Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Despite Everything, Central Banks Stall on QE

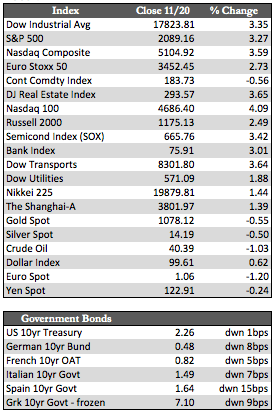

To start the week stocks looked as if they were headed lower following last Friday’s attacks in Paris. However, as soon as our markets opened stocks began a relentless climb (with decent breadth) to within striking distance of interim highs. The bet was clearly that central banks would add QE to stabilize the effects of hostilities, but after several chances to do so no central bank has thus far committed to easing. The FOMC minutes released Wednesday reiterated the intention to take raising rates “slowly.” Draghi said for the umpteenth time that he’ll do “whatever it takes,” while the BoJ spoke only about falling short of inflation targets. So when it comes to QE central banks remain all talk and no action.

This is not to say that the banks won’t try to print more; the ECB may in fact do so in December. However, as I have said in this forum before: Why should central banks print when the speculative community has repeatedly demonstrated the unaided ability and proclivity to stimulate markets (apparently using leverage), despite the abundance of bad news? Add to that the fact that QE is losing or has lost its ability to affect long-term rates in the first place, and the whole debate about “to QE or not to QE” becomes very nearly moot. In any case, this situation leads me to believe that we have a massive inflection point ahead of us – where the selling has the potential to get ugly fast.

The economic data was mixed in October. Housing starts fell 11%, permits rose 4.1%, and U.S. industrial production declined 0.2% while the CPI rose 0.2% (instead of falling). Data-dependent as the Fed may be, this mixed bag of information certainly doesn’t make for a QE-inspiring moment. In any case, it’s just one more obstacle for bulls, who need some kind of an accident to spur the Fed to act. As I’ve mentioned before, that accident is more likely to occur within the stock market at this point than the economy at large.

As for the unprecedented selloff in commodities, I have no comprehensive explanation for the alarming depths to which they have descended. I’m certain that the warming effect of El Niño has combined with the energy glut to produce what will turn out to be short-term imbalances, but those imbalances are being exacerbated by year-end tax loss selling and some hedge fund unwinds. Trading in sympathy with all that and a stronger dollar, the precious metals revisited their lows. However, in a surprise turn of events, the miners led the way higher on several occasions. That is usually an indication of a turnaround in the sector.

Next week during the holiday, trading volumes for stocks will be low. In that environment anything can happen, but sales surrounding Black Friday are likely to be unimpressive. What that means for stocks, the dollar, bonds, and gold isn’t entirely clear, but as we head into December with the prospect for weaker fourth-quarter earnings looming, attitudes toward risk could turn defensive again – without much notice.

There will be no comments next week as we join you in celebrating the holiday. We wish you and yours a heartfelt and happy Thanksgiving!

Best Regards,

David Burgess

VP Investment Management

MWM LLLP