Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Stumbling Back to Reality

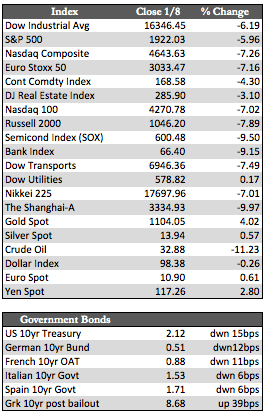

This week equity markets gave back many of the gains accumulated during the low-volume trade over the holidays, despite dovish remarks released in Wednesday’s FOMC minutes. Since the start of the year, the Dow has shed 5.0% alongside the broader market (the New York composite index). At the same time, rumors that China is raising cash by selling its US Treasury reserves to contain its equity meltdown kept a lid on the usual “flight to safety” rally in fixed income markets. This, I believe, left the metals wide open for a safe-haven bid. Gold gained over 4.0% and silver 1.5%, as the US dollar remained mostly flat on the week. Select energy shares also caught a bid; the sector may seem relatively cheap to the market after the exaggerated bludgeoning received at year-end.

Over the next few months equity markets in general will likely come under increased pressure for myriad reasons, not least of which are chronically weak credit markets. Those markets are the source of growth here in America. Once speculators realize that China is not entirely to blame for every market downturn and/or that the Fed won’t or can’t come to the rescue at these levels, I expect stocks to pick up speed to the downside. In the meantime we are sure to see bear market rallies brought on by intermittent QE chatter from any number of central banks.

Over the next few months equity markets in general will likely come under increased pressure for myriad reasons, not least of which are chronically weak credit markets. Those markets are the source of growth here in America. Once speculators realize that China is not entirely to blame for every market downturn and/or that the Fed won’t or can’t come to the rescue at these levels, I expect stocks to pick up speed to the downside. In the meantime we are sure to see bear market rallies brought on by intermittent QE chatter from any number of central banks.

Next week we’ll get to hear from several Fed officials on various topics. In the past these speaking engagements have been bullish for stocks based on the expectation that officials would use the opportunity to hint at or declare an end to rate hikes or the start of more QE. Such developments will likely remain improbable since jobs, the Fed’s primary mandate-affecting policy, were rather firm all the way through December (ADP +257,000 and US non-farm +192,000). Bulls are therefore unlikely to get what they want from the Fed anytime soon, which leaves only a lackluster earnings season to contend with dead ahead.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP