Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Price-In “Nothing Matters”

Stocks worldwide moved higher this week, supported by ECB President Mario Draghi’s dovish remarks and a quarter point rate cut by the PBoC. Better-than-expected earnings from Google, Microsoft, Texas Instruments, and Amazon may have also contributed to the strength in stocks this week, though beneath the headline numbers nobody was perfect. Texas instruments in particular saw negative growth in revenues and flat earnings quarter-over-quarter, while the CFO warned that the company is seeing “generally weaker demand.” Regardless, TXN shares still popped 14.0% higher following the release, perhaps supposing that the worst is over or a merger is in the works.

Shares of the other names mentioned above behaved in similar fashion, but to me the jump had more to do with anticipated Fed and ECB easing than anything company-specific. In any case, stock indexes are now back to respectable levels, with the Nasdaq 100 at or near its all-time high – as if nothing bad had ever happened. But now that stocks have demonstrated the ability to recoup their losses to a large degree, it prompts the question of just what the Fed is required to do to help. I imagine that whatever the Fed can or will do in the form of QE will most likely fall dangerously short of expectations.

Shares of the other names mentioned above behaved in similar fashion, but to me the jump had more to do with anticipated Fed and ECB easing than anything company-specific. In any case, stock indexes are now back to respectable levels, with the Nasdaq 100 at or near its all-time high – as if nothing bad had ever happened. But now that stocks have demonstrated the ability to recoup their losses to a large degree, it prompts the question of just what the Fed is required to do to help. I imagine that whatever the Fed can or will do in the form of QE will most likely fall dangerously short of expectations.

Stocks may now be in the process of forming a top where the overall earnings picture (which remains negative) for the 3rd and leading into the 4th quarter will come back into focus. But judging by the way equity markets still wish to extrapolate trends into infinity, it may be a little while before stocks plateau and then retrace.

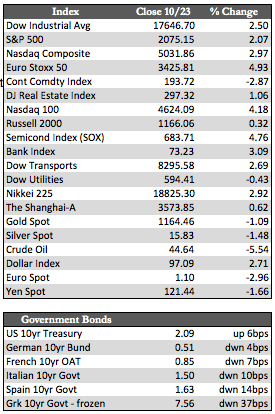

Away from stocks, Treasuries barely moved, though ECB debt jumped on Draghi’s intention to “investigate” QE options in December. His comments also caused the US dollar to spike against the euro to just over 97.0. Technically speaking, the move put the dollar back into the higher end of its trading range. It’s now on the brink of a bullish break above its downward trend that began in March of this year. Surprisingly, the precious metals remained somewhat firm, losing only minor ground (see the box scores), which may mean the metals are ready to earn back some of the losses endured during the equity bounce just witnessed.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP