Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Take a Short Breather

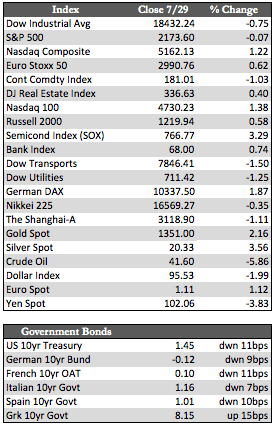

Global stock markets were essentially mixed this week, failing to gain any real momentum to the upside. Earnings and central bank policy decisions had produced unwanted results. Both Amazon and Apple seemed to have set the tone for the NASDAQ, which managed to finish in the black by a little over a percent for the week. Amazon kept costs under control while offering delivery and credit card perks that continued to boost revenues. This allowed for an 800% increase to just shy of $2 in earnings for the quarter, which could be their best in terms of profit potential. If that turns out to be the case, you can buy the stock at a not-so-cheap multiple of 94x earnings. Apple forecasted another drop in revenues for a 3rd consecutive quarter. That didn’t stop the bulls from declaring that the worst was over, sending Apple’s shares to a 5.63% gain. With somewhere around 40% of S&P companies reporting thus far, earnings estimates have been ratcheted down from where they stood on June 1, 2016 by just over 6.0% – even factoring in a few blowouts like Amazon. If that rate of deceleration continues, earnings may be flat to down on a year-over-year basis by the time the reporting season concludes.

As for central banks, we heard from a notable three this week. The Fed meeting Wednesday was a non-event, as the Fed kept rates unchanged on reduced market risks (think stock market rally), but gave no clear indication on the expected rate hike later this year. Both the PBoC and the BoJ began a heated debate on the deteriorating efficacy of quantitative easing and the use of “cold fusion” or “helicopter money” tactics. BoJ chair Kuroda in particular gave warning that Japan is now in the throes of a liquidity trap – where QE can no longer decrease long-term interest rates to the point where they will enable economic growth. This issue, which I believe all central banks utilizing QE will be forced to confront, is nothing new to readers of this recap. We have talked about it repeatedly, but I thought it important to mention since it will have a dramatic impact on stocks once it becomes mainstream – perhaps sooner than stock bulls here in the US expect.

As for central banks, we heard from a notable three this week. The Fed meeting Wednesday was a non-event, as the Fed kept rates unchanged on reduced market risks (think stock market rally), but gave no clear indication on the expected rate hike later this year. Both the PBoC and the BoJ began a heated debate on the deteriorating efficacy of quantitative easing and the use of “cold fusion” or “helicopter money” tactics. BoJ chair Kuroda in particular gave warning that Japan is now in the throes of a liquidity trap – where QE can no longer decrease long-term interest rates to the point where they will enable economic growth. This issue, which I believe all central banks utilizing QE will be forced to confront, is nothing new to readers of this recap. We have talked about it repeatedly, but I thought it important to mention since it will have a dramatic impact on stocks once it becomes mainstream – perhaps sooner than stock bulls here in the US expect.

Away from stocks, Treasuries and the metals were firmer, while the dollar was weaker against most other paper (except the yen), driven by the Fed’s non-commitment to rate hikes. Gold gained 2.15% to silver’s 3.59%, and the miners tacked on a little over 6.0%. Oil resumed its bear market, due to another outbreak of oversupply, and trended down to the $40/bbl level. Natural gas moved meaningfully higher to $2.86/btu (up from $2.28/btu at year-end) on opposite dynamics. Next week there will be more earnings reports, but I believe it will be more important to see whether the bulls have enough ammo left to extend this rally – potentially into the 3rd quarter. In that quarter, I believe the temporary benefits of lower long-term rates, financial engineering, and foreign capital inflows seen in this quarter will begin to unravel.

Best Regards,

David Burgess

VP Investment Management

MWM LLC