Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Believe It or Not, Mr. Market Half Expected a Rate Hike

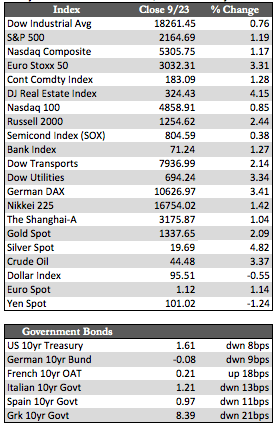

Fed and Bank of Japan policy meetings took place this week. From what I could tell, there were no major changes. The Fed chose to keep rates unchanged and delayed a rate hike decision to December. Paradoxically, it continues to insist that the economy has shown “definite signs” of improvement. The BoJ made a decision motivated by concern over the state of bank profits. It decided to use its 10-year Japanese government bond (JGB) as its new inflation gauge, with a target of zero to start. This action brought the yield on 10-year JGBs up from negative 30 basis points to -.05, at last read. Both central bank decisions were considered to be bullish for stocks globally. Indices around the world added between one and three percent. The Dow in particular tacked on about 300 points, and the NASDAQ set a new high by the end of Thursday’s trading session.

Of course, the policy decisions had the customary effect of “floating all boats.” Fixed income both here and abroad rallied smartly, along with the metals and oil, while world currencies remained somewhat range-bound. During trade on Friday, fixed income, gold, and the dollar held steady in light trading. Stocks and oil gave back a portion of the week’s gains, as Apple’s iPhone 7 sales may disappoint and OPEC stalled on an agreement with Iran over a production freeze.

Of course, the policy decisions had the customary effect of “floating all boats.” Fixed income both here and abroad rallied smartly, along with the metals and oil, while world currencies remained somewhat range-bound. During trade on Friday, fixed income, gold, and the dollar held steady in light trading. Stocks and oil gave back a portion of the week’s gains, as Apple’s iPhone 7 sales may disappoint and OPEC stalled on an agreement with Iran over a production freeze.

In parting, I’ll share some thoughts, at least from a trading perspective, regarding the market’s reaction to the Fed’s decision not to raise rates. Because the rally we had was rather sizeable across the board, it occurred to me that traders may not only believe that a rate hike (or tightening in general) is possible, but may in fact be warranted. It could be because actual (not core) inflation is running above a two-percent pace, the US stock market is overheating, or, in this instance, negative rates have had such deleterious effects on bank profits abroad. Whatever the case, it’s the first time in a while that I’ve seen the markets take the central banks and their tightening bias seriously.

Best Regards,

David Burgess

VP Investment Management

MWM LLC