Weekly Hard Asset Insights

By David McAlvany

Telling the Economic Truth

Major market indexes took a bit of breather this week. The Dow Industrials and the small cap Russell 2000 index both made new all-time highs on Monday, but subsequently faded to close lower on the week. Shockingly enough, in light of what is rapidly becoming a market expectation, neither the S&P 500 nor the tech heavy NASDAQ managed any new all-time highs. Overall, the declines in the indexes were muted. Index weakness reached a mid-week drawdown extreme of about 3% before rallying again by Friday.

Over the last five trading days, the headline price action shifted away from major equity indexes and more towards the dollar and the materials sector. The US dollar had a very significant week. The dollar index broke above multiple points of chart resistance, and made a new high over the 95 level in its ongoing 10.5-month rally. The dollar index reached its highest level since July of 2020. The dollar topped-off its week of distinguished accomplishment by closing above every major daily and weekly moving average.

Dollar strength is certainly something to keep a sharp eye on going forward. A strong dollar could reasonably be expected with the US Federal Reserve having announced its plan to initiate tapering of asset purchases, and markets expecting the Fed to increase interest rates next year. That said, dollar internals, as measured in the weekly Commitment of Traders (COT) report, are weak at present. After extremely bullish market positioning in the dollar as recently as March, dollar internal positioning has since ebbed all the way back to extremely bearish. Since midway through last summer, speculative long positioning in the dollar has become bloated and the trade quite crowded. Typically, high levels of speculative long positioning in the dollar, or any other asset for that matter, is a contrary indicator. At present, speculative long dollar positioning is the highest it’s been in over two years. The type of extreme positioning seen in the dollar currently is not a particularly effective short-term indicator. It is, however, a better indication of developing dynamics suggestive that a major trend change may be approaching.

With the dollar action in mind, the significant strength in the materials sector this week becomes all the more interesting. Given the bullish breakout in the dollar this week, expectations might have been for commodities and the materials sector to be battered, bruised, and among the worst performing segments of the market. In fact, however, the materials sector ETF (XLB), was the only market sector to end this week at new highs. Interesting! Nonferrous metals, aluminum, precious metals, and chemical producing companies led the way higher.

Narrowing in more closely, the epicenter of these unusual price correlations is the breakout higher in the dollar happening in the context of a newly unfolding breakout higher in gold. Two weeks ago, gold closed above all of its significant daily and weekly moving averages and was threatening to break out above major resistance. This week, the yellow metal decisively broke through critical resistance to close at the highest levels since June. The technical developments in the gold price this week are extremely significant. Having now made a higher high on the price chart, gold is now in a technical uptrend off the August 9th lows. In addition, gold’s ascent has broken above a major downtrend resistance line that has contained all gold rally attempts since the August 2020 high. This week’s move in gold clears the technical road for a possible significant new rally phase in the precious metals complex.

With seven consecutive up days, gold is now in a short-term technically overbought condition. A near-term consolidation in price at this point will come as no surprise. Nevertheless, even if gold corrects in the short term, the considerable bullish technical accomplishments will remain as long as gold holds the $1820 to $1835 zone.

While it is possible that both gold and the dollar could continue to move higher in tandem for a while, it remains more likely that over the intermediate term, one of these assets will assume the lead and firmly outperform the other. So which breakout is telling the truth? In this crazy market environment, only time will tell. Nevertheless, there are several indications that shift probabilities for the next major uptrend in gold’s favor.

In addition to the above-mentioned bearish COT readings, the dollar is already into the 11th month of an advance. Gold, on the other hand, is 16 months into a grinding consolidation. Throughout the gold price consolidation, investor sentiment has reset to the low levels conducive to the initiation of a significant new advancing phase. Speculative interest has only just begun to flow back into gold, and is not at the excessive levels that might be cause for concern. Perhaps most important, however, gold is starting to reassert itself as a dominant inflation hedge. After months of muted responses to high inflation and hot consumer price index (CPI) readings, gold is now rallying alongside the hottest CPI reading since 1990.

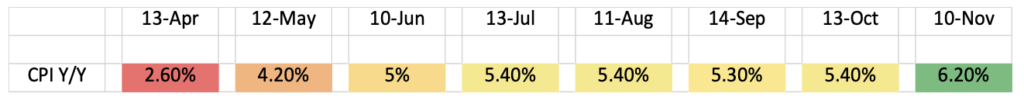

This week, the Labor Department reported that in October the CPI rose 0.9% after gaining 0.4% in September. On a year-over-year basis, CPI accelerated to an eye-popping 6.2%. That was the largest year-over-year advance since 1990, and followed a 5.4% reading in September. Dow Jones estimates had been for a 0.6% M/M increase and a 5.9% Y/Y reading. The reading was a stunning beat over already elevated estimates, and landed an undeniably heavy blow to a “transitory” inflation narrative that was already in retreat. The Fed has been repeatedly dismissing inflation as transitory since last spring. In that time, the market has largely given the Fed the benefit of the doubt. In addition, market rational has been that either the Fed is correct on the transitory narrative, or it will take policy response actions to quell inflation if it persists.

Well, last week’s Fed meeting surprised the market with a dovish stance on interest rates and a more dismissive position on inflation than expected. After months and months of high inflation defying the transitory narrative, increasing evidence of developing wage-price spiral dynamics, a heating up of the “persistent” inflation components within CPI, increasing inflation expectations, and an emerging inflationary global energy crisis, the market had finally assumed the Fed would talk tough on inflation. The Fed’s dovish surprise seemed to have increased market concern that the Fed is recklessly lax and behind the curve on the inflation problem. The below table illustrates just how out of touch the Fed’s transitory narrative, maintained since last spring, has really been.

Gold’s recent strength may be a strong indication that the market is losing patience and confidence in Fed management of what is rapidly becoming a very worrisome situation. While the Fed has repeatedly affirmed that it would implement more aggressive strategies if inflation ran too high, it has offered no details as to what that exact “high” number might be. Currently, the Fed is still pumping liquidity into markets while the Fed funds rate sits at 0% to 0.25%. That is an amazing policy in the context of a rapidly accelerating inflation trend that now officially runs at a blistering 6.2%.

In the wake of this week’s CPI shocker, Wall Street strategists are now anticipating a rate hike sooner than previously expected. That may be the primary fundamental driver of dollar strength. In fact, market expectations for eventual future interest rate hikes in response to the trend of high inflation readings may be the primary fundamental driver of the entire 2021 dollar rally. Concurrently, fear over pending interest rate hikes are likely a prime contributor to gold prices correcting throughout an inflationary surge.

Given what we have seen for months, the dollar rallying on interest rate hike expectations in response to hot CPI’s isn’t the surprise. The surprise is that gold is now flexing its muscle in spite of the dollar and the threat of higher rates. Perhaps the strength in gold is evidence that the Fed’s narrative is losing sway over the market. Perhaps the market is starting to discount Fedspeak and assurances in favor of the facts on the ground.

This week’s University of Michigan Surveys of Consumers report adds to those facts on the ground. Survey chief economist, Richard Curtin states:

Consumer sentiment fell in early November to its lowest level in a decade due to an escalating inflation rate and the growing belief among consumers that no effective policies have yet been developed to reduce the damage from surging inflation. One in four consumers cited inflationary reductions in their living standards in November, with lower income and older consumers voicing the greatest impact. Nominal income gains were widely reported, but when asked about inflation-adjusted gains, half of all families anticipated reduced real incomes next year. Rising prices for homes, vehicles, and durables were reported more frequently than any other time in more than half a century. The reactions of consumers to surging inflation should be no surprise, as it has been reported during the past several months. The description that inflation would be “transient” has the undertone that consumers could “grin and bear it” as economic policies counted on a quick and automatic self-correction to supply and labor shortages. Instead, the pandemic caused economic dislocation unlike any prior recession….

Speaking to the connection between the devastating impact of an era of extreme political partisanship and the inflation problem, Curtin adds that “Such extremes [in partisanship]…make achieving [politicians’] policy goals much more important than providing effective countermeasures to ongoing economic hardships.”

Curtin’s assessment that political partisanship in Washington trumps a serious motivation to adopt the sound policies needed to combat “ongoing economic hardship” is a sad and regrettable one. If correct, the devastating consequences are likely to be wide-ranging.

This week, economics professor Steve Hanke from Johns Hopkins University and John Greenwood, chief economist at Investco, co-authored a Wall Street Journal op-ed. Their contention is that it’s the growth of the money supply that has triggered this surge in inflation. In their view, with the recent 35% increase in M2 money supply, “the monetary bathtub is overflowing.” In the op-ed, the two economists make a key observation: “It is the past growth of money that matters. Unfortunately, an excess money problem cannot be countered quickly. The lag between money growth and inflation is typically about two years. Therefore, even if the Fed counters immediately, it will take at least two years before the monetary bathtub stops overflowing.”

Unfortunately, the Fed balance sheet is still growing, and the Fed is taking its sweet time in reducing liquidity injections. It isn’t even ready to seriously talk about imminent rate hikes. With inflation having already grown into a 6.2% monster, and liquidity and near zero interest rate policy still in place, a two-year inflation lag-effect is a terrifying thought. For the second survey in a row, Richard Curtin at University of Michigan is indicating that inflation psychology and serious consumer pain are already firmly in place. The fact that rising prices for “homes, vehicle, and durables” were mentioned “more frequently than any other time in more than half a century” should be an alarming wake-up call. That half of all families anticipate lower inflation-adjusted incomes next year should downright scare policymakers and consumers. When it is known that prices are soaring, and half the population, despite nominal wage gains, is aware that their purchasing power will decline, you have inflation psychology in place. In such dynamics, people aggressively spend today on that which they expect to be more costly tomorrow. That is the inflation force multiplier and accelerant that Fed economic models struggle to capture.

As Curtin mentioned in his last survey, when inflation psychology manifested in the 1970s and early 1980s, it took Paul Volker dramatically increasing interest rates to break that imbedded inflation psychology. Despite these facts on the ground, the Fed now appears extremely reluctant to even talk tough on inflation, and certainly seems miles away from being Volker-ready. It could be that the deep fragility of the market and economy along with the devastating impact of higher interest rates on massive current debt levels explains the Fed’s reluctant stance. Perhaps the recent gold price behavior, with the metal reasserting itself as an inflation hedge, is an indication that the market is catching on to the reality of a trapped Fed. Perhaps the market is showing signs of recognition that overcoming inflation is more important than the threat of higher interest rates. So, again, which asset is telling the truth? The breakout in gold or the breakout in the dollar? In the very short-term, it’s anyone’s guess. Beyond that, however, the facts on the ground argue that gold’s rally is telling the economic truth.

As for weekly performance: The S&P 500 closed the week down 0.31%. Gold was higher again by 2.85%, silver gained 4.93% on the week, platinum was up by 5.16%, and palladium gained 4.44%. The HUI gold miners index had a big week, up 7.41%. The IFRA iShares US Infrastructure ETF was higher by 0.99% for the week. Energy commodities were lower and extremely volatile again. WTI crude oil was off 0.59%. Natural gas was crushed, down 13.14% on the week. The CRB Commodity Index was up 0.89%, and copper gained by 2.46%. The Dow Jones US Real Estate Index ended the week down 0.08%. The Dow Jones Utility Average Index lost 1.13%. The dollar was higher this week by 0.86% to close the week at 95.13. The yield on the 10-year Treasury increased by 13 bps to close the week at 1.58%.

Have a great weekend!

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC