Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Traders Counting the Downticks into September 16

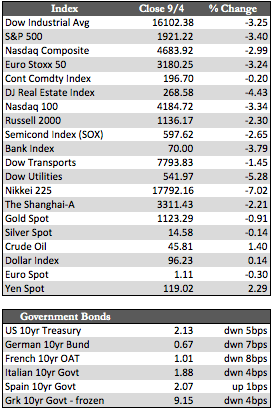

Global equity markets were lower this week, as Mario Draghi failed to deliver on “actual” QE in Thursdays ECB policy meeting. He did, however, raise the bar on ECB purchase limits with respect to outstanding member debt from 25.0% to 33.0% and lower its forecasts for both growth and inflation through 2017. All of this allows the ECB to beef up its QE program somewhere down the road, but not necessarily in the next few weeks. That’s bad news for speculators because the ECB hasn’t found reason enough to come to the rescue, even though the Euro Stoxx 50 index is off over 17% from its high and the EC economy has shown signs of slowing. Contrast that situation with the much better conditions on both counts here in the US, and you might come to the conclusion that the Fed is nowhere near talking about QE. That in turn implies that US stocks may be under more pressure again next week, perhaps deliberately in order to draw the Fed into a more dovish stance prior to the September 16th FOMC meeting.

Perhaps unsurprisingly, Treasuries rose as stocks fell, but I think the age-old correlation between the two assets may be breaking down, psychologically speaking. So far this year, China has sold $315 billion worth of its $3.65 trillion in reserves to stabilize its markets, most of which we assume were Treasuries. In an $18 trillion US debt market, that may not be much, but the fact that China plans to sell reserves at the rate of $40 billion per month indefinitely may be what has the Treasury market acting a bit out of character.

Perhaps unsurprisingly, Treasuries rose as stocks fell, but I think the age-old correlation between the two assets may be breaking down, psychologically speaking. So far this year, China has sold $315 billion worth of its $3.65 trillion in reserves to stabilize its markets, most of which we assume were Treasuries. In an $18 trillion US debt market, that may not be much, but the fact that China plans to sell reserves at the rate of $40 billion per month indefinitely may be what has the Treasury market acting a bit out of character.

The metals, as you doubtless know, have been range bound these last few weeks, despite the many difficulties central banks have had getting a decent stock rally started. This has much to do, I believe, with the perception that without China’s or Europe’s issues in the equation; the US market would be just fine. I suspect that notion has begun to change, given that US stocks were off considerably these last two days while Chinese markets were closed. That said, we may need to see a bit more softening of the bullish tone – as I believe will happen soon – before a real shift in these perceptions occurs and the metals can get underway.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP