Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

If All Else Fails, Cheerlead

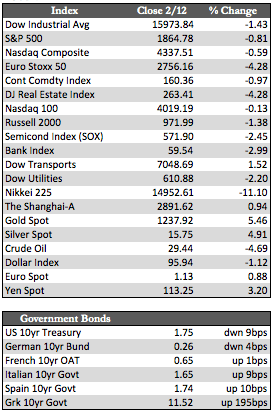

Stocks in the US, Japan, and Europe entered into a bit of a freefall for most of the week. Late in the trading session Thursday, however, they were once again saved from the throes of capitulation (below the August lows). Support formed around the key level of 1,812 for the S&P 500 index, at which point a sharp rally ensued – fueled by short covering I presume – on the back of yet another emergency meeting by OPEC to reduce oil production, a few upbeat earnings forecasts (e.g., Cisco) and a swath of bottom callers from within the now panicked financial community. Prominent among these latter was Jamie Dimon, who endorsed JP Morgan by buying $26 million worth of its shares. In any case, without a real panic – in which the continuous dip buying we’re seeing would be absent – I seriously doubt that a bottom has been reached. For now, though, we have a rally, and it could extend itself into next week before reality starts to settle in again.

The root issue isn’t oil, Asia, or even the banking sector per se. It’s the failing of central banks and their policies to control or foster growth in the economy and asset prices. Keep in mind that while stocks have been in falling out of bed, central banks have remained consistently accommodative. Still active are the ECB’s €60 billion per month bond-buying program, the Chinese record setting emergency interventions, and the many attempts by the BoJ this week to stem the ascent of the yen. Yet the results have shown very few signs of stabilization, contrary to what these organizations repeatedly claim.

The root issue isn’t oil, Asia, or even the banking sector per se. It’s the failing of central banks and their policies to control or foster growth in the economy and asset prices. Keep in mind that while stocks have been in falling out of bed, central banks have remained consistently accommodative. Still active are the ECB’s €60 billion per month bond-buying program, the Chinese record setting emergency interventions, and the many attempts by the BoJ this week to stem the ascent of the yen. Yet the results have shown very few signs of stabilization, contrary to what these organizations repeatedly claim.

Away from stocks, the realization that the banks are losing their grip may be taking hold. Treasuries rocketed higher (for now), along with gold, silver, and the miners this week. A short squeeze by the non-commercials seems to be the primary motivator behind gold’s ascent. To be sure that the rally will be sustained, I’d like to see signs of natural buying first, which I believe will come once the correction in stocks resumes. The timing of that resumption will depend to some degree on how traders choose to react to the many central bankers (including Draghi on Monday) due to speak next week and the FOMC minutes to be released on Wednesday.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP