Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Hype, Not Substance Drives Stocks Higher

Stocks both here and abroad gained an average of about 3% early in the week. Bulls were excited about an uptick in Chinese exports (+11.9% in March) and a surprise White House meeting between Yellen and Obama. As it turned out, the Chinese data was a nonevent because the holiday month of February was omitted from the figures. If China’s export totals were smoothed across the first three months of this year, exports were down 4.0%. As for the meeting at the White House, Yellen was quoted as saying “we are focused on Main Street,” which I assume means that the so-called “fusion” policy might be gaining adherents in Washington. In any case, as the week wore on, the focus turned to earnings. That caused the markets to get a little shakier.

Stocks here in the US didn’t start to wobble on the JPMorgan report Wednesday, though I think they should have. The company reported one of its worst quarters of revenues in the past five years and a drop in earnings (after having “stabilized” at the end of 2015). However, when Bank of America, Citigroup, and Wells Fargo all reported similar results – except that Wells Fargo did see some revenue growth year-over-year – stocks began to leak a little bit on higher downside volume by week’s end.

Stocks here in the US didn’t start to wobble on the JPMorgan report Wednesday, though I think they should have. The company reported one of its worst quarters of revenues in the past five years and a drop in earnings (after having “stabilized” at the end of 2015). However, when Bank of America, Citigroup, and Wells Fargo all reported similar results – except that Wells Fargo did see some revenue growth year-over-year – stocks began to leak a little bit on higher downside volume by week’s end.

It probably didn’t help matters Friday when Goldman Sachs announced a push for “the deepest cuts [layoffs] it’s seen in years.” Smaller banks reporting this week seem to be faring better because they are less apt to be dependent upon trading revenue as a source of profit. However, the key question is whether or not the bulls can ignore the negatives, which appear to be worse than expected, and push stocks higher while claiming the worst has been seen. Without a catalyst for growth, aka the Fed, which probably won’t print in earnest until a real emergency appears, I doubt that the market can hold together much longer. We’ll get a better idea of things next week as we hear from a broader array of companies.

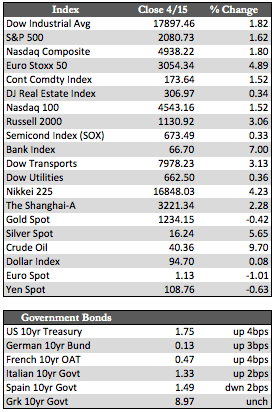

Away from stocks, Treasuries went sideways, as did most European debt – though the PIIGS debt did see a bounce following efforts by Italian authorities to patch up Italy’s banking system. Oil tacked on a few percent, as there was no shortage of bottom callers. The metals finished in split fashion, with gold losing 0.42% to silver’s gain of 5.65%. The miners also continued to shine with a gain in excess of 3%. Silver was the only component that finished at or near its high for the week (and the year), which may mean it’s ready to break out further. Again, however, much depends on whether stocks can advance from here or not. If they don’t, then the metals may see more upside for a while longer. Once initiated, the downside in stocks could get quite nasty, quite fast.

Best Regards,

David Burgess

VP Investment Management

MWM LLLP