Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

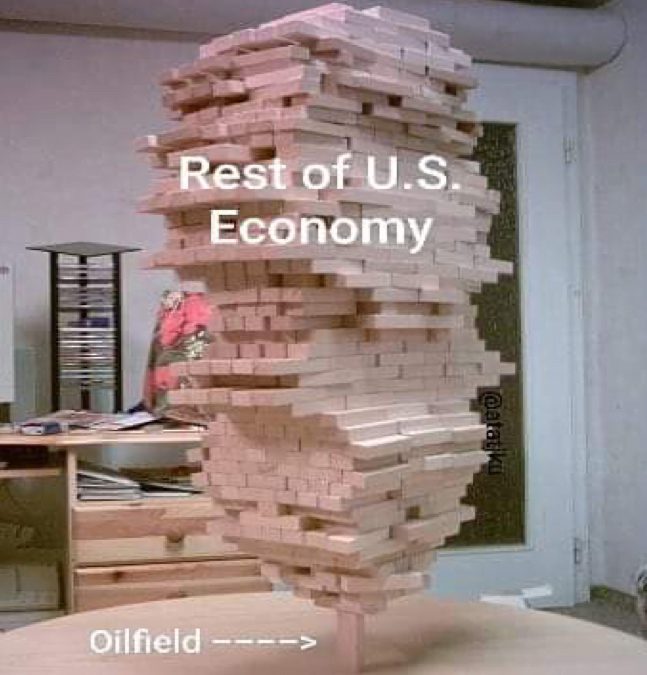

The Oil Industry’s Version of Coronavirus

While the above photo may seem like a bit of an exaggeration given the significant damage that COVID-19 has wrought on the economy, so much of the problem in the credit markets stems from energy high-yield. This week alone we saw one independent producer file for Chapter 11, and at least one other independent E&P and an oilfield services company hire restructuring advisors, presumably to explore alternatives and prepare for the likely scenario that there will be a reorganization of the company. The industry was quite troubled long before COVID-19 and the dissolution of OPEC plus. However, those events have forced a quick and painful reckoning. We believe there is much more of this to come.

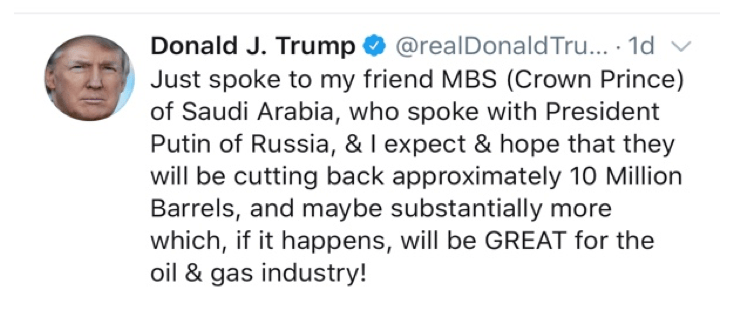

Given the stress that the energy industry has wrought on the overall credit markets, it is no surprise that policymakers have begun to step in to try to solve the problem of protecting the domestic energy industry. Yesterday, Trump had a brief call with both Saudi and Russia after which he tweeted the following:

Despite being very light on details (15 million barrels? A day?), this fueled a big rally in the commodity. The rally was further aided by reports that energy executives would be meeting with President Trump to try to agree on a voluntary production cut and perhaps obtain support for the industry with a royalty holiday or an import tariff – though several major producers have come out against this. There is also speculation that the Texas Railroad Commission may attempt to curb production by ordering production limits, which has not occurred since 1973. As recently as March 20, the Texas Railroad Commissioner was opposed to any concerted effort to cut production despite the collapse in pricing. In addition, there is an “emergency” OPEC meeting this Monday, and it is clear to us that the wagons are circling in an attempt to support pricing.

So, let’s walk through some math. Saudi decided a few weeks ago that it was going to maximize production and go to production of 13 million barrels/day from the current ~12 million barrels/day. Russia, which went along with fewer of the cuts under the old OPEC+ agreement, currently produces 11.4 million barrels/day. Trump’s assertion that those countries in aggregate agreed to cut half of their production seemed to us a bit sketchy. A great deal of detail likely needs to be worked out before that could possibly happen. We might consider at least remotely possible a 10 million barrel/day GLOBAL cut, with Saudi/Russia each taking on 2.5-3 million/day if the US/North American agree to also cut by 2 million/day. Maybe you get another 1 million/day out of the rest of OPEC. I’m not really sure how you get everyone to agree to all of this, particularly independent producers, of which there are many dozens in North America. There may also be a violation of anti-trust law associated with trying to force this.

Significantly, though, we don’t think you can get any OPEC+ action unless you get some significant cuts in North America, and it is unclear as to how that might be achievable. There are already signs that a “deal” may be falling apart before it even gets started – the US is trying to corral Saudi and Russia to make a deal without participating[1]. We believe this is ill-fated, as OPEC (rationally) wants to see US participate in any deal around production cuts. Why should they support the market so the US can just take market share, as they have for years? The dissolution of OPEC+ is an admission that it has been a horribly flawed strategy on their part.

In any case, will concerted action by OPEC+ and North America really balance the market? Let’s say we get 10 million barrels per day in global supply cuts, per the math above (which, again, we think is wildly optimistic). Our research and reading suggests that coronavirus has created demand destruction on the order of 20-25 million barrels a day plus. So while a cut may slow the rate of global inventory build, and perhaps significantly impact market psychology in the short run, in the medium-term we will still face a global situation of full storage capacity. Supply is only half of the equation, and the demand decline we are seeing is like nothing we have experienced in modern history. The International Energy Agency (IEA) is inclined to agree with us, and indicated that even with 10 million barrels/day in production cuts, we will still build inventories on the order of 10-15 million plus barrels/day.[2]

We believe that balancing the markets sustainably will be a multi-year process. That said, capital expenditure cuts on the part of producers that are fighting for their lives could entail cuts in production of up to two million barrels a day from the peak. As they say, the cure for low prices is low prices. Weaker players being taken out of the market and a prolonged period of under-investment will ultimately set us up for the next bull market in pricing. Unfortunately, the most rational route for Saudi/Russia to take is to maintain output and keep pricing low long enough to force out the weakest shale players in North America and force budget cuts on the rest of the industry so supply reductions match the global cost curve. The industry as a whole was already facing structural flaws of high debt loads and difficulty making cost of capital returns before COVID-19 and the dissolution of OPEC+ drove pricing below $30/barrel.

Sometimes sentiment and psychology can become so poor that it takes very little to spark a significant rally, particularly in an area where so many have been very short, and that is what we saw the last 48 hours or so in the energy markets. The situation is extremely fluid, and continues to evolve even as this week’s Hard Asset Insights is being written.

Best Regards,

David McAlvany

Chief Executive Officer

MWM LLC

[1] https://www.reuters.com/article/us-global-oil-trump-energy/us-not-negotiating-with-saudi-arabia-russia-wants-them-to-reach-oil-deal-source-idUSKBN21L3CF

[2] https://www.oilandgas360.com/deep-oil-output-cuts-wont-offset-unprecedented-demand-loss-iea/?utm_source=Closing+Bell&utm_campaign=3442338d2f-RSS_EMAIL_CAMPAIGN_2019&utm_medium=email&utm_term=0_d4943fe35f-3442338d2f-27539345&goal=0_d4943fe35f-3442338d2f-27539345#utm_source=rss&utm_medium=rss&utm_campaign=deep-oil-output-cuts-wont-offset-unprecedented-demand-loss-iea