Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

To Hike or Not to Hike

The amount of time that folks have given the subject of a rate hike (or not) in the June FOMC meeting is absolutely absurd. The obvious fact is that the printing and borrowing of multiple trillions of dollars is what got us to the levels we see in the markets and, to a smaller degree, the economy today. That said, if there is anything that might help keep the markets moving higher, it’s an extremely large quantity of QE. I say “might” because the impact of QE is now a shadow of its former self. But arguments to that effect aside for the moment, I think it’s more important to recognize that the Fed is a long way away from a policy decision of that size and scope. As I have said before, it will take a major accident to get the Fed off the bench for such an undertaking, and the markets have given the Fed no reason to act – so far.

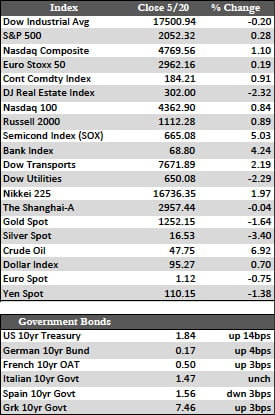

In any case, stocks were a bit firmer (and bonds weaker) across the globe this week. I believe they were acting more on hype than substance, as Buffet disclosed his purchase of a little over $900 million worth of Apple in the first quarter and the CEOs from Avis and Hertz announced they were purchasing their own shares. These things, combined with the speculation over Fed intentions, had stocks rallying into the close on Friday. The FOMC minutes and Fed speakers were somewhat bearish as they signaled that a few rate hikes were needed in the near future, but I think the market took this as a matter of crying wolf one too many times. It rallied anyway, perhaps on the notion that if a rate raise occurs it may be the last – for reasons that should be obvious.

In any case, stocks were a bit firmer (and bonds weaker) across the globe this week. I believe they were acting more on hype than substance, as Buffet disclosed his purchase of a little over $900 million worth of Apple in the first quarter and the CEOs from Avis and Hertz announced they were purchasing their own shares. These things, combined with the speculation over Fed intentions, had stocks rallying into the close on Friday. The FOMC minutes and Fed speakers were somewhat bearish as they signaled that a few rate hikes were needed in the near future, but I think the market took this as a matter of crying wolf one too many times. It rallied anyway, perhaps on the notion that if a rate raise occurs it may be the last – for reasons that should be obvious.

As for the metals, gold chose not to react as well as stocks did to the prospects of a rate hike in June, and is now testing the support limits of its 50-day moving average near $1,249. If that level were breached, I suppose $1,200 or somewhere in that vicinity would be the next support level. Much will depend on the behavior of the stock market and whether or not momentum to the upside can be maintained. With no money coming in from the Fed, a contraction in first-quarter earnings of 1.3% (with 91% of firms reporting; 12.6% growth was expected), and no catalyst at work to reverse that trend for the second quarter, the market is more likely set up for a dislocation than anything else. However, it is often the case in the non-earnings period (or “no news” period) that stocks have a tendency to drift higher, so we’ll see just how daring the bulls intend to be along those lines starting next week.

Best Regards,

David Burgess

VP Investment Management

MWM LLC