Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Central Banks Rule the Week

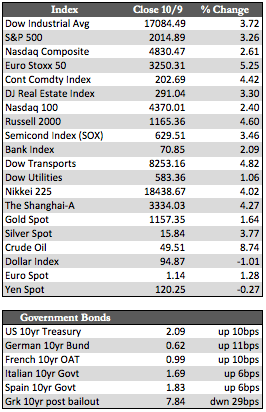

Global stock markets saw their biggest weekly gains this year on the back of central bank jargon. We heard from the U.S. Federal Reserve, European Central Bank (ECB), and the Bank of Japan (BoJ) regarding monetary policy and more specifically quantitative easing. The Federal Reserve minutes were released on Thursday, explaining their rationale for keeping interest rates unchanged at their September 16-17 FOMC meeting. The minutes stated that most committee members were close to raising interest rates, but emerging market weakness and a global economic slowdown halted their decision. Global stock markets interpreted these comments as dovish and rallied on the news and the prospect that U.S. growth remains strong.

Over a year ago, investors and policymakers worldwide became fixated on when the Fed would raise interest rates. Its probable timing has been the subject of intense study, but most Fed members and analysts presume we’ll see an interest rate rise at the upcoming FOMC meeting in December. While we would not be surprised by a small move in rates, there is a growing probability of delay well into 2016. A dovish posture like this might be considered positive by the bullish contingent as easy credit conditions remain in place, but it could also point to the failed impact of those same policies. Central bankers are undeterred in their positioning of loose credit conditions as a cure-all for economic weakness, even if evidence to the contrary abounds.

Over a year ago, investors and policymakers worldwide became fixated on when the Fed would raise interest rates. Its probable timing has been the subject of intense study, but most Fed members and analysts presume we’ll see an interest rate rise at the upcoming FOMC meeting in December. While we would not be surprised by a small move in rates, there is a growing probability of delay well into 2016. A dovish posture like this might be considered positive by the bullish contingent as easy credit conditions remain in place, but it could also point to the failed impact of those same policies. Central bankers are undeterred in their positioning of loose credit conditions as a cure-all for economic weakness, even if evidence to the contrary abounds.

Mario Draghi and the ECB were also leaning dovish this week. Draghi restated the ECB’s 2012 commitment to be: “ready to use all the instruments available within its mandate to act, if warranted, in particular by adjusting the size, composition, and duration of the asset purchase program.” Draghi has made comments similar to this in the past, making a positive impact on the markets but very little impact on the real economy after three years. As the global economic slowdown continues, markets are taking these remarks seriously. They’re pondering whether another round of stimulus represents an opportunity as it did the last time, or an indication of central bank desperation. The Bank of Japan was in the news this week as well. Its leader, Kuroda, maintained the BoJ’s asset purchase program (buying securities of ¥80 trillion annually), but did increase their QQE commitment as some had hoped.

Gold, silver, and the miners saw solid gains this week, possibly due to a delay in rate hikes. These gains in the face of U.S. economic strength (as stated in the Fed minutes) are encouraging, suggesting there is more to current demand dynamics than meets the eye. Next week, we will see a slew of Q3 earnings roll in. Expectations of a decline in both earnings and revenues could fuel an even further rise in metals prices.

Best Regards,

Gavin Lyons

Equity Analyst

MWM LLLP