Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stimulus – Not So Stimulating

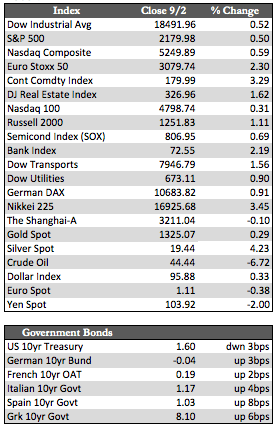

Overseas and US stock markets were a bit stronger this week, with most indices behaving as if new highs will soon be realized, as the bulls continued to feed on the supposed benefits of negative interest rate policies (or “NIRP”). Of course, this years’ bond bull has been great for stocks, but the jury is still out on just how great they really are for the economy. Growth in consumer spending spiked in April, but then tapered off rather quickly back to a rate below that of 2015 levels – even as rates continued to decline all the way into mid-July, where they now appear to have stalled out (for now). All that is to say, we may be in the midst of a “liquidity trap,” as I have stated here before, (the case where lower rates fail to stimulate growth – i.e. China), but to be sure, more data will be needed before a solid conclusion can be reached along those lines.

That being said, the news in August has gone a long way to suggest that we are in fact in a liquidity trap, as the traction we’re getting off the lower rates is proving to be very short lived. Auto sales have disappointed (Ford’s sales fell 8.4%), ISM Manufacturing dipped to 49.1 (a recessionary level), retailers continue to miss on estimates (latest was Costco), and non-farm payrolls registered 151K (180K was expected). Again, this hasn’t put much of a dent in the bullish tone, as stocks have defied all sorts of gravity, but I suspect, if this deceleration in the economy continues, third quarter earnings will present unexpected challenges to the current euphoria in equity markets.

Away from stocks, Treasuries essentially moved sideways, the US Dollar was fractionally higher while the metals stabilized following the jobs report. Oil took it on the chin, with a 6.8% drop, as I believe supply issues still hinder progress in that market. Other than that, there really isn’t much to report. Though it may be important to note that we are now entering into what has been in the past a seasonally strong period for the metals. Given that the most recent economic data has tipped in favor of a more dovish stance at the Fed, I’m inclined to believe that history stands a good chance of repeating itself.

Away from stocks, Treasuries essentially moved sideways, the US Dollar was fractionally higher while the metals stabilized following the jobs report. Oil took it on the chin, with a 6.8% drop, as I believe supply issues still hinder progress in that market. Other than that, there really isn’t much to report. Though it may be important to note that we are now entering into what has been in the past a seasonally strong period for the metals. Given that the most recent economic data has tipped in favor of a more dovish stance at the Fed, I’m inclined to believe that history stands a good chance of repeating itself.

Best Regards,

David Burgess

VP Investment Management

MWM LLC