Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Enter a Different Kind of “Normal”

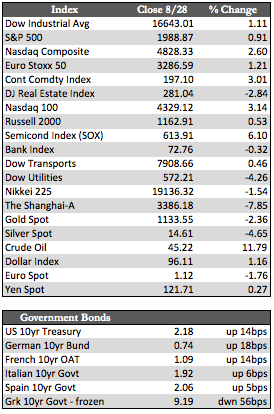

As you may already know, the market action this week turned out to be a roller coaster ride for stock investors. The Dow Industrials lost a little over 1,000 points within the first 13 minutes of trade on Monday and then gained it all back with interest by the close on Friday. Apparently investors were hit with a swath of margin calls following that 1,000-point digger, which created the first wave of buying pressure. As the week progressed, the markets caught a tailwind from a round of dovish talk and action by various central banks. China cut its interest rates, sold US Treasuries, and infused cash of approximately $63 billion into its stocks, while back here in the US Fed governors Dudley and George were busy spouting off about how rate hikes are now “less compelling” than they were before the market fell. In addition to the usual stock market damage control agenda, perception control ahead of China’s WWII military parade and the Fed Symposium that will end Saturday may have contributed to the decision-making.

The rally in stocks allowed Fed governors Fischer and Bullard to take a neutralizing hawkish tone at the symposium during Friday’s trade, which no doubt kept traders in a quandary. In any case, the Fed is obviously not ready to “QE4” just yet, and that means leveraged operators may be forced, as early as next week, to unwind equity positions a bit further. What it actually takes to get the Fed back into QE is anyone’s guess, but if we end up following China’s playbook, markets may have to suffer in excess of a 20% decline to get the Fed off the bench and back into the game.

The rally in stocks allowed Fed governors Fischer and Bullard to take a neutralizing hawkish tone at the symposium during Friday’s trade, which no doubt kept traders in a quandary. In any case, the Fed is obviously not ready to “QE4” just yet, and that means leveraged operators may be forced, as early as next week, to unwind equity positions a bit further. What it actually takes to get the Fed back into QE is anyone’s guess, but if we end up following China’s playbook, markets may have to suffer in excess of a 20% decline to get the Fed off the bench and back into the game.

Gold sold off near 3% earlier in the week alongside stocks and a slight firming of the US dollar (as did the miners). But those losses were moderated by close on Friday following increased political tensions in Greece, an unexpected uptick in Japanese inflation (ex-food), and of course repeated Chinese interventions. That said, I’m guessing folks still don’t see a pressing need for gold quite yet, as everything that befalls US equities has been dismissed as normal, or curable by the Fed. That will change as folks begin to understand that things like 1,000-point swings are typically characteristic of severe bear markets, and that European and Chinese central bank policies are thus far failing to stimulate their respective economies. Next Friday we’ll get a look at the jobs data. As I said earlier this month, the economic data is unlikely to be bad enough for the bulls to get excited, so it’s possible, absent any dovish jawboning by Fed governors, that stocks will have a rough go of it again.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP