Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Jobs Save Stocks from the Doldrums

The action in stocks earlier this week was a bit blasé. The indices seemed to be merely posturing in front of today’s non-farm payroll report. Of course that number was once again nearly perfect, with jobs created registering 255,000 for the month of July. On top of that, we saw a positive revision of 5,000 (to 292,000) for June. I don’t want to spend a great deal of time analyzing that July number because the government can spin it any way it wants. However, I will note that the majority of jobs the government claims were created in the last year have been service (including retail and leisure) or government (education and health) related, while goods-producing jobs have been flattish or in decline. Translate that into trade terms and it shows that the US is still doing absolutely nothing to reduce our $10 trillion (and growing) cumulative current account deficit. In any case, I suspect “debt” or “credit” driven jobs were given a boost in the last handful of months thanks to the recent spike in bond prices (or drop in yields). But, as we have seen with the rest of the world, a drop in rates doesn’t buy you much nowadays in terms of economic or stock market growth. And as I have said before, we may be well into the 3rd quarter before we see how that plays out here at home.

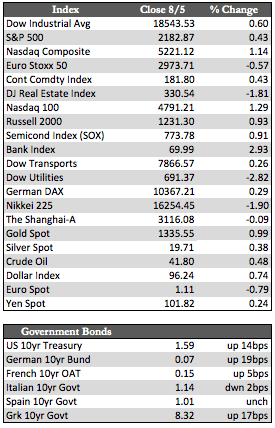

Following the jobs report, the Dow, S&P, and NASDAQ launched higher immediately. Both the S&P and NASDAQ set new all-time highs. Exacerbating that bullish tone, I’m sure, was a rate cut from the BoE, an increase in Japan’s QE (of ¥4.6 trillion), another lending initiative in China, and some decent – at least on the surface – earnings releases. This time the significant earnings news was from Priceline, where a larger than expected increase in travel bookings and subsequent earnings sent its shares to about a 4% gain. Even so, the gain in US stocks was not that impressive. As the overall earnings picture continues to ratchet down, many worldwide stock indices and U.S. broader market stocks are going absolutely nowhere. European banks in particular are showing tremendous weakness. S&P earnings estimates for this quarter (in the latest week) were lowered once again by about 3.2%.

Following the jobs report, the Dow, S&P, and NASDAQ launched higher immediately. Both the S&P and NASDAQ set new all-time highs. Exacerbating that bullish tone, I’m sure, was a rate cut from the BoE, an increase in Japan’s QE (of ¥4.6 trillion), another lending initiative in China, and some decent – at least on the surface – earnings releases. This time the significant earnings news was from Priceline, where a larger than expected increase in travel bookings and subsequent earnings sent its shares to about a 4% gain. Even so, the gain in US stocks was not that impressive. As the overall earnings picture continues to ratchet down, many worldwide stock indices and U.S. broader market stocks are going absolutely nowhere. European banks in particular are showing tremendous weakness. S&P earnings estimates for this quarter (in the latest week) were lowered once again by about 3.2%.

Away from stocks, fixed income was marginally weaker, oil managed to stay above $40/bbl, and the dollar was fractionally higher at the expense of the metals (gold fell 1.14% to silver’s 3.09%). Aside from this, I really don’t think there is much else to say about the trading action – other than that stocks now appear to be grinding, not gapping, higher, while defensive assets such as the metals have been loath to relinquish any of the technical high ground. Next week we have very little in the way of corporate or economic news hitting the tape as we enter the “no news period.” In such times bulls have been known to game stocks higher – but given the advancement we’ve seen in the major indices thus far, I doubt that they have much gas left in the tank to fuel such shenanigans.

Best Regards,

David Burgess

VP Investment Management

MWM LLC