Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

BoJ Decision Sparks Month-End Ramp Job

More central bank talk than action seemed to sway the markets again this week. Beginning with the FOMC meeting Wednesday, bulls were disappointed with the Fed’s decision to maintain the status quo with respect to policy (no change in rates and no QE), and were again unmoved when the Fed admitted that the economy had “slowed” in the 4th quarter of last year (to 0.7%) – perhaps due to the fact that they ceded nothing when it came to jobs, which the Fed still insists are steadily improving.

In response, the Dow fell over 200 points that day, but began to rally in front of the BoJ’s policy decision Thursday night. At that meeting no additional QE was initiated, but the BoJ did surprise with a rather meaningless move into negative territory on its key interest rate – to minus 0.10. This caused a ramp job in stocks across the globe, magnified by what appeared to be a short squeeze and month-end gaming amid low volume trade. Bulls appear to be extrapolating central bank goodwill into infinity.

In response, the Dow fell over 200 points that day, but began to rally in front of the BoJ’s policy decision Thursday night. At that meeting no additional QE was initiated, but the BoJ did surprise with a rather meaningless move into negative territory on its key interest rate – to minus 0.10. This caused a ramp job in stocks across the globe, magnified by what appeared to be a short squeeze and month-end gaming amid low volume trade. Bulls appear to be extrapolating central bank goodwill into infinity.

Some will say that US corporate earnings have something to do with the rally, though I remain skeptical. The quality of earnings among the large-cap majority has either slipped or been gamed higher using leverage and subsequent share buybacks. Facebook’s revenues and earnings growth have so far been the exception to this rule. However, I believe that the slower growth and guidance of bellwether companies like Apple are more likely to dictate market action, despite central bank efforts – which at this point are relatively helpless to stem the decline in consumer spending and resultant corporate earnings.

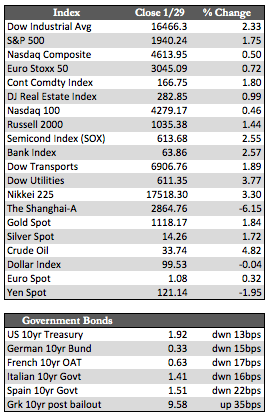

Next week we’ll get a better idea as to whether or not the decline in stocks is over – not, if I’m any judge. I suspect that upside momentum will be difficult to maintain without QE, especially while the cyclical problems in the energy, technology, and financial sectors remain unresolved. As for the metals, gold gained about 1.7% to silver’s 1.8%, while the miners tacked on about 8% for the week for no apparent reason. If I were to guess why, I would say it was the Fed’s change in tune regarding the economy.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP