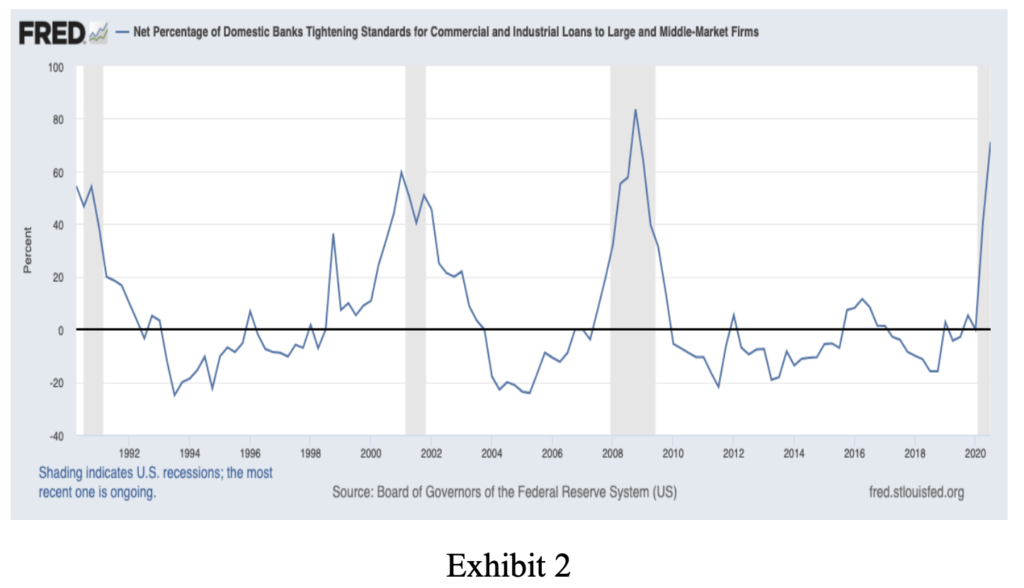

A key issue is bank lending standards. Despite exceedingly loose monetary policy globally, lending standards tightened dramatically post-COVID once the economic picture began to weaken. A survey of senior loan officers on bank lending indicated that standards tightened on commercial and industrial loans to companies of all sizes, and this sentiment is reflected in Exhibit 2. Lending to many businesses is either prohibitively expensive or completely unavailable because of the banks’ very low tolerance for risk despite having significant capital buffers.

One cannot blame the banks, of course. They are looking at their current loan portfolios without knowing what sorts of loan losses they may be faced with in the next 12-24 months. Their job is to ensure that they do not fall below required capital ratios or face distress. Further, Current Expected Credit Loss Standards (CECL) have required banks to forecast losses over a business cycle. Without a crystal ball, they must be conservative so they don’t run afoul of regulations. As a result, they reserved heavily in the first half of 2020 when lockdowns ground the global economy to a halt, and lending is particularly bifurcated across credit quality. Much of the added liquidity, therefore, is not making its way into the real economy.

Europe presents a similar picture. The European Central Bank (ECB) indicates that European lenders are also preparing to tighten lending standards. In a survey of lending policies, the ECB indicates that banks are very worried about the economy. Accordingly, they plan to tighten lending guidelines in the third quarter after already having tightened internal lending guidelines in the second quarter. Despite the fact that risk tolerance is excessively high in the current capital market environment, within the loan committees in banks globally, the risk tolerance is indeed low.

There has been massive monetary stimulus, but it is clear that the path to it making its way into the real economy remains challenged. There are conclusions to be drawn from this. It is clear that, despite the Fed’s and other global central banks’ best efforts to inject liquidity into the real economy and make money as inexpensive as possible for borrowers, tight bank lending standards have caused the velocity of money to decline. To be fair, this has gone on for years. COVID-19 has merely exacerbated the problem.

Asymmetric access to capital on the part of large companies is giving them additional competitive advantages beyond scale over small and mid-sized businesses, which are the lifeblood of the economy. Although some fiscal stimulus measures such as the CARES Act have helped, COVID-19 has effectively solidified the dominant position of large companies over small ones, and will have greater market share coming out of the pandemic. Without willing lenders or able borrowers, the Fed – despite rate cuts to zero – is effectively pushing on a string. Politicians and policymakers who blame central banks only add to the perception problem that monetary policy can save the real economy single-handedly.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC

1. https://www.worldbank.org/en/publication/global-economic-prospects

2. https://www.uschamber.com/report/july-2020-small-business-coronavirus-impact-poll