Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Fed Stands Ground – At First

This week may have been one for the record books in terms of the volatility in stocks. Up until Wednesday’s FOMC policy decision, stocks were in melt-up mode as the Dow tacked on nearly 500 points. No news was driving the action that I could see, other than the fact that short and put option positions were fat – which might have made for some panic if dovish talk reappeared, but of course it did not. As expected, the Fed increased its target rate 0.25% to 0.50% and made some downward revisions in its inflation outlook, which I am sure the bulls appreciated. But those revisions were made on what the Fed deemed “transitory” conditions (low prices) in the energy sector. And perhaps to the bulls chagrin, the Fed used this as an excuse to promise further rate increases an additional four times over the course of 2016. To soften that blow, the Fed qualified the hikes as being “gradual” instead of “measured.”

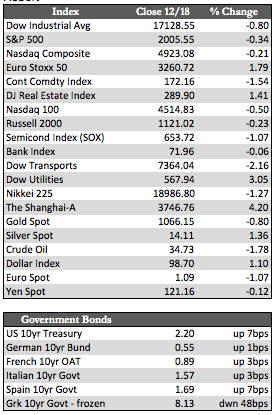

As I have said here before, the speculators desperately need the Fed to print money. Rate hikes, no matter how gradual they may be, are simply not the same thing. This is why I believe stocks began to retreat (rather quickly) through to the close on Friday. The Dow finished nearly 140 points in the red, for an approximate 640-point turnaround on the week. That bloodletting caused an upward reversal in both Treasuries and gold, while the dollar gave back a portion of its earlier gains (see the box scores).

As I have said here before, the speculators desperately need the Fed to print money. Rate hikes, no matter how gradual they may be, are simply not the same thing. This is why I believe stocks began to retreat (rather quickly) through to the close on Friday. The Dow finished nearly 140 points in the red, for an approximate 640-point turnaround on the week. That bloodletting caused an upward reversal in both Treasuries and gold, while the dollar gave back a portion of its earlier gains (see the box scores).

For the remainder of the year, anything can happen. Stocks will enter another low-volume stretch through the holiday – from which they have rallied 14 times out of the last 18 years. Yet with the Dow closing below its lowest moving average today (the 100-day at 17,151.95), and on relatively healthy volume, we could see more selling pressure in stocks early next week. In any case, the important takeaway from the post-Fed market action we witnessed is that it may be a prelude to what will come in the new year.

There will be no recap for the remainder of the year. From all of us here at McAlvany Wealth Management, have a Merry Christmas and Happy New Year!

Best Regards,

David Burgess

VP Investment Management

MWM LLLP