Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Earnings Challenge Stock Momentum

As noted in a recap a few weeks ago, expectations for 3rd quarter earnings were in the process of being ratcheted down by a fairly substantial 5.0% from that of second quarter results (which is a long way away from the original 16.0% increase expected). But as earnings season gets into full swing, those previously reduced estimates are turning out to be a touch conservative; the contraction in earnings is now expected to reach 7.2%. Given the fact that stocks have remained (thus far) rather resilient to shattered expectations and rather paltry growth, at least among the larger names, such as GE, JP Morgan, Goldman Sachs, Citigroup (lower revs), Linear Tech, Intel, Honeywell, CSX, Johnson & Johnson, and Walmart’s negative forward guidance, it appears that stock bulls believe that the worst (either technically or fundamentally) is over and/or the Fed will come to the rescue. I happen to believe that stocks have merely bounced off their interim lows, aided and abetted by healthcare stocks and semis on Thursday, but are now in a position to head lower in what should be the perhaps more severe second phase of the bear market.

That said, I suppose the rally in stocks that started around 16,000 on the Dow could continue a bit longer, up to its 200-day moving average of 17,581. Bulls may be emboldened by the fact that stocks have refused go down on bad news, based on hopes for more QE. But keep in mind that the idea of QE is hardly enough when this “contraction” began on the back of troubled outside markets that tanked despite the existence of several QE programs and a record increase in US debt over the last few years. So what we are looking for are two things: a loss in momentum in the rally, which may have already happened, in combination with an outside trigger. Perhaps Internet names (which buoyed stocks last quarter) will provide just that, and take the wind out of the bulls’ sails. Netflix’s disappointing results were treated as they deserved, with a near 8% drop in its shares since it reported earnings this past Wednesday. In any case, I do believe this stock rally is on borrowed time.

That said, I suppose the rally in stocks that started around 16,000 on the Dow could continue a bit longer, up to its 200-day moving average of 17,581. Bulls may be emboldened by the fact that stocks have refused go down on bad news, based on hopes for more QE. But keep in mind that the idea of QE is hardly enough when this “contraction” began on the back of troubled outside markets that tanked despite the existence of several QE programs and a record increase in US debt over the last few years. So what we are looking for are two things: a loss in momentum in the rally, which may have already happened, in combination with an outside trigger. Perhaps Internet names (which buoyed stocks last quarter) will provide just that, and take the wind out of the bulls’ sails. Netflix’s disappointing results were treated as they deserved, with a near 8% drop in its shares since it reported earnings this past Wednesday. In any case, I do believe this stock rally is on borrowed time.

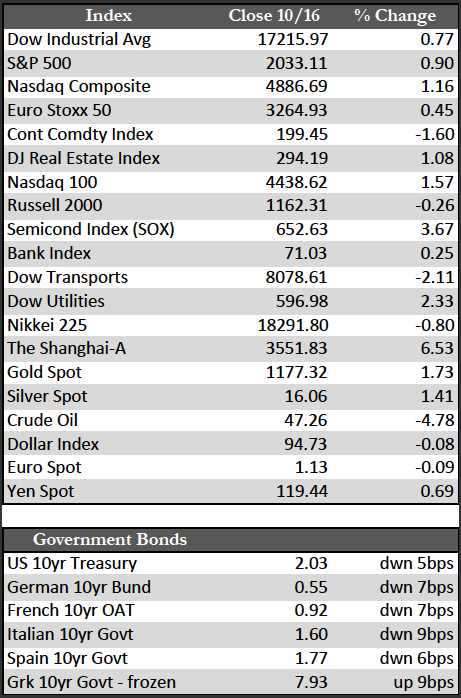

Aside from stocks, Treasuries and other sovereign debt remained range-bound, while some modest weakness in the US dollar, combined with Fed speculation on rates, propelled the precious metals to some of their best levels of the year. I suppose China’s 0.9% increase in its gold reserves may have had something to do with the advance in the gold price, but I’d like to believe that US investors have begun to see the need for protection here on the home front. I suspect we will need to see more from the metals on the upside (which I believe we are set to do) before that theory gains additional traction.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP