Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Short Sellers Capitulate First

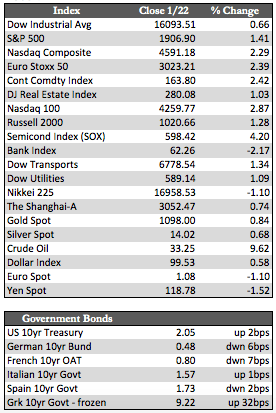

U.S. equity markets were under considerable pressure early this week as worldwide equity markets teetered on the edge of bear market territory, and as U.S. corporate earnings rolled out in sub-par fashion. However, the bearish action reversed course abruptly by midday Wednesday as U.S. stocks, for apparently technical reasons, “bounced” off the August intraday lows. From that point on, stocks only gained momentum, no doubt at the expense of short sellers both here and overseas.

In a statement Thursday night Mario Draghi gave bulls what they wanted by “hinting” at more stimulus by the March meeting. That stimulus could consist of an increase of €15 billion to €75 billion per month to its QE program and a reduction to its deposit rate to negative 0.4. For the most part, stocks finished decidedly in the black on a global basis by the close of business Friday. It may be worth mentioning, though, that while U.S., Japanese, and European stocks reacted positively to these events, Chinese equities didn’t – even though the PBoC made several injections (a record $60 billion on Thursday) into its markets. Major indexes in both Shanghai and Hong Kong finished either flat or down for the week.

In a statement Thursday night Mario Draghi gave bulls what they wanted by “hinting” at more stimulus by the March meeting. That stimulus could consist of an increase of €15 billion to €75 billion per month to its QE program and a reduction to its deposit rate to negative 0.4. For the most part, stocks finished decidedly in the black on a global basis by the close of business Friday. It may be worth mentioning, though, that while U.S., Japanese, and European stocks reacted positively to these events, Chinese equities didn’t – even though the PBoC made several injections (a record $60 billion on Thursday) into its markets. Major indexes in both Shanghai and Hong Kong finished either flat or down for the week.

This Chinese news is significant because if there were any point at which equities would have reacted well to stimulus it should have been from these relatively oversold levels. If Chinese investors have begun to shun QE as irrelevant, or even worse damaging to the bullish cause, I would have to imagine that U.S. and European investors aren’t too far behind in reaching the same conclusion. If – not when – that happens, the ramifications for stocks, long-term rates, and the metals will be profound. But for the moment, markets are what they are – volatile.

Aside from the action in stocks, Treasuries finished flat, the dollar flirted with its all-time high against the euro, and the metals (on average) gained a few percent. Year to date, gold is up 3.40% to silver’s 1.12%, but we have yet to see any of that rub off on the mining shares. After another round of restructuring, including cuts to reduce all-in sustained costs and impairment charges against non-profitable assets (i.e. Barrick’s $3 billion write-off), share prices rest at or near their all-time lows. Regrettably, I have no simple answer for this negativity at a time when the price movement should be more encouraging, but I will say that business structures in this sector are now primed for significant gains as the price of gold and silver improves.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP