Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Earnings and Jobs Weigh on Stocks

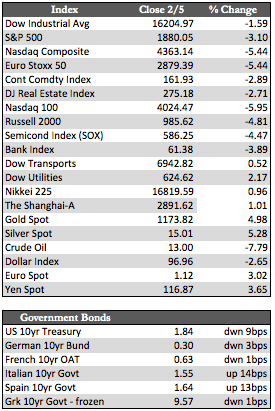

Early this week US stocks seemed to be benefitting from a host of different catalysts, including a rally in oil, corrective forces in the dollar, and the usual dovish talk from central bankers Stanley Fischer, Haruhiko Kuroda, and Mario Draghi. However, it turned out that all that positive action hinged on the employment numbers released today. Non-farm payrolls came in at a much-less-than-expected 151,000. That would normally be bullish, but it was the outsized hike of 0.5% in average hourly earnings that spooked stock traders. Anything that looks inflationary is assumed to mean that the Fed will be slow to ease. In any case, that bit of news sparked a rather sharp selloff in the major indexes. The Dow lost as much as 1.5%, while the NASDAQ gave up a little over 3%. The selloff drove stocks into the red for the week, led by the FANGs (Facebook, Amazon, Netflix, and Google) in the NASDAQ. Treasuries tacked on a third week of gains, while the precious metals broke out to the upside due to the turmoil in stocks and the dollar (see the scores).

In contrast, overseas equities remained soft through the week – with the possible exception of a few emerging markets that saw a bounce along with oil. It may be worth mentioning that there isn’t one major index in overseas markets that hasn’t broken below its August lows. The German DAX finally joined the club in the last few days. This is significant because US stock markets haven’t yet responded in kind, but if the recent action serves as any indication, they may do so by next week. That would put the Dow below 15,400 and the NASDAQ 100 somewhere south of 3,800. With fourth quarter earnings and first quarter guidance coming in on the low side of estimates, breaching the August lows appears all the more possible.

In contrast, overseas equities remained soft through the week – with the possible exception of a few emerging markets that saw a bounce along with oil. It may be worth mentioning that there isn’t one major index in overseas markets that hasn’t broken below its August lows. The German DAX finally joined the club in the last few days. This is significant because US stock markets haven’t yet responded in kind, but if the recent action serves as any indication, they may do so by next week. That would put the Dow below 15,400 and the NASDAQ 100 somewhere south of 3,800. With fourth quarter earnings and first quarter guidance coming in on the low side of estimates, breaching the August lows appears all the more possible.

If and when we break through those lows, I suspect the need to de-leverage will intensify among the speculative crowd. Up to this point they have been rather cavalier about risks and confident about the Fed’s abilities – however misplaced that confidence might be. We will hear from Janet Yellen as she speaks to members of the Senate banking committee (among others) on Wednesday next week. If stocks choose to slide despite any dovish talk on her part – as did European equities in response to Draghi’s dovish remarks Thursday morning – the downside potential in stocks could get interesting, to say the very least.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP