Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bulls Running Out of Excuses

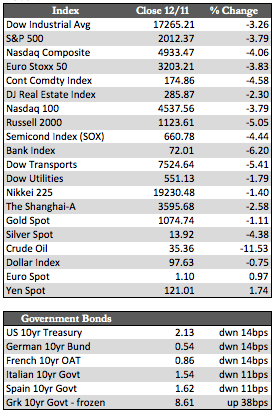

Since May of this year the major stock indexes have done their very best to keep up appearances and defy the corrective forces affecting the broader market. This week that story may have begun to change. Despite the celebrated mergers (i.e., Dow and DuPont), dovish talk/action from central bank officials (ECB’s Praet), much cheaper oil, typically bullish bad economic news, and Fed-approved bank stress tests (Bank of America), stocks attempted and failed to take out the old highs. Instead they trended lower, with the energy-laden junk bond market providing an added undertow (see the box scores). However, with the Dow now back below 17,500 – which is where it was before the sharp selloff we saw in August – pressure is building against a sea of deeply over-levered operators. In a situation like this, selling could intensify at any moment. Customary year-end dynamics suggest we can expect a low-volume ramp job – but starting from what level is anyone’s guess at this juncture.

As stocks fell, sovereign debt saw modest gains and gold stabilized in a defensive bid. The dollar fell against most major currencies as the euro decline stalled on signs of ECB policy indecision. Next week we have the FOMC meeting in which a 25 basis-point increase in rates is expected. If the Fed doesn’t deliver, we may see a quick reversal of this week’s events, but that outcome may be farfetched. Fed officials have been extrapolating rate hikes into March of next year. That fact combined with earnings that are likely to disappoint based on meager gains in retail (0.2% rise in November) means that the more defensive posture we saw this week will likely persist.

As stocks fell, sovereign debt saw modest gains and gold stabilized in a defensive bid. The dollar fell against most major currencies as the euro decline stalled on signs of ECB policy indecision. Next week we have the FOMC meeting in which a 25 basis-point increase in rates is expected. If the Fed doesn’t deliver, we may see a quick reversal of this week’s events, but that outcome may be farfetched. Fed officials have been extrapolating rate hikes into March of next year. That fact combined with earnings that are likely to disappoint based on meager gains in retail (0.2% rise in November) means that the more defensive posture we saw this week will likely persist.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP