Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Internet Plays Rule for Today

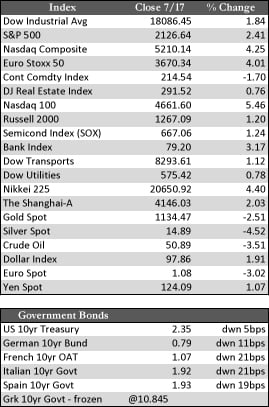

Stocks put up a pretty good showing this week thanks to the Iran nuclear deal, the Greek deal, a “stabilizing” bounce in Chinese equities, and a few US earnings reports that looked better than they really were – with the exception of Google. In the balance of things, I believe what we witnessed this week was the result of an equity market that was positioned for bad news but received what appeared to be the exact opposite. I say “appeared” because Iran has been known to break its promises, €86 billion in additional debt only degrades Greece’s economic condition further, and regulatory controls in China’s stock markets are effectively like applying a band aid to a heart attack. But none of these things matter at the moment, as the media will no doubt attest; all crises have effectively been averted.

Where the rally stops is anyone’s guess, but it seems to be operating on borrowed time as breadth technically and earnings momentum fundamentally remain the primary obstacles. That means that any “tops,” however achieved, will likely be determined false – as we have seen more than a few times here in the recent past. Outside of Google, Netflix, Priceline, Baidu, Amazon, Facebook, and the sectors they represent (including biotech), stock performance in general has already proved to be sketchy or uneven at best. New highs in the aforementioned Internet names have yet to be confirmed, technically speaking, by the small caps, the Dow, the Transports, and/or greater portions of the Tech sector (chips and device makers). Keep in mind that, on average, S&P 500 firms are set for another 4.0% decline in revenues this quarter. So far, whether or not those same firms “beat” on earnings, stocks have been discounted (if and when it happens) as a result. This is an uncharacteristic development compared to quarters past, and may suggest that a much weaker market lies ahead. Of course, that may not happen until the Internet names fade from the headlines.

Where the rally stops is anyone’s guess, but it seems to be operating on borrowed time as breadth technically and earnings momentum fundamentally remain the primary obstacles. That means that any “tops,” however achieved, will likely be determined false – as we have seen more than a few times here in the recent past. Outside of Google, Netflix, Priceline, Baidu, Amazon, Facebook, and the sectors they represent (including biotech), stock performance in general has already proved to be sketchy or uneven at best. New highs in the aforementioned Internet names have yet to be confirmed, technically speaking, by the small caps, the Dow, the Transports, and/or greater portions of the Tech sector (chips and device makers). Keep in mind that, on average, S&P 500 firms are set for another 4.0% decline in revenues this quarter. So far, whether or not those same firms “beat” on earnings, stocks have been discounted (if and when it happens) as a result. This is an uncharacteristic development compared to quarters past, and may suggest that a much weaker market lies ahead. Of course, that may not happen until the Internet names fade from the headlines.

Away from stocks, Treasuries and other government debt markets essentially moved sideways with long-term rates at levels uninspiring to economic growth. The dollar rose against the euro (thanks to the Greek debt extension) and the precious metals fell, with gold and silver returning to lows not seen since last November. In response, it may be reasonable to say that the lows have held (as they did today), while commercial short positions in the futures pits are currently at levels consistent with significant reversals. Before that happens, we may need to see the headline shocks settle down to the point where the waning data, both economic and corporate, can dictate the psychology and subsequent price action with a bit more authority.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP