Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

A Small Window of Opportunity for Stock Bulls

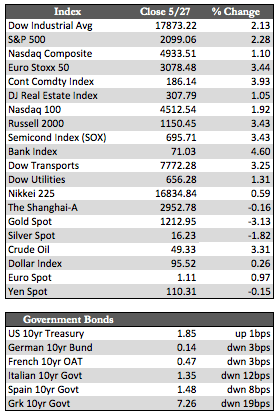

Foreign and US stocks gained a couple of percent on the week, with European indices leading the way higher. Reports indicated that German first-quarter exports (+1.0%) and US new home sales for April (+16.6%) both increased at rates that were better than expected. However, bad news had the same effect. Layoffs at Microsoft (1,850) and Royal Dutch Shell (2,500), the nonchalant way Yellen spoke of future interest rate increases – just about any news hitting the tape recently has been interpreted as bullish. As I said last week, without corporate earnings to say otherwise, stocks are positioned to grind higher. And by the look of it they may continue to do just that between now and mid-June when the Fed meets again – provided there are no disruptions in the interim.

Away from stocks, Treasuries were flat, the dollar was slightly stronger, and the metals consolidated around a probable rate hike with a loss of 3.13% for gold to silver’s –1.82%. Remarkably, however, the miners have remained relatively firm, as have the inventory levels at the COMEX depository – which saw sharp increases in the last handful of days. It could mean something or it could mean nothing, but I get the sense that the market believes (with good reason) that this next rate hike is likely to be the Fed’s last for the foreseeable future. If that turns out to be the case, it could translate into substantially higher prices for the metals over the next several months. Conversely, stocks have already discounted that possible outcome. Without a meaningful catalyst for growth, however, they face considerable downside risk. Earnings in the second quarter are bound to be worse (again).

Away from stocks, Treasuries were flat, the dollar was slightly stronger, and the metals consolidated around a probable rate hike with a loss of 3.13% for gold to silver’s –1.82%. Remarkably, however, the miners have remained relatively firm, as have the inventory levels at the COMEX depository – which saw sharp increases in the last handful of days. It could mean something or it could mean nothing, but I get the sense that the market believes (with good reason) that this next rate hike is likely to be the Fed’s last for the foreseeable future. If that turns out to be the case, it could translate into substantially higher prices for the metals over the next several months. Conversely, stocks have already discounted that possible outcome. Without a meaningful catalyst for growth, however, they face considerable downside risk. Earnings in the second quarter are bound to be worse (again).

Best Regards,

David Burgess

VP Investment Management

MWM LLC