Podcast: Play in new window

- Central Banks Urgently Accumulate Gold – 50 Year Demand High

- Trump Tweets Tariffs… China Tweets Devaluation

- Hong Kong Protestors Use Lasers To Block Facial Recognition

The McAlvany Weekly Commentary

with David McAlvany and Kevin Orrick

Currency War With China… Game On!

August 6, 2019

“You choose a negative yield voluntarily, either if you’re stupid (laughs) – that’s one possibility – or if you believe that a liquidity crisis is looming and you want an asset that provides that liquidity in the future. Bonds have some appeal, and maybe the smartest people in the room are moving there. Gold has some appeal, and maybe that’s why some of the smartest people are moving into it. “

David McAlvany

Kevin:When I first came to work for your dad back in 1987 I was taught that the central banks – the big government banks – were the largest holders of gold in the world, that they had about a third of the world’s gold at the time, and they generally kept about a third of their reserves in gold. Little did I know that the next 20 years the central banks would be the largest net sellers of gold in the world, as well.

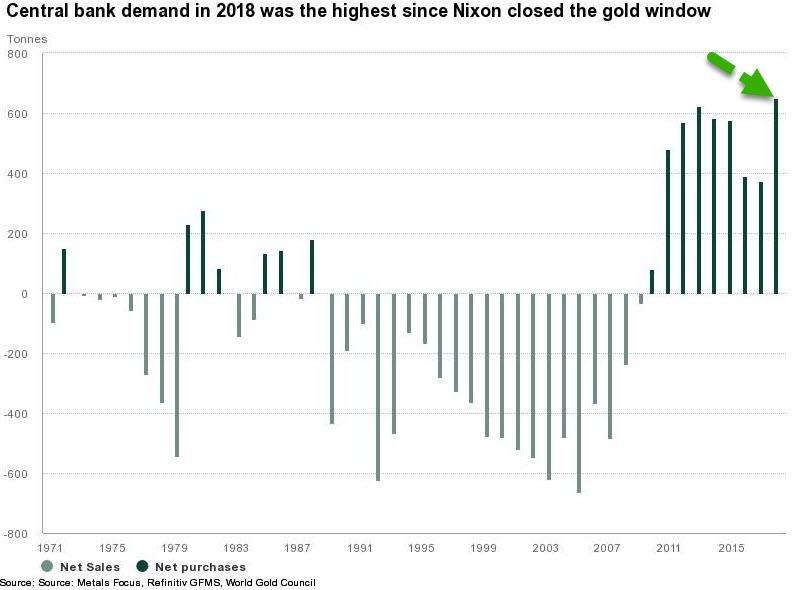

David:If you look at the development of the financial markets from 1987, Kevin, when you began at this company, until now, here have been some very significant changes, because you are right, 1987 to about 2009 you had liquidation after liquidation after liquidation. This is, frankly, after decades, even a century or more, of accumulation of gold as a reserve asset. And so, there is a telling story here, and I think it is worth reviewing a chart put together by the World Gold Council, just to look at, graphically, how big a deal it is, these changes, this preference for securities during a certain phase.

And it really was the popularization of securitized products. And as interest rates were sky-high in the 1980s, and then coming down, there were so many ways to profit in the world of paper assets, whether it was stocks or bonds. But financial instruments were far more compelling in that timeframe than this staid asset, this dead asset, this non-interest bearing asset – gold – just sitting, collecting nothing but dust.

Kevin:Something we have seen throughout history, not just in the last 25-35 years is that there has been this tendency to want to be able to create your own wealth out of paper. It’s much easier than having to go dig for it as a scarce item. So what you will see – and I would highly recommend our listeners click on this chart – is about a 21-year period where the central banks said, “Hey, finally we are free from gold. We can go ahead and sell our gold because we are now using securities. And instead, what actually happened was they ended up ruining the very thing that they wanted to replace with gold. We’re now at negative interest rates. So they ended up buying all this paper and it’s not working. So what you will see in this chart will explain it, about 21 years of net selling of these reserves of gold from 1987/1988 to 2009. And then you will see a dramatic increase of net buying from about 2009 on, especially 2018. In 2018 more gold was purchased by the central banks than since we have been off the gold standard.

David:That’s right. And it is very probable that 2019 even blows that number away. So here we are in that period of financialization where creativity and finance were paramount, and where the advantage went to those who were creating derivative products and insurance products that allowed you to add greater leverage to a financial balance sheet without taking more risk. That was the promise anyway. Again, the divestiture of gold through that period of time, the exchange for financial products, what is really critical is, we left that era in 2009, and I think very few investors are aware of just how significant the gold buying has been by central banks from 2009 until the present.

Kevin:The question that we asked last week – what do they know that we don’t? If you look, they have known something, actually, since about 2009. They have reversed – they are actually buying gold, not selling it.

David:And the focus has been on yield through that earlier period of time. Yield as an alternative to gold on central bank balance sheets. What can we get for the asset that we have here, and can it still be of such a high quality that it can be used as collateral? And yet, can we generate income with it? Perhaps we will return to the merits of a central bank holding gold, a new era of benefits of securitized products today really don’t outweigh the costs of owning and storing gold, because, as we have discussed, perhaps ad nauseam, we are in a period of low to negative interest rates, and that redefines the motivation to look at these structured financial products instead of what served as the ballast, the main support for central bank reserve assets for centuries.

Kevin:I think what you will see also in this chart when you look at it is, we the people, the non-central bankers, tend to be, possibly, in the wrong thing at the wrong time. I think about my career from 1987 until about 2009 – gold really had not done much, but the people were holding gold. Well, the central banks were selling their gold. Then we the people reversed. We now hold paper very confidently. Very few people are owning gold. In fact, the U.S. Mint has said that the numbers are just about as low as they have ever been for U.S. buyers of coins.

Well, isn’t it interesting that that is not what the central bankers are doing? The central bankers are buying more gold than they have ever purchased, but we the people – they’ve gotten us comfortable, Dave. They have figured out a way to smooth this over with unlimited debt and negative interest rates.

David:We have had a very eventful week, between the much anticipated 25 basis point cut, what the economists describe as the Powell Pirouette – I kind of like that – and the market then digesting Powell’s comments on being mid cycle on the cuts versus at the beginning of an extended rate-cutting cycle, which is really what the markets had hoped for. That’s what they hoped would be the case. And time will tell if … here we are applying stimulus in the 11thyear of an economic recovery. Time will tell if that is prudent.

Kevin:Stop and think about that. Oh my gosh, we’re in the 11thyear of an economic recovery. What that is basically saying is, this is the longest period in history without a recession in the United States, and yet we are still applying stimulus? That’s what you do when you are at the beginning of a recession.

David:Well, I suspect we all know the answer to whether or not this is prudent. But one of the other significant things this week, if you’re looking at interest on excess reserves, when rates were moved lower last week they also moved the interest on excess reserves lower. They did two significant things. And the QT, Quantitative Tightening, ended two months ahead of schedule, so there will be no more balance sheet drawdowns. I think that is worthy of note. And also, the interest paid on excess reserve was reduced from 2.35 down to 2.1%.

Kevin:Let’s explain that. These are bankers being paid interest to not loan to us.

David:That’s right. There is about 1.3 trillion dollars in bank reserves which has been sitting outside the economy, deposited directly with the Fed. The Fed is paying these commercial entities that 2.35% just to sit on that cash. And this is all a holdover from the global financial crisis where you needed a place to put cash and keep it safe. And it didn’t matter that you were earning little to no interest on it. As it turns out, 2.35% is a lot of interest in a world of zero or negative rates elsewhere. And they are just paid to sit and do nothing.

Kevin:Yes, do nothing. But what if it starts to do something? What if the dollars start coming into the economy?

David:That’s why I mentioned last week that velocity is on my mind, because if you incent those dollars to be lent, and then spent and recycled, you have domestic inflationary pressures galore. And there is potential for major inflationary surprise. And of course, you have the fixed income market. If you look at how the fixed income market views the idea of inflation, it doesn’t exist. Inflation is the dead horse. The assumption amongst fixed income investors is that no amount of spurring is going to get that horse back up on its feet. No amount is going to get it going again.

Kevin:Now we have tariffs and the way the Chinese answer a tweet back from Trump is actually just to devalue their currency. Talk about inflation galore.

David:That’s right. We had further tariffs announced on Chinese goods at 10%. It was so funny reading the tweet – “a small 10%” – that’s the way Trump wrote it.

Kevin:On a small 300 billion.

David:300 billion in goods, and that is by contrast to the 25% on the first 250 billion which was put in motion a few months ago.

Last, but not least, on the list of very important things that happened since we were last on the program was the RMB devaluation before the market opened Monday of this week.

Kevin:That’s tit for tat.

David:So if you look at the Chinese currency, this is by far the biggest news because you’re talking about being welcomed to a world of overt currency wars. There have been decades of covert action, which, frankly, is no less significant, but what we are talking about is the system of a managed peg – the Chinese currency to the U.S. dollar – that, coming to a close. You have the Chinese surprising the markets early this week, and having to digest the looming possibility of a full-blown RMB devaluation.

Kevin:This is exactly what Russell Napier told you, in June, was going to happen, that this was a currency war that could actually lead to other types of wars.

David:Well, that’s right. This is a critical part of our discussion with Russell. Go back to June 4thif you’re interested, and read the transcript – RMB Devaluation, A Free Float. These were important topics, as were the deflationary impacts of such a move. You hear us talk about the inflationary impact of certain decisions that are made, and the deflationary impacts, as well. I’m not meaning to be contradictory here or speak out of both sides of my mouth, but you can have deflationary effects within particular asset classes while generally speaking you have an inflationary impact in terms of the monetary system, itself.

And lest we forget, we are talking about the de-linking here of the RMB from the U.S. dollar, the peg, and it has been there for a long time. It has been there for a couple of decades. And this issue of undoing the peg is running in a parallel track with continued pressure on the euro. So, in what appears to be a rapidly failing monetary experiment on the continent, these currency issues, both including the RMB-dollar exchange rate, and the currency issues within the eurozone, are defining factors for the years ahead. I think they define not only the opportunities ahead, but I think they also will be the defining triggers for the reassessment of liquidity and solvency in many markets around the globe. You change the stability of the underlying unit of account, and as we mentioned last week, there is collateral damage – literally and figuratively.

Kevin:I think we should look at the collateral damage, because what does a currency war do for a country? It makes them more competitive. When they devalue their currency, it makes them more competitive in the world market. The problem is, every time you do that, I have to pay more for everything at the store. These tariffs are costing money already, but you start competitively devaluing currency, what that means is that the dollars in your and my wallets pay for less and less of real things. So the collateral damage isn’t just political. That will show up. We have talked about before, if the wallet is thin, politics start to change. That’s when rebellion happens. But the collateral damage is just the inflation you are talking about.

David:Yes. And it is interesting to me that there is a move at the lower end of the wage spectrum to make up some of that pressure in terms of a rising cost of goods and services. I hate to admit, but here I am doing so publicly – I ate at McDonald’s last week. And in the back seat I’ve got two kids saying, “Why are we here? You know that they poison their food.” Actually, that’s not true. I might have been slightly hyperbolic last time we drove by McDonald’s (laughs).

Kevin:(laughs) Be careful what you say with your kids.

David:I know. Well, we were desperate for a fast breakfast, and I’m looking at the sign in the window — $12 starting pay. And I thought, “This defines two things – not only a new wage scale, whether it is the Walmarts or the McDonalds of the world, but it also defines the executive imperative amongst these major corporations to figure out how to reduce staff. So yes, great on the one hand, but you are going to increase the ranks of the unemployed within a certain social strata. And this is the reality. I have been involved in discussions with a number of restaurant chains that are looking at how they can process food orders without any interaction with a human being, where you just eliminate that portion of staff.

Kevin:Bring a kiosk in, let it take care of it.

David:Exactly. So from texts, to kiosks, to apps – but whatever you do it is a reduction, and elimination. You want a pay increase? Great. But the number of employees per place, per restaurant or establishment, is going to go down.

Kevin:So that makes me wonder. Politics changes, also, with economics, the economic soundness of a person. And at this point, is Trump maybe getting more than he has bargained for? Or might he get more than he bargained for in this trade conflict? It is leading to what we are talking about.

David:It is certainly something we suggested last week, that there are political implications – major political implications to economic change. I think you’re right, Trump may be getting more than he bargained for.

Kevin:Well, the stock market is falling, too. That is something he has hung his hat on. What if it continues to fall, Dave?

David:Exactly. So if you continue to put pressure, in terms of the trade conflict, but that ends up exaggerating or exacerbating weaknesses within the Chinese financial system which have a negative domino effect into the financial markets globally, yes, there are factors involved which cause the markets to continue to sell off and now you’re talking about real pressure on his election bid. I listen to a variety of news sources and thus far the Democrats have seized on nothing of substance to derail his effort at another four years in office.

Kevin:But what about the eight that Biden thought he …?

David:I was going to say, “The debates! The debates!” We’ve got another eight years of Trump according to Biden. That’s good math, that’s good math. Well, the debates last week – what else did they tell me? It doesn’t seem like anybody is on the same team. You have decorum and civility, which are dead, even among the comrades. And the last debate last week really did remind me of the conflict between Trotsky and Stalin.

Kevin:You know what makes me so sad, you have families who are grieving this week about the tragedies that we have seen in the shootings and yet immediately everything became politicized. I’m talking on both sides, but it was immediately politicized.

David:On the way to the office, and again, I do listen to a variety of news sources and NPR is occasionally one of them, I learned from NPR that Donald Trump was directly responsible for the mass shootings over the weekend. And I’m watching things in the pre-market and watching what is happening overseas, the Chinese currency crossing the Maginot line, receiving no mention at all. This is the news which on Monday tipped the equity markets into a 700-point tizzy.

Kevin:Right. But nothing was said because we were arguing politics over shootings.

David:Right. And even at the end of the day, on Monday, NPR blocked all market commentary and news of international interest for a re-run of the same interviews with the analysts that were linking Donald, the President, to both the Ohio and the Texas shooters. I’m thinking, “What is going on here?” I admit, the quotes from the Oval Office, I know they were edited to make the NPR’s point, they were not flattering comments. In fact, you could just pick and choose any quote from Trump and they are rarely going to be flattering.

Kevin:But is Trump the cause? I mean, let’s look at cause and effect on…

David:And I said I think that is the point – causation, personal choice, specific personal responsibility, insofar as there are violent and deplorable acts which are connected to a body of belief in an ideology, I think what was really weird to me was that NPR neglected to mention the Twitter account of the Dayton shooter where he is promoting Bernie Sanders, he is promoting Elizabeth Warren, he is pro Antifa, and he is elevating a recent attack of an ICE facility in Tacoma, Washington, and he puts that person in the status of a martyr. NPR doesn’t mention this. It’s just a connection between violence and Trump, and who Trump is and what he stands for. And I just thought, “This is not even good reporting. There is no conversation to be had here.”

Kevin:Well, let me ask – are you really shocked? You’re listening to NPR. My wife turns on ABC in the morning so that she can see what is going on. Is the news ever, or has it ever been, objective?

David:I don’t know that news has ever been objective. I don’t know that it will ever be objective. I always tend to think that it is worse now than it has ever been before and that’s not necessarily the case. When I read through the biography of Alexander Hamilton and I’m reading about the cat fights that they would have in the papers, it was absolutely astonishing. And I thought, “I can’t believe that there was such a lack of civility in his age. Maybe this is a human problem, and we just need to be more kind to each other.” But no, it’s not a new issue.

Thomas Jefferson, back in the day, looked at the nature of political power, the struggle to get it and keep it, and he said, “You know well that government always kept a kind of standing army of news writers who, without regard to the truth or to what should be truth, invented and put into the papers whatever might serve the ministers. This suffices, he said, with the mass of people who have no means of distinguishing the false from the true paragraphs of the newspaper.”

So whether it is Alexander Hamilton and he is getting drug through the dirt because of infidelity (laughs) and a variety of potential misdeeds, or Thomas Jefferson saying, “Look, truth is not a limiting factor when it comes to reporting.” The problem is, when we hear something, Kevin, or we read something, typically that settles the matter. Bias goes unaccounted for in most instances. That is bothersome, particularly as we come into an election season.

Kevin:If you own the method of delivering the medium, as far as TV, radio, Internet, whatever, if you actually own the people’s interest in that area, you actually can just control the narrative. If they want to just lead everyone to believe that it is a white nationalist, it doesn’t matter what the news story is. It could be flowers blooming in the spring. It could still lead to white nationalist, or whatever you want to call it. And that is the amazing thing. It’s not even objectivity that we’re even crying for. What we’re crying for is to stop forcing a forced narrative.

David:Right. So looking at the alleged El Paso shooter, the Atlanticwrote an article which I thought was pretty decent. They had a few interesting things on this particular point. This person is a registered Democrat. He is angry at Democrats and the open border policies. He is very angry and critical of the Republicans’ pro-corporate, pro-immigration stance. He actually equated that pro-corporation equals pro-immigration. That was the connection that he made – don’t know how, but that’s the connection that he made – sponsor for, enthusiastic about universal income, universal healthcare.

And in fact, as you put together this composite, he is more of a progressive. But again, listening to NPR, he has been rebranded as a white nationalist. I don’t know, maybe he was. Maybe those aren’t mutually exclusive categories, but the way he was cast, it was not all that he was. So pull selects facts from anyone’s biography and you can tell just about any story you want to about them.

Again, my conclusion early this week – and I know this has nothing to do with the markets, and I apologize, but Nietzsche was fond of saying, “Sometimes people don’t want to hear the truth because they don’t want their illusions destroyed.” And I think we’re moving into this period of illusions and delusions as we come into the political cycle.

Kevin:We were talking last night at the restaurant that we meet at. It is interesting, blind rage was the topic last week that you brought up during the Commentary, that it just doesn’t seem like there is any objectivity in the narrative or in the conversation anymore. But if you really look at people, the more fearful they become, the more insecure they become, oftentimes the angrier they become. The question was, by this gentleman who manages the restaurant, “What is happening to our nation? What is the heart behind the nation?” Actually, it is insecurity, fear and anger. And of course, it is being promoted by the media, as well.

David:Yes, and I don’t know that the rational contingent of the Democrat party is strategically engaged right now. If they were strategically engaged they would be asking questions about the economy. They would be looking at the markets and they would be shining a bright light on global economic instability, and isn’t that instability being exaggerated by trade tensions? Isn’t that instability being exaggerated by the presence of non-diplomatic negotiation strategies? Instead, what you find is somebody like Beto O’Rourke looking at these specious connections between the President and a national tragedy.

Again, it doesn’t even make sense. If you’re thinking with a clear head about how to undermine the President, they’re not doing it intelligently. It is embarrassing logic and analysis, and I think it supports the idea that Frank Herbert described when he said that the recurring problem with governments is that power attracts pathological personalities (laughs). I can be far too cynical when it comes to politics, but truth is a casualty in a democracy that is circling the drain.

Kevin:I’ve got a question. We’ve had bad politicians, and actually, we’ve had good politicians. One of the men we have had on this commentary, a Colorado Senator who listens to the Commentary – I was sad that Colorado had term limits when he finally term limited out. I wonder if the election cycle, Dave, is a little too short. I agree that term limits make sense, but yesterday I was driving in downtown Durango and a big semi pulled in front of me, and I couldn’t figure out what it was pulling because if you ever see carnival rides disassembled, it takes a little while.

David:The circus is back in town!

Kevin:The circus is back in town. And I’m thinking, “Gosh, has it been a year?”

David:Is it that time of year again? That’s the way the election cycle feels. The circus is back in town (laughs).

Kevin:That’s exactly right. Should the terms be a little bit longer so that we’re not continually doing this every four years?

David:It’s a good question. I am supportive of term limits but I’m not in favor of the circus coming back through town that often. I’ll never forget reading sections of Oliver Sacks’ book on neurological disorders. Unfortunately, he passed away this last year, but he documents a group of generally catatonic patients who are triggered back to life, and they are full of laughter and animation, but they respond – and it took him awhile, granted, remember he got his Ph.D. in studying the behavior of earthworms, so he is a guy who is willing to watch for small clues and figure out what it means, and what the triggers were.

Well, the triggers that he found as he was watching this group of catatonic patients is that they came to life whenever they were exposed to lies.

Kevin:Somehow they knew.

David:And there was a cycle of sensitivity to them. This whole group that was being treated for the same thing, it was almost like an eruption periodically.

Kevin:I remember that article. They would all just start laughing.

David:And Oliver Sacks tied it to the election cycle. Every two to four years they would emerge as if from a cocoon when the election campaign ads were on and the debates were happening. And then all of a sudden, when all of that wrapped up, the results were in, this group of people would go back to sleep for a few more years. Absolutely fascinating.

Kevin:Isn’t it amazing that they would know that. But again, the election cycle. What we are going to go through at this point is about a year-and-a-half of ads that you wish you did not have to hear – anywhere you go.

So, let’s go back to the financial side of things.

David:Maybe the more important issues.

Kevin:The Treasury just announced – I’m so glad that they told us – that China is now a currency manipulator. Good to know.

David:Right. So they changed the allowance for this flexibility on the peg, and the currency immediately shifts beyond 7-to-1, that is RMB, or yuan, to the U.S. dollar. So Monday night, within less than 24 hours, roughly 24 hours, the Treasury Department designates China a currency manipulator. Granted, this peg is arbitrary to begin with. We don’t know where the value of the RMB would be if we just let it float like every other currency.

So they are moving closer to letting it float, and the reality may be that the real market value for the RMB, not supported by the PBOC, the People’s Bank of China, is 30-40% lower. But we’re going to say that they are responsible for this move lower, and so we call them a currency manipulator. There are a host of sanctions and options that open up for the Treasury once that official designation is put out there.

Kevin:Yes, but what do you do when you have a tiger that is about to bite? Do you poke him, or do you back away? We have a choice. At this point, do we escalate, or do we de-escalate? But we can’t stay in between.

David:This is a family conversation like five times a day – not a week. Kids, do you choose to escalate or de-escalate? This did not have to go here. You did not have to be that mean to each other. Back here you were making choices that led to other choices, that led to other choices. And everybody responds in a way that becomes less rational and more emotional as time goes on. Escalation versus de-escalation – those are the choices.

We have made the choice to escalate tensions and conflict. I think this is, again, where markets operate off of positive anticipations of the future, or negative anticipations. So how do the markets get involved in these currency market machinations and trade policy tit-for-tat, back-and-forth tweets and responses?

Kevin:Well, do they become fearful and insecure? That’s what we talked about with politics.

David:The issue with trade conflict, let alone currency wars, is that markets are put on edge.

Kevin:There is the insecurity.

David:And they tend toward negative anticipations of the future. And that is why I would say, Trump may get more than he bargained for in the trade conflict. What if he wins the war, but loses the Oval Office? Because, I’m telling you, he has to be careful here because if the trade and currency war all of a sudden has a negative impact and he can’t control the direction of the stock market, which he has hung his hat on as the best evidence that he, the Commander in Chief, has delivered the sun, moon and stars and everything grand to we the people, all of a sudden he has lost his props.

And I think the other thing that he is not sensitive to is that these trade conflicts and currency wars can – and if you are a student of history you know that they can, and often do, morph into something far more bloody.

Kevin:We had brought up about competitive devaluation leading to inflation because it is ultimately the destruction of currencies worldwide. But are there pockets of deflation, like you had mentioned before, where you actually have an incredible slowdown, maybe, in certain portions of an economy, to create recessionary pressure?

David:Yes, but the global deflationary pressures are definitely growing, those pressures are magnified by competitive devaluation. You can have the costs of goods going up and you can have the actual number of transactions and the capital flowing between countries, or within a country, slow significantly at the same time you are dealing with a rise in the price of goods and services. Right now you have Trump crying foul play, and I think it is interesting because, sure, the Treasury got involved in terms of the labeling of the currency manipulation, but his appeal is that the Fed should do something in response.

So we go after the currency manipulator tag and that means we get to get nasty with the Chinese, but the Fed is supposed to then level the playing field. What does that mean, exactly? Well, we know what that means. It means respond. If you’re fighting with a foil, you have a thrust and a parry, you have a back and a forth, and he is asking for a monetary back and forth in this sword play.

Kevin:It’s like a kid who pushes another kid, and somebody says, “Oh yeah? Well, I’ll push you, too.” That’s all that’s happening is, “Oh yeah, I’ll do the same thing.”

David:Clearly, if you look at the odds of further rate reductions between now and year end, even between now and the end of September, further reduction of rates – what does that do in terms of a knock-on effect? It puts downward pressure on the dollar. And simultaneously, this is great for the President. Simultaneously, this juices the asset markets, boosting stocks and bonds, theoretically, and hopefully, precisely what the President wants. So he is putting pressure on the Fed to get involved. He got what he wanted from the Treasury already, but he’s not going out with a Treasury billy club, necessarily – not at this point. He really wants the Fed to do the heavy lifting on this and that helps his election bid.

Kevin:But the pressure is also on Chinese leadership. What are they going to do to control their narrative?

David:RMB passes 7-to-1 on the exchange rate, and it is significant. We mentioned Baosheng and we mentioned the series of defaults and the need for intervention within the financial markets last week. We have had, I would say, dozens of other financial institutions in China come under pressure since our conversation last week, and again, some of them are small enough it doesn’t matter, but it’s billions, not hundreds of billions or trillions, so it doesn’t make the radar in terms of real risk.

What I’m saying is there is an accumulation of problems in China. And the two distractions that I can foresee the government there employing that you could use to draw attention away from either currency depreciation or financial market concerns – the Chinese are well aware of the risks they face in the financial markets and within the economy, and their step sequence for dealing with conflict and issues on the street, this is where I think you have two ways to rally an unhappy populace should you see domestic sentiment sour further.

Number one, you have distraction. The Hong Kong issues and the protests that are there in recent days have turned violent, and who knows to what degree that is the people on the street turning violent or the stage being set for the PLA, the People’s Liberation Army, and the incursion by the PLA from the mainland. For the Chinese army to get involved at this point is very likely, actually, after the violence that has been on the streets in recent days.

But what is that, really? It is a convenient distraction from a deteriorating financial and economic situation, which, if you’re looking at the price of soy and rice, things that would be needed to feed either livestock or people, they have issues of social stability that hang over their heads all the time.

The second thing I would say that would serve as a distraction, and this is a bigger issue, and probably lower probability, is military action taken against Taiwan. The first looks like a police action to control dissidents, but that is pretty straightforward. It’s tough for us to get involved. In part, who are we to criticize a militarized response to protests. If you’ve checked, our police force is pretty well militarized as it is. You don’t need the National Guard. If you see the local sheriff’s department or police department show up on scene to control a crowd, they are indistinguishable from the marines. So where do we criticize the PLA for getting involved in Hong Kong?

But the second would trigger military conflict between two superpowers.

Kevin:Do you think that is likely?

David:The first seems higher probability, but both serve to redirect domestic attention, that is Chinese attention, away from a deteriorating financial market situation. Again, it is this direct economic impact that is so important, because here we are, the 70thanniversary of the founding of the People’s Republic of China, also coinciding with the 30thanniversary of the protests in Tiananmen Square this year.

Kevin:I remember that. We had a television in the trade room back in the Denver office before we moved down here, and I will never forget that iconic scene that we have never forgotten of the man standing in front of the tank in Tiananmen. That was 1989.

David:That’s right, 1989 – 30 years ago. So which is the narrative that the Chinese Communist Party wants to promote? I don’t think there is going to be a tank man in Hong Kong, but there may very well be a PLA crackdown on the Hong Kong demonstrators, and I think Xi wants to control the narrative. This is the year to celebrate, this is not the year to commiserate.

Kevin:My son showed me something on YouTube that just shows how things have changed in 30 years. With all the surveillance in China, he showed me a video of how people who were there in Hong Kong protesting had lasers, and they were shining these lasers on the various cameras in the area where they were protesting. It was actually a very colorful video, but it was because everybody was pointing lasers at these cameras because we now live in an age – this wasn’t 30 years ago. That man standing in front of the tank could not be identified within seconds on a computer program based on cameras. Now he can be. Every one of those protestors can be identified by the software and the hardware that has been put in place in China.

David:Sometimes you run into the most fascinating people when you’re traveling. I remember sitting on a plane – I don’t know if it was six years ago, eight years ago – time goes by so quickly, it could have been that long. We introduced ourselves and he said he was an engineer with Google and that he was working on a technology for them. I said, “What kind of technology?” He said, “Facial recognition software.”

Kevin:For China. He was working on this for Google.

David:For Google. He looked at it as a very innocuous improvement to technology. And I just have a hard time thinking about the benign effects of that kind of information. In Hong Kong every one of those protestors is a marked person if they have been on camera. They have been identified, their whole families have been identified, there is a dossier, there is a file, and it is a very complex world when you have data accumulation, identification, no real recognition of the value of anonymity or privacy.

Kevin:And you are scored by how politically close you play the game to what the Communist Party wants.

David:I think we’re going to find ourselves at a social jumping off point where no one has valued privacy for a long time, no one has valued anonymity, the right to be forgotten, if you will. And no one has really put that as a priority. But I think we’re going to discover why it is a priority and maybe the Chinese will teach us a thing or two on why it makes sense to keep a lower profile.

Kevin:You told me that you were up until 2:30 in the morning last week with one of our guests who specializes in this. In fact, he is a guest who told us if we get something free on the Internet we are the product. He says, “Get used to it.”

David:Becker Polverini – a really neat guy. And yes, we got to brainstorm a little bit more on a few privacy issues and some of the technological challenges as a hacker and as someone who is brought on by corporations, and even governments, to figure out how to protect against attacks.

Kevin:Well, he has to hack to learn how to protect against hacking. We can’t even name the people he does know how to hack.

David:No. But it is interesting because I’m just left with this impression that today no one cares about privacy and anonymity, and tomorrow, everyone will.

Kevin:Until you have to hold a laser at a camera to be able to speak your peace.

David:And so I wonder if we’re not at that similar inflection point where the central banks have already recognized a significant shift, a move from the world of financial assets where it doesn’t matter if anyone knows that you own it, the benefits to ownership speak for themselves, and they have already made the transition back toward an asset which is just kind of boring, collects dust, and hardly anything else.

So that issue of gold being central to the way that central planners position their reserves – wouldn’t it be interesting if we are also entering into the same period of time where individual investors are discovering that they actually do need a part of their wealth which is private, which is portable, which is unknown to most people? And again, it’s a mindset shift, because if you ask the average millennial, or even Gen-X person today, what they would do with an ounce of gold, let alone 10, or 100, or 1000, they just kind of shake their heads and say, “Why would you bother with that?”

It is important for us to keep in mind that the traffic into gold is happening at the same time you are seeing traffic into the bond market, and it may be a very important messaging. You and I have talked, and maybe even minimized, the importance of the messaging in the bond market because the footprint of central bankers into the bond market is a massive one. But we continue to see new record lows in terms of yields around the world, now 14.1 trillion dollars in negatively yielding paper.

Kevin:Negative paper – that is amazing.

David:And I know that is a part of the central bank edict – lowering rates. I know that is a part of the central bank footprint – their purchases. And a part of it is, also, investor traffic into those bonds. If you combine the impact of Chinese devaluation, the end of the euro as a monetary unit, and what that leads to in terms of global financial stability, or instability – those concerns – we are right back to this very dangerous two-step of liquidity and solvency. We saw it in 2007, 2008 and 2009.

You choose a negative yield. If you’re an investor, why would you do that? Why would you be a part of that fray – the investor, alongside the central banker? Why would you move into bonds with a negative yield? You choose a negative yield voluntarily, either if you’re stupid (laughs) – that’s one possibility – or if you believe that a liquidity crisis is looming and you want an asset that provides that liquidity in the future.

Now we’re full circle to where we began the conversation. Bonds have some appeal, and maybe the smartest people in the room are moving there. Gold has some appeal, and maybe that’s why some of the smartest people are moving into it.