About this week’s show:

- Venezuela’s Tier 1 Collateral: GOLD

- Putin vs. Obama: The new Energy War

- Safe Assets: Real, Out of sight, and Off the Grid

The McAlvany Weekly Commentary

with David McAlvany and Kevin Orrick

“This is a period of time where you want to go quiet with your assets. Hang a beautiful piece of art on the wall. Fill a vault with gold. But don’t tell everybody where the vault is, and certainly don’t tell anybody what the access code to your house is. You realize that the problem of wealth in ages past was you had to have an army to keep it, and the wealthy of our day don’t have an army to keep it, and the governments that they are subject to do.”

– David McAlvany

Kevin: A little bit of a break this week, Dave. I felt like gold has been contrived and manipulated for months, but especially last week, it just seemed like every time gold wanted to go up a little bit, somebody would knock it down. They were trading it in a very, very narrow range. We found out later that there was a deal between Venezuela and City Bank as far as a gold swap. Do you think they were controlling the price for some reason as they were moving into that deal?

David: It’s interesting. We may have two bookends in the story of depressed gold prices, what began in August of 2011 as a request for 99 tons, roughly six billion dollars in gold which was held by the Bank of England. The government of Venezuela asked that it be sent back. They wanted to repatriate it. It was about one-third of Venezuela’s gold which was being held by foreign banks. That brings us full circle to why you own the metal in the first place. Gold is an asset that – let’s say it has an off-grid pedigree, and if you think about it, certainly, it is something that has an air of the regal, but also, again, something that is off-grid. It makes me think of the Queen of England in her land rover – I don’t know if you have ever seen pictures of her driving to her house in the highlands of Scotland – and it is officially acceptable, but it is decidedly off-grid.

Kevin: (laughs) Well, I think none of us liked Chavez much, but I think he was ahead of the curve, because Venezuela asked for their gold to be repatriated, and then, it wasn’t long after that that Germany said, “Yeah, why don’t you send us a portion of our gold back,” and then the Netherlands, and we’ve talked about France here in the future doing the same thing. It seems like it might have been a good move.

David: Venezuela has a financial asset. It is over 70% of their total foreign currency reserves, and according to the Bank of International Settlements, gold is a Tier 1 asset in terms of capital. It is a top quality asset, so to say. And here is what they are doing – they are swapping with City Group for immediate liquidity needs. They are using roughly 1.3 million ounces of gold – that is what is included in the swap – with the majority of their gold still remaining outside the hands of bankers like City. And, of course, the vast majority has been in their direct control since 2011 in that repatriation.

It was interesting – looking at what central bankers were doing for the benefit of Venezuela, you have the Bank of England, which was holding close to 99 tons, the Bank of International Settlements was holding another 12 tons that belonged to Venezuela, 17 tons in the custody of J.P. Morgan. And then about 82 tons held with a variety of banks, HSBC, Barclays, Standard Charter, and what have you. And I think what they undid at that point was the entanglements of a financial asset. They were disentangling it, getting it out of the hands of the financial marketeers. The beauty of the asset in question, that is, gold, is that by its nature it is a financial asset. It is just outside the financial system.

Kevin: Let’s face it. Look at what Europe is going through right now. They are trying to figure out what is going to happen with Greece in reference to their own currency. Here in the United States, everybody is watching what the Federal Reserve is going to do on a moment-to-moment basis to see whether the dollar is going to hold, or the bonds are going to hold. It doesn’t matter with gold. It doesn’t matter if Greece goes belly up with gold, it doesn’t matter if Venezuela has its gold in Europe or Africa or America. I mean, gold is gold is gold, and talk about a Tier 1 asset – in a way I have to smile when I think of the Bank of International Settlements calling gold Tier 1. Gold is Tier 1 times Tier 1, times Tier1, times Tier 1, times 1000, compared to paper.

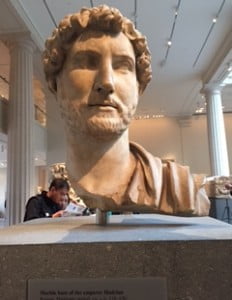

David: Things change, but the value of gold in the financial picture has been constant through time. I mentioned last week that in New York my son and I went to the Greek and Roman exhibit at the Metropolitan Museum of Art, and they had a bust of Hadrian there. And it wasn’t that long ago, within the last few decades, that they found a stash, a hoard, of old Roman coins near Hadrian’s Wall there in Great Britain. You’re talking about something that has gone from the 4th century up until the current time, and gold is gold, is gold.

I think, in terms of the role that it plays, this is particularly interesting, because no one values the distance between financial firms until something goes wrong, and then everyone becomes aware of the risk from a counter-party. So, the entangled assets from one balance sheet to another, not unlike the bloodlines of the royal family – where does one family end, where does another begin – is not entirely clear.

Venezuela, for a variety of reasons, is reintroducing some of its reserves back into the financial system because they prefer to have dollar liquidity. We, as a firm, and personally, prefer gold on the outside variety, that is, outside the financial system, knowing, quite frankly, that banks love arrangements that primarily benefit banks. Goldman-Sachs actually made the same offer to the Venezuelan government back in 2011 and Chavez declined. We think he was wise to do so.

Kevin: Let’s look back at that time. The gold was held by other people at that time. Now, they have repatriated enough to where this is a much better deal for them at this point. Goldman-Sachs pulling off that same deal in 2011 would be with gold that they may not get back.

David: Well, right, I think when a banker extends the helping hand, I think, certainly, the big city banker, maybe not your small town guy that knows you well. Yesterday I walked by a sign advertising free beer. I stepped closer to the sign and I could see in small subscript the words, right under “free” in little teeny tiny words, “Wi-Fi.” So it’s free Wi-Fi, and then you also had subscript under beer which was “extensive list.” So you have this extensive beer list, and it’s not a free beer. What is being advertised – actually, there is something quite different going on. I imagined instantly the big banker’s sign saying, “Here to help you,” in bold letters, with the subscript being, right after “help,” in small letters, “myself.” (laughs) And just before the “you,” – “screw you.”

So, euphemistically, of course, this is, I think, the nature of banking – what’s in it for the banker? And you can see all the deals that have been revealed that, actually, Mario Draghi was a part of – very strange deals, dealing with special purpose vehicles, and getting things off balance sheet. In fact, a number of your peripheral European countries would not have been allowed into the EU if it wasn’t for the lies and subterfuge created by Goldman-Sachs and Mario Draghi to cover up the amount of debt that they had, allowing them to meet the metrics that made them acceptable, and welcome into the crowd. So, to me, it is a very fascinating world where self-interest and self-reference are just inextricably linked.

Kevin: Even this last week I was mentioning how gold felt manipulated. It felt more manipulated than even the past few months. And sure enough, then, we find out about this deal with City. Do you think that is maybe why gold is rising again now that this thing is over?

David: Maybe it is coincidental. We, of course, have long wondered if the German request and the Venezuelan request for gold didn’t put pressure on governmental positions. We are talking about lent, leased, re-hypothecated. You have an asset that rarely sees the light of day and it is fairly easy for a nefarious character to count the asset more than once. We saw the Chinese notoriously doing this with copper holdings just in the last few years, taking out multiple loans against the same asset, and failing to disclose that very small and almost immaterial point to the other lenders.

We don’t know for sure if that is what has happened with the great gold hoards in the Western central banks, but the systematic pressure on the gold market since the fall of 2011 has the hallmarks of market operations that needed to occur – how did Warren Buffet say? “Lest the proverbial swimmer, without the swim trunks, be revealed by the receding tide.

Kevin: Re-hypothecating gold is a little bit different than when Jimmy Stewart was talking about how the money was in Mary’s house, and in John’s house, and in Bob’s house. The gold is either there or the gold is not there. It is funny, you brought up the Chinese. I just want to take a quick side note here. The Chinese double-counted, triple-counted, quadruple-counted copper, but you know what is interesting – as they prepare, and I want to talk about this later, because we may be having a currency reset coming at some point – isn’t it interesting that they undercount their gold? Strangely, they have had a little over 1,000 tons of gold now for the last five years. There is speculation, maybe, that they have doubled that. But we know, with the thousands of tons that have been going into China the last couple of years, that they could have far more gold than they want anyone else to know about until the right moment.

David: Clearly, they want to be a part of the SDR system, that is, the central bank settlement system, currency system. It is basically a fiat system for fiat currencies – a synthetic currency which only trades hands between the central banks. Why would you want to be a part of that? Well, it’s not just bragging rights, it has to do with your clout in the international community. It has to do with the amount of trade that your economy represents.

Kevin: You can borrow using those reserves. You can borrow a lot more money using those reserves.

David: And the strike against the Chinese is that the RMB is not the most liquid currency. If you look at the yen, it is a very liquid currency, and you might say, well, it was downgraded by Fitch yet again this week. What does that mean? You don’t have to be the best quality to be a part of the world monetary system, but you do have to have liquidity. The Japanese yen has it, the euro has it, and the U.S. dollar has it. A variety of currencies fit the bill. The RMB may not fit that bill quite yet, but they certainly would have the argument, in terms of stability, and in terms of being an additive in the mix, with a sufficient amount of gold reserves they may fit the profile of an up and coming currency. Not a flash in the pan up and coming, but a currency that intends to make an important mark on the world monetary system in coming decades.

Kevin: Is it any mystery that they would want to have more of a viable currency in the world markets? Look what they are doing with the dollar. I just read a report this morning that the Boston Fed is suggesting that quantitative easing actually be a permanent part of the Fed’s strategy. So, instead of it being an emergency measure like we talked with Andrew Huszar about, who was in charge of the first 1.2 trillion, he stepped away because he saw that they weren’t backing away. Well, at this point, Boston Fed is saying, “You know, QE is nice to have in our bag at any time and at every time.”

David: Sure. Once you’ve been given the keys to the kingdom it’s very difficult to hand them back, not realizing that it was just a temporary loan. You could use them, but you needed to return them at the end of the day. They actually like the power, the control, and the rock star status. Well, there is an alternative interpretation of the positive action in gold this week. Maybe it is not the bookends of Venezuelan chicanery and requesting the physical gold and central banks playing games because they couldn’t come up with it in short order. An alternative interpretation would simply be that gold this week saw a number of short interests covering their bets in anticipation of the Fed making further commitments to support an ailing economy.

Kevin: Let’s explain that. A short interest covering their position is basically someone who was betting against the market who is now coming back in and saying, “Oops, looks like they’re going to stimulate again. Let’s cover that short.”

David: Yes, if you are betting against the price of gold, you are assuming it is going to go down, you have possession of the gold and you can return it at a lower price and profit on the difference in price, assuming that the price goes down. However, if the Fed is going to further make commitments to support an ailing economy, that, in theory, would put a cap on the dollar rally for now, and give a further boost to the gold price, moving it higher, maybe a move toward $1300 would ensue, in which case the gold that you borrowed would have to be given back at a higher price, meaning you lost money if you were shorting the gold market.

So, we may already be in a recession, and certainly the developing world numbers are keeping the Fed up at night. They are focused on what that may suggest about the developed world markets, and clearly, we talked about this last week, there is an overheating in the U.S. stock markets relative to actual economic activity. You have the rocket ship in market prices, and it is just not reflected or supported by GDP growth figures, which we mentioned both in nominal terms and in real terms, with last quarter, the fourth quarter of 2014, seeing one of the lowest deflator numbers applied to the GDP statistics in recorded history. So, I think the Fed is up at night for good reasons. They are looking and saying, “We’ve got loose monetary policy in place.”

Kevin: This is not the first time we’ve seen loose monetary policy. I remember in the 1990s as the tech stock bubble was growing and growing, we saw very loose policy. Alan Greenspan may want to distance himself from that at this point, but we saw bubble dynamics at that time.

David: Yes, and what were they watching? They were watching Asia, they had just bailed out, or helped facilitate a bailout of Mexico, and there were greater concerns over systemic stability following a long-term capital management debacle, and the Russian default in 1998. So, you had loose monetary policies which then stimulated, with those as backdrop issues, market speculation, even while internal pressures were developing. So again, emerging market pressures, it was a clear win moving to U.S. financial assets in that period of the late ’90s, for not only the capital gains, but also the currency appreciation, because you were seeing currency depreciation in the emerging markets. Does that sound similar? Does that sound like what we have seen in the last 6-12 months, bringing it more into the current tense?

Kevin: So, you are saying we have bubble dynamics again, like we had bubble dynamics in the last two bubbles. In the last 15-20 years, we had the tech stock bubble – it popped. It moved to the real estate bubble – it popped. It moved to the government debt and QE bubble. So what makes this time different?

David: But I think that’s part of what makes it different is that we are talking about a government debt bubble, and we are talking about dollar dynamics, which are a bit more complex now versus then. We are a lot closer to a global currency reset, a remaking of the world monetary system, which was not the case in 1999, although you could argue you had the introduction of the euro at that time, so certainly, that was a part of the back story, and that certainly served as a reason for central banks to be dropping their holdings of U.S. dollars and increasing their holdings of another foreign currency. But again, when we talk about a currency reset, we’re talking about a radical shift. We are talking about, basically, the equivalent of a Bretton Woods III, where all the world’s central banks get together and say, “We’ve got to regain control. Here is what it looks like to do so.”

Kevin: And it almost always involves some people giving up buying power for their currency and others winning. We saw this in Europe when the euro came about. Let’s talk about bubble dynamics here for a moment, because one of the signs of bubble dynamics, Dave, is margin debt. You have been talking and preaching and pounding on margin debt in the stock market, over the last year, but it just continues to stay at record levels.

David: Before we move beyond that currency reset theme, I think one of the things you saw as the definition of the dollar changed dramatically every time you had a currency reset. If you were pricing gold in other currencies you would see this, as well, the definition of the dollar, officially, 1/20th of an ounce of gold prior to the currency reset in 1933. That’s what you had with the confiscation of gold. It wasn’t, “No you can’t own it,” as much as it was, “Yes, we will control the value of the dollar, and it’s no longer going to be a function of the free market, it’s going to be by our dictation.”

That’s what occurred in 1933, and it went from the definition being 1/20th of an ounce to 1/35th of an ounce. And then all of sudden, fast forward to the 1970s, you have the failure of Bretton Woods, the removal of gold as an asset to be exchanged for greenbacks, and the definition of the dollar went from 1/35th of an ounce of gold to about 1/400th of an ounce of gold. So again, every time we have had a major currency reset, the definition of the dollar has changed, and it reflects a massive devaluation.

The flip side of that is, you’ve seen appreciation in the gold price. Now we’re setting about, again, if you are to define a dollar as it always has been in gold terms, we’re at 1/1200th of an ounce of gold. Is it unreasonable to think that during the next currency reset, it is defined as 1/300th of an ounce of gold? I don’t think so. I don’t think that is unreasonable at all.

Kevin: A guest of ours, Jim Rickards, has set the numbers. He has done the math. He basically has said, 1/12,000th of an ounce of gold is even reasonable, with the amount of dollars that have been printed, and would still only be a partial backing of the dollar if they did that.

David: Speaking of very speculative pressures, what was building in 1999, what is building here in the United States in terms of the stock market and valuations, March margin balances – we just got those numbers in this morning – inched higher by 11 billion dollars. That’s a new all-time high – 476 billion dollars – so it is the largest in terms of a percentage of market capitalization in all of U.S. history. And it is the largest in nominal terms in all of U.S. history. There are more speculative dollars today in the stock market than at the peak of 1929, the market peak of 2000, that is, March of 2000 just before the NASDAQ imploded, and even the market peak of 2007.

Kevin: It’s the assurance of easy money, Dave, just like it was in the late 1990s.

David: It’s like we are partying now as if it were 1999.

Kevin: It all seems to be like walking on thin ice. I think I’ve told this story to you before, Dave, but when I was walking to junior high each day as I was growing up, we had a lake – Kendrick Lake – which was between our house and the junior high. And it really cut down the time, especially if I left late for school, if I just walked across the ice. The problem was, every spring, even though we all knew the trick, somebody ended up breaking through the ice, and it was always a dangerous endeavor. And it feels like we are on thin ice right now. Yes, there is this assurance of easy money, so you have margin debt increasing. You have this assurance of zero interest rates. But what if interest rates go up, even just marginally?

David: I don’t think they can, as much as they might want to or need to, raise rates on a more aggressive pace, but if you will go back to 1994, in the right context, even a small move can absolutely obliterate the bond market.

Kevin: So, it’s like breaking through the ice.

David: The temper tantrum that we had two years ago had nothing to do with an increase in rates, it had to do with a discussion of an increase in rates. So, what is the difference between saying we’ve thought about doing it, and again, having a taper, or a temper tantrum in the marketplace, as opposed to actually raising rates by 25 basis points? That’s exactly what we were raised in 1994 – a 25-basis point move higher off of 3, to about 3.25, decimated the corporate bond market. And a part of it was because of the amount of leverage in the system, in the bond market, at that point.

And what is fascinating to me is that we assume that we can begin to raise rates without ill effect, and we are far more leveraged today than we were in 1994. Do you remember what happened in 1994? This is when Orange County went bankrupt. Orange County went bankrupt, in part, because they had derivative products, and they were basically on the wrong side of a derivative trade, so their fixed income portfolio implodes, they have to declare bankruptcy. Orange County! You’ve been to Orange County. Orange County is not Detroit.

Kevin: No, nary a BMW or Mercedes is lost in Orange County. It’s amazing, you drive around and it’s either a Beemer or a Mercedes.

David: You’re the odd man out if you’re driving a VW Bug.

Kevin: Okay, but let’s go to Orange County, then. One of the key problems that you have in the bond market, and you brought this out last week, Dave, which is that fixed income market, is if there is interest rate irregularity or volatility, you could have a liquidity problem very, very quickly. It’s not like there are people that are lining up at the doors to buy bonds that are underpaying.

David: What is interesting is, this week in the Financial Times, they were reporting that a number of banks are requesting to have the settlement of corporate bonds being done on a delayed basis. Right now they have to settle those transactions and report them within 15 minutes. This goes back to rules that were put in place in 2002 in order to increase transparency. So, now what you have is the financial industry regulatory authorities trade reporting and compliance engine. Again, that is what brings in the data for U.S. corporate bond transactions and reports within 15 minutes what has been bought or sold. And what banks are asking for is a delay of a day or more in reporting the block trades for bonds.

Kevin: So if there a liquidity problem, nobody really gets to know.

David: No one is going to know about it for 24 hours. No one is going to know who was trying to sell what, and at what price those orders filled. It is amazing to me that you basically have Wall Street firms saying it is entirely acceptable for anyone on the other side of the trade to be blind for 24 hours as long as it serves “our purposes.” And “our purposes” are to be able to get out of position quietly without anyone knowing, to avoid a snowball effect, because quite frankly, what they are afraid of is price discovery. What happens in any market – if you can imagine the guys that gathered in the ’20s, ’30s and ’40s to watch the ticker tape, they were watching price discovery in real time. What is the value of a stock? What is the value of a bond? It’s up, it’s down, it’s up, it’s down, it’s up, it’s down. What Wall Street is asking for in terms of bond trading is…

Kevin: Stop the tape.

David: Stop the tape, there’s going to be lots of activity as it occurs, you’re never going to know it’s happening, and then after the fact we will tell you how it happened and what happened. And we suggest that that is required for market stability. This gets to the heart of what we were talking about last week which is, there is no liquidity in the bond market, and the only way they are going to be able to settle large block trades is quietly, and out of the purview of the marketplace. What that suggests, again, is that they are afraid of price discovery. They know what happens in an illiquid market as you are trying to discover what the true price is. What are you willing to pay for it?

This is probably one of the larger issues, in my mind, not only this week, but potentially this year. I don’t know that they are going to get it. If they get what they want here, understand what a coup it is for Wall Street, and understand how much the general and investing public are being treated like patsies. This, to me, would be one of the great destroyers of the capital markets, because it basically would say an institution has an advantage over the man in the street.

Kevin: It’s like guys going into a smoke-filled room, determining a price of something that I own outside of that smoke-filled room. I can’t determine whether I want to buy it or sell it at that price until they come back out and tell me what they did.

David: This is, I think, a very, very big deal. It suggests market rigging. It suggests, again, lack of transparency, and the whole purpose of having this rule introduced in 2002 was to increase transparency. To rescind the rule implies the decrease in transparency. And the big question is why?

Kevin: What are they worried about?

David: Exactly. And I think we covered that last week in terms of what it is they are actually worried about.

Kevin: Do you think maybe then that’s why hedge funds are hedging themselves? We talk about hedge funds but you don’t think about them hedging themselves.

David: For sure, you are seeing premiums on puts, that is, options, which protect you against downside in a marketplace, well above normal. And so, I think hedge funds, and investors, too, are hedging, and for a hedge fund to hedge, that is novel, believe it or not. That is not their primary function. They call themselves hedge funds, but it is actually an engine of speculation oriented toward using other people’s money to leverage growth for your own personal gain. That’s really what a hedge fund is.

Kevin: But these are the guys that you listened to a few weeks ago in New York. These are the guys who basically had nerves of steel, but right now they’re weakening.

David: I think what people don’t realize is that when you hedge risk, it’s not an elimination of risk. All it is, is a shifting of risk, and in this case, the more concerned market practitioners become, the more they shift the risk of loss onto other third parties. That is typically a financial entity, typically banks. So, you actually have, today with the stock market, at the outer edge of reasonable in terms of price, and I would say well beyond the price of reasonable. That would certainly be the opinion of many of our guests – systemic risk is high. No one seems to care. There is a greater concentration of risk as people start to hedge out downside from their portfolios, and it ends up being bank risk.

Kevin: And sometimes those risks come from the outside. You had mentioned the downgrade of Japan. Let’s talk about that a little bit. This is the world’s third largest economy, and they have been downgraded to a rating lower than some of the…

David: Eastern European countries.

Kevin: Yes.

David: Yes, they now have a credit rating that is worse than Malta and Estonia. Fitch rates them as an A. Just for context, you have to understand that is not exactly like a school grade where A would be acceptable, this is the sixth notch down from the best. And it is acceptable, but it certainly suggests problems. What is interesting is, Fitch downgraded them on one basis, primarily – too much debt compared to growth in the economy, which just is not showing up. In spite of all the stimulation, apparently easy money is not stimulating growth in the economy.

Kevin: So, the Abe-nomics miracle is not necessarily a miracle at all.

David: Which is interesting, because we still hold to the idea that excessive stimulation, cheap credit – the Americanized version of Abe-nomics – is going to generate economic growth. It has yet to do that, but that doesn’t mean that we aren’t people of faith, or at least, the Fed folks aren’t people of faith – a unique kind of faith, a unique brand of it, very much like the Abe-nomics, it’s not working. The growth in the economy is not running at the same pace as the increase in debt, and so Fitch, along with S&P and Moody’s, which downgraded Japan to equivalent grades many months ago, is now acknowledging, “Folks, we’ve got a problem here.”

Kevin: One of the things that the dollar has enjoyed here over the last couple of years is an increase in value based on Abe-nomics, based on the European problems with Greece.

David: They happen to be printing more than we are, so it literally is, “We win the beauty contest because we’re less ugly.”

Kevin: But, when the dollar rises, and you’re a corporation, and you’re trying to compete with the rest of the world, there are losses there, are there not?

David: There are. Certainly, when you look at U.S. corporations which have expanded a lot overseas, there are dozens of U.S. corporations that in the most recent quarter have lost anywhere from 500 million to upwards of two billion dollars in revenues due to rise in the dollar, so yes, there is an impact to corporate America, and as companies are reporting, Apple was no exception, they lost a couple of billion dollars because of the currency exchange. That doesn’t mean they didn’t make quite a bit of money, but there is a real impact in terms of the increase in the value of the dollar.

Kevin: Okay, so let’s go across the Atlantic now. Let’s look at what’s going on with Greece, and some of the strategic maneuvering that is going on. Russia is talking pipeline now with Greece. Is that something that they need, or is this just a strategic tactical maneuver?

David: We’ve talked about Veroufakis’s background and his interest in game theory, and to watch what is happening in Greece, I think, is a fascinating application of game theory.

Kevin: The prisoner’s dilemma applied to a lot of areas.

David: Well, he is constantly throwing the parties of interest off balance, and he is doing a brilliant job of doing that. So Greece says to Russia, “Hmm, we could be interested in your pipeline.” And the U.S. then says, “Well, we’re going to send our energy envoy over to Greece immediately. We might have an offer for you, as well.” What is that offer? I have no idea. But, when Russia puts a formal offer on the table to run a pipeline through Azerbaijan and make Greece an energy hub to all of Europe, and then we instantly send our energy envoy, it certainly makes me think maybe it’s LNG. Maybe the four terminals that we’re building here in the United States and should have complete this year for the purpose of exporting LNG, that is, liquid natural gas, could upset an energy balance in Europe.

Is that the way we’re responding? I don’t know, but I’m frankly wondering what we offer in the equation in terms of energy resources. If Russia’s offer is a hard offer and ready to be signed, how do we counter it, if not LNG? Because that is really the only energy that we can get there efficiently, effectively, and beat the market. Our cost on LNG is below $3 compared to European production at $7, and Asian and North African at closer to $10, so we have a clear advantage because of the amount of LNG and the cost to extract via the fracking technology here in the United States.

Kevin: Well, we can feel comfortable, though, that it’s in good hands, because if I remember right, we have a Vice President that has a son that is directly related to energy, as it applies to Ukraine, so maybe as we apply it now to Greece we can work our way in politically. Let me bring something up. Harold James, a guest of ours here on the Commentary, excellent author of multiple books, looks at globalization, and he has a quote, Dave, that you told me about last night, that just is very disconcerting, because you have brought out in the past that a good statesman is going to do the right thing, nondependent on whether they are re-elected or not. And Harold James – what was that quote?

David: He points to the real problem in Europe being a problem with politicians, and he quotes Jean-Claude Juncker, now the President of the European Commission, who said some time ago, “We all know what to do, we just don’t know how to get re-elected after we’ve done it.” And of course, this is the same guy who had said, “When it becomes serious (he was talking about a real economic problem) you have to lie.” That’s in the same vein, we’re not talking about a statesman, we’re talking about somebody who is concerned about their political longevity. So, what is the issue in Europe? It’s a political issue.

Kevin: It’s self-interest.

David: If we had true statesmen, I don’t think we would be stuck on the horns of a dilemma. But again, one more thing on how masterfully Greece is playing this. They have taken an issue which was merely economic and financial – how much debt do we owe, how are we going to pay it off? Who is going to take a haircut, to what degree? Is it going to be via austerity, it is going to be an increase in taxes? What does this look like? They have turned it on its head and now they have the world community concerned about energy security and geopolitical alliances.

And all of a sudden it is no longer them in a spitball contest with the ECB – the European Central Bank – and the “troika.” Now, the U.S. is sending energy envoys, because guess what? We have something to be concerned about. And look at what happens? We lose the NATO eastern flank, we lose a large part of what represents stability in the Mediterranean to us, if we see an alliance shift toward Russia. There is a lot at stake here, and all of a sudden it is no longer just about who owes what to whom, but who will ultimately be in the service of whom moving forward?

Kevin: Isn’t it amazing? Little bitty broke Greece, who supposedly doesn’t matter – what’s the name of the movie that you brought up?

David: The Mouse That Roared. It’s a Peter Sellers movie, probably from the 1970s, about this little Eastern European country that no one has ever heard of, and they are holding the world in their grasp. It is this fascinating story about people who really haven’t even come out of the Middle Ages coming into the modern world and starting to call the shots.

Kevin: Yet they’re affecting the whole world.

David: Exactly. And I think this is really a brilliantly orchestrated strategy. I don’t know how it ends, I don’t know if it ends well for the Greeks, or very poorly, but all of a sudden they’ve got our attention in terms of international relations, and it is no longer just a matter of settling accounts.

Kevin: Since we’re talking about geopolitics and we’re talking about Russia, let’s step into Putin’s shoes, or into the nation’s shoes. What is it that you want right now if you are in Russia?

David: You want to support your satellite, Iran. You want to, after a very disappointing showing in terms of the price of oil, eliminate OPEC by destroying the Saudi royals and breaking their influence on the oil market.

Kevin: Because if you are a Russian, you need $80, $90, $100 per barrel oil?

David: You need $100-110 to break even in terms of all of your fiscal commitments. And so the back of the energy giant is being broken, and it is in large part because the Saudis have refused to pump less oil and lower what is available on the market. So we have a glut which is impacting the price, and the price is impacting the revenues to Russia. If Russia wants to respond, yes, certainly they counterbalance with support to Iran, not only because of Iranian oil reserves, which are something of an offset to Ghawar and the large fields in Saudi Arabia, but also because you are pitting Shi’a against Sunni.

And again, this is an age-old conflict, but to create a real balance and to support the one party who would certainly feel some fealty toward you, they’ve certainly been a great partner, in terms of arms transactions and what not through the years. Yes, you support your satellite in Iran. Yes, you do what you can to destabilize the Saudi royals and break their influence on the oil market. And yes, you look at Ukraine and say, “Listen, we don’t have to control it to keep it from being a non-native state.” They’ve essentially neutralized NATO. I don’t know that they have to move arms and an army in. I think they’ve done what they needed to do. If they commit more in terms of military strength to the area, I’m not sure that it really serves much of a purpose.

Kevin: You know what it reminds me of, Dave? It reminds me of pinning a piece in Chess. Sometimes the most powerful move in Chess is just having a piece that is pinned that can’t move. And let’s face it, Russia – they’re Chess players. I remember I was young in the ’70s – it reminds me of that famous Chess match, Boris Spassky versus Bobby Fisher, the Russians versus the Americans back in 1972. It was the Americans, now showing that they, too, could be Chess players. Let me ask you – so, we’re sitting at the Chess board across from Putin – what does the U.S. want instead?

David: The U.S. looks at this work-around in Ukraine, because if you’re not going to control Ukraine, and you’re not going to control the pipeline which is a large part of your energy supplies to Europe, then all of a sudden that offer to the Greeks of creating an energy hub and a pipeline through Azerbaijan to Greece becomes very relevant because it creates an alternative to Ukraine for transmission of energy to meet European needs. So, the Russians are there. What does the U.S. do? Well, we’ve just created, or attempted to create, an entangling relationship with Iran, and that is in contravention to the coziness already between Iran and Russia, so if we can upset, or wedge in a little bit, into that relationship, we’re making some attempts to do that.

Kevin: That’s a strange bedfellow, for sure.

David: Yes, very much so. Well, we’re creating an energy buffer domestically that allows for direct competition with OPEC and the Saudis. There is the looming question of, how long do our reserves and resources last? Don’t really know, but certainly, the current numbers have our production directly in competition with what Saudi brings to the oil markets. And so, we not only have that, but we are directly competing with OPEC, and I think that also suggests that we will see much more of our foreign policy directed toward our energy policy, and our energy policy directed toward our foreign policy. We will see a lot more overlap in the next few years.

Kevin: At least for America, liquid natural gas is our main asset at this point, but one of the problems, and one of our guests a couple of years ago said that transporting it is really the problem. Replacing Russian energy with American energy is going to be tough, because technically, it requires refrigeration, it requires specialized ships, specialized trains, specialized processing plants.

David: That’s right, it has to be processed very differently, so we, domestically, have the pipelines to move it to terminals, and those terminals are still in the process of being built, but we do need a number of things. We need there to be a significant differential between the price of oil and natural gas, and with the drop in the price of oil that differential is not what it once was, and it makes LNG less attractive. We still have the benefit of being cheap relative to the European and Asian markets in terms of the cost of natural gas.

To liquefy natural gas, you are right, there is an added expense to refrigerating it to -260 degrees Fahrenheit, putting it in molybdenum-hulled ships and shipping it wherever you are going to ship it. So far, the world’s best at that, and largest in terms of market share, is Qatar, and it is not out of the realm of possibility that, 10 to 15 years from now, we’re competing with some of them and maybe even displacing them as the world’s leader or largest provider of LNG.

But think about this. Think about the political balance. If Russia, for decades, has been the primary provider of energy to Europe, it behooves us to be exporting LNG to Europe and basically end the stranglehold, end the energy monopoly, that Russia has long held with Europe. Europe is in the course of, not only an anti-trust lawsuit against Russia and Gazprom – it’s very complicated. It’s very, very complicated. But Europe, in the end, is energy-dependent. They don’t have what they need in terms of domestic sources. So, we would change the balance of power in Europe and really shift away from Russia if we could, if we were exporting a huge amount of LNG to Europe.

Kevin: Doesn’t this seem to have the makings of the beginning of a war, though, Dave? Russia is not going to roll over. They’re not just going to say, “Oh well, by golly, we’re glad you guys have energy. You go ahead and replace us.”

David: Remember we talked about competition, and what countries like or don’t like competition. This would be one of those instances where, if they felt like they were going to be on an equal playing field with the U.S. and compete, you might see the play get a little nasty. You might see the elbows thrown, a little bit more tripping on the field. Again, I hate to say it, but when self-interest runs into self-interest, wars are often the outworkings. And whether that is proxy wars fought in other places, and not directly conflicting between these two countries we have mentioned, or direct conflict, that remains to be seen. But we’re moving into a direct conflict in terms of their lifeblood, which is energy to Europe. If we choose to compete, again, this is where our energy policy may very well have a huge ramification in terms of our international relations policies.

Kevin: It is not a gentle Chess game, it can sometimes become a very bloody knife fight, and when I talk about a bloody knife fight, I’m not necessarily saying that blood has to be spilt. Look what the United States did to Iran. We basically controlled their currency. We controlled their ability to transact, and I’m wondering – Russia seems to be taking note about its vulnerability to a world that is dominated by a dollar cash system.

David: It is interesting. It is as if in the last few years the walls between the Treasury Department and the War Department have been torn down, and they are just operating as one unit. Certainly, that was the case with Iran, and it is in response to what was witnessed in Iran, that the Russians have said, “We want independence. We don’t like the U.S. financial-based system, and we don’t like the U.S. dollar-based world monetary system. We will find a work-around.” And that’s why they are talking about an alternative to SWIFT, where they can transact internationally, and wire funds and have a complete financial system that isn’t using New York as a hub.

Kevin: Outside of the control of the United States.

David: Clearly, if the hub is in New York, then guess what you end up with? You end up with a bottleneck. You end up with the ability for assets to be frozen, seized, liquidity to be shut down, etc. And it is interesting because they actually have the clout to do something about that, and operate outside of a system that would otherwise have them trapped. What I am noting a lot of dialogue on in the financial community today is a growing awkwardness with cash, and this is here in the United States. We witnessed these same changes in Europe three to five years ago as we traveled there for business, but you are looking at greater scrutiny, both on withdrawals and deposits, where they are frowned upon, and where debit card usage and credit card usage is really encouraged as the only means of transacting business.

Maybe I’m being a little paranoid here, but it feels like there is a greater corralling and a pushing toward transactions which are based in a medium which can be subject to greater scrutiny, and even control. Again, look at the Russians trying to break the bottleneck, and they are doing that through the creation of a new SWIFT program. The average American citizen can’t do that, necessarily. This is what we are witnessing, a sort of rationalization away from cash.

I went into my first retail store last year that did not take cash, and did not take checks. Well, that’s no surprise in terms of the checks. But debits and credit cards – the explanation that was given for only accepting those two mediums was that the costs involved in handling cash, that is, employing someone and paying them hourly to count the drawer, both at the beginning of the day and at the end of the day, were greater than the fees for processing the cards. I don’t know if that holds or not, but again, this notion of a cashless society.

My dad writes about this extensively in his most recent MIA. I would highly recommend it except for one thing. It’s classic Don McAlvany in the sense that, if you are having a good day, this newsletter will utterly ruin it. If you’re having a bad day, and relish the artistic sense of being depressed and somehow out of that morose, critical, if you feel like, as an artist, you operate and you write your best poetry and music out of this deep, dark place, this newsletter will facilitate it. I mean, really, on a bad day you want to read it because it will make it worse. On a good day, you don’t want to read this newsletter. It is just the reality of moving toward a cashless society.

Kevin: It wouldn’t be depressing if it weren’t so accurate.

David: Right. And that’s what I’m getting at, today we are dealing with not only a limited availability of cash in the banking community as everything has moved toward a digital dependence and we are moving more and more toward that digital dependence, but branches – they rely heavily on online banking and online bill payment, etc. So, what we are seeing in complement is the use and the reporting of cash – this is all falling out of favor.

Kevin: Dave, do you remember when we went to Argentina last October? If we used our credit card, we had to use the government official exchange rate between the dollar and the peso, which was about 7 or 8 to the dollar, whereas because of inflation it is actually twice that. And so, the Argentinian experience showed us immediately that you do not want to be under the control of a cashless society because then you are completely subservient to the amount of inflation that the government says is occurring instead of what is reality.

David: Exactly. You are trapped by the official exchange rate as opposed to the real market exchange rate. I never knew that there was such a thing as official versus nonofficial. I must have been 17 or 18, maybe I was in my early 20s, I don’t remember the exact year I read Jim Roger’s book, The Investment Biker. It’s an excellent read. It’s a great story of a hedge fund trader traveling the world on a motorcycle, a BMW – all around the world. And I remember, specifically, he is going from North Africa to South Africa, and he is noticing these huge, huge variances in the official exchange rate you would get at the bank versus what you would get on the street, and as we move toward a cashless society, it really does trap you with the official rate. There is nothing you can do as a work-around.

So, I’m very interested, just in the last week or two I know a cash deposit by a local bank that was not accepted without providing a driver’s license. And again, it’s like, “Well, we have to identify person and cash, because cash in itself…” and we’re talking about collections from a local church, a couple thousand dollars, being refused as a deposit unless there is an identity associated with it. That to me just sounds eerie. And obviously, we’re not talking about drug money, but in the name of the Drug War, in the name of financial crimes, in the name of money laundering, bankers are being turned into financial market spies.

I’m very uncomfortable with that, because you have reporting of a variety of normal activities now as suspicious activities via the standard form, what is called the SAR report, the Suspicious Activity Report, and the new twist in the bank community is that branches are expected to hand in a decent number of them each year. I don’t know if you get agitated by this the way that I do, but do you ever feel like traffic tickets are a means of making the monthly budget for the local police department?

Kevin: Well, Del Norte, Colorado – that’s the only way they bring money in, I think. They just have a speed trap there, and we all have paid into it.

David: Well, clearly, we don’t have SAR reporting with a specific quota yet, but can you imagine if branch banks were given a rebate for every report they handed in? Can you imagine if a teller or bank manager was given a share of the take if funds were ever seized? And quite frankly, that sounds like the current breakdown in the rule of law with police chiefs and sheriffs. They get to keep a percentage of all assets confiscated from an average citizen, even if no crimes are discovered, no charges are pressed, nothing was committed. If they have a belief of something, they need not prove it. Again, this is why I say it is a breakdown of the rule of law. Where is your day in court? Where is it? Guilty until proven innocent? That’s essentially what we have.

Kevin: There is this need for information control, Dave, and we have seen all through history, those who would control the information would ultimately control the behavior of their own people.

David: That is the sequence, isn’t it? Information control comes prior to behavior control. We have bank data, we have digital records of everything you purchase. We have metadata, which we are told is collected, and not only kept safe, but is collected in order to keep us safe. And forgive me if I’m a little bit skeptical here, but isn’t it a great thing that we publish every detail of our lives via social media, and everything we do in the banking sector via a credit card or debit card is on display, and actually can be bought and sold as a commodity in order to gear marketing specifically toward us, an end consumer. I think to myself – General Alexander, who was the former Chief of the National Security Agency, the NSA, said, “Of course we’re going to keep big data in place. Of course we’re going to collect all this stuff. It is, specifically, to keep you safe.”

Kevin: “You can trust us.”

David: Honestly, I think there are really good people at the NSA, who have good intentions and assume that they are fighting back against state-backed hacking, whether it is North Korea, Iran, Russia, and there are real threats and they are fighting a real cyber battle, and it makes sense. But on the other hand, have they not studied history? Do they not know what happens when complete control is handed to one person? You know what happens? Sometimes that one person who is trusted isn’t the person who stays in power. And so who takes their place?

This is the skepticism that you saw amongst the founders. When you look at the Constitution, when you study the Constitution, it is a study in human skepticism. It is a research paper on all the ways bad things can happen if, and only if, you cede power to government. It really is a document which says, individuals will always be threatened if power is ceded to government. Individuals will always have freedom and live free of threats from government if they stay an informed and active electorate. Clearly, we don’t exactly have that today.

My point is quite simple. The changes that we see in the banking system that occurred in Europe several years ago, and are occurring now, are in complement to a fiscal disaster. Why do I say that? Because the U.S. financial system, in order to address the issues of our day, which are essentially feeding an oversized government leviathan, the only way you are going to continue to accomplish that is if you can ring-fence deposits.

Kevin: It’s a little bit like Argentina. Like I said, if everyone had to use a credit card in Argentina, everyone would starve in Argentina except for the very rich because their currency does not buy what the government says their currency buys.

David: So, let me go back to Venezuela, just to bookend our conversation. This is a very personal question, I understand, but how much of your resources do you want inside a banking system? I would suggest that in the coming years it is wise, it is prudent, to consider locating part of your assets in a variety of geographies, and certainly in a variety of assets that are outside the financial system. What is interesting to me is, the world’s wealthy are doing this right now. The world’s wealthy have chosen to do this in what is called – and this is a new asset class, according to the Financial Times and a Bank of America study, they are actually looking at a brand new asset class called vanity capital. And it is interesting because I think the wealthy are making a mistake. I think they are making a big mistake. The value of gold is not only that it is a financial asset outside of the financial system, but it is a high-value asset that is very quiet.

The Sotheby’s sale of a 22-million dollar, 100-carat, perfectly internally flawless stone this last week makes all the sense in the world to me. Buying a Giacometti or a Bugatti – that does not make sense to me. Why? Because driving a Bugatti around town and one-upping your neighbor with a Ferrari, or owning a Giacometti which is bigger than your neighbor’s Giacometti, or housing your Picassos in your private museum as opposed to your neighbor’s singular Picasso – do you know what you are asking for?

Your narcissism is asking for public punishment via the tax code. Your narcissism and need to be recognized is begging for something like the late 1790s and revolution – not the American Revolution, the French Revolution, where people say, “Oh, we know who the bad guys are, they’re all the conspicuous consumers. They’re the ones who are in bed with government, they’re the ones who are corrupt, they’re the ones who stole from the people. I think one of the stupidest things people can do…

Kevin: Is to show off their wealth.

David: Is to show off their wealth – exactly. I think, if you want to own a Giacometti – great. Don’t open it to the public. If you want to own a Bugatti – great. Put it inside your garage, and drive it on your own property. Do you see what I’m saying? This is where, again, I think the idea of vanity capital – and this is great commentary from the Financial Times – brand new asset class. I just think this is absolutely insane.

This is a period of time where you want to go quiet with your assets. But going quiet with your assets – yeah, hang a beautiful piece of art on the wall, fill a vault with gold, but don’t tell everybody where the vault is, and certainly don’t tell anybody what the access code to your house is. You realize that the problem of wealth in ages past was, you had to have an army to keep it, and the wealthy in our day don’t have an army to keep it. And the governments that they are subject to do. Do you see the mismatch?

Kevin: And that government has control of the movement of money, and the value of money, if you keep it in that system.

David: There is an incredible amount of naiveté in the hedge fund community. Let me illustrate it with this. Mr. Einhorn, who runs Greenlight Capital, suggested this last week that you buy modern art and Manhattan apartments as the best asset classes. And I’m thinking to myself, don’t you remember such things as the hearth tax where in England, depending on the number of chimneys you had, or the number of windows you had on the outside of your house, the tax was determined? Don’t you know the story of English landed gentry where if you have too much of something the government will increase the taxes to the point where you have to give it up? The landed gentry of England gave up their lands a long time ago, and literally just gave them to the state because the taxes were too high.

I just don’t get it. I don’t get it. You look at the fiscal mess we’re in and you look at the advice that people would give to not only conspicuously consume, but to have obvious wealth, and I think it is patently insane, patently absurd. So to me, what the Venezuelans did years ago, three, four, five years ago, to remove a part of their wealth from the financial system, was brilliant. Gold represents that opportunity to be right on the cusp of the financial world, but not in the financial system.

Kevin: With everything that we have been talking about, and the instability of credit, and the infinity of quantitative easing, and the lack of transparency in the markets, gold seems to be one of the only answers, yet people are still questioning gold. They are looking at it and they are saying, “Is there really going to be, or ever will be, a free market again?” We’re seeing manipulation, we saw the manipulation last week before the Venezuelan thing. We’ve seen the gold price pretty much held at this $1200 level. Granted, we’ve got a little volatility right now. Is there going to be return of the free market?

David: Let’s spend some time looking at that next week. Does the free market still exist? You’re right, looking at asset price levitation, suppression of interest rates, looking at the opportunistic drubbing that gold has taken in recent years at critical junctures, does the free market exist? We asked this question last week in the form of a confession. I have assumed it does and will continue to. Let’s explore a justification or a reason why we think it is an enduring reality, regardless of actually the kind of political construct you have as an overlay.

Let’s look at that next week – does the free market exist?