Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Take Your Stock Profits and Run?

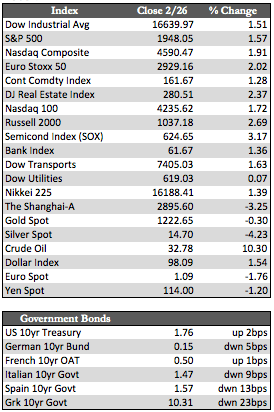

Foreign and domestic equities were mostly higher by a couple of percent this week as US oil inventory pressures abated, merger talks reignited (i.e., United Technologies and Honeywell), and lower inflation in Europe reinforced speculative hopes for more of Draghi’s QE. This weekend’s G20 meeting and the fact that the Dow broke through its 50-day moving average (on the daily chart) helped to fuel the bullish tone, but while stocks have rallied higher, trade volumes have steadily diminished – well below recent averages. Needless to say, this is not characteristic of a real bull move. It leads me to believe that short covering was once again the driver behind the rally.

Away from stocks, the dollar was stronger against most currencies, with one exception. The Japanese Yen has been racing higher despite many attempts by the Bank of Japan to debase it. Treasuries were flat, while sovereign debt in both Europe and Japan extended gains as the yield on the 10-year Japanese government bond closed at negative 0.065%(!). Gold and the miners held up surprisingly well in a week where things could have been much worse. Silver, which has lagged gold in this year’s rally, gave up about 3.0% in addition to some technical ground along the way.

Away from stocks, the dollar was stronger against most currencies, with one exception. The Japanese Yen has been racing higher despite many attempts by the Bank of Japan to debase it. Treasuries were flat, while sovereign debt in both Europe and Japan extended gains as the yield on the 10-year Japanese government bond closed at negative 0.065%(!). Gold and the miners held up surprisingly well in a week where things could have been much worse. Silver, which has lagged gold in this year’s rally, gave up about 3.0% in addition to some technical ground along the way.

Summing it up, I still believe that what we’re seeing is a fairly sizeable yet very normal bear market rally. With QE efforts in China, Japan, and Europe failing, and with prospects for QE at the March FOMC meeting near zero at this time, US stocks could have a pretty rough month ahead. There is the earnings picture to consider, as well. Expectations for the first quarter have factored in growth of nearly 16% on a year-over-year basis – they’ve already been ratcheted back by 7.5% in the last few weeks. But I find the chances of reaching that growth target to be next to none given that economic fundamentals have been range-bound since this time last year. Keep in mind that stocks have yet to discount the 15.7% drop in earnings we’ve had thus far (the Dow is 9.12% off its high), and you have yet another data point to suggest that a dislocation in the markets may be imminent.

At last glance, midday Friday, stocks were having difficulty maintaining any momentum to the upside. It may therefore be fair to say that the upcoming G20 meeting and characteristic month-end performance gaming have already been priced into stocks. There are no Fed governors scheduled to speak next week, and I expect that any economic data released will not be bad enough to inspire a liquidity-driven rally. It could be a week in which stocks start to sputter again, but we’ll just have to wait and see how the market trades next week to tell us more.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP