Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Another Close Call

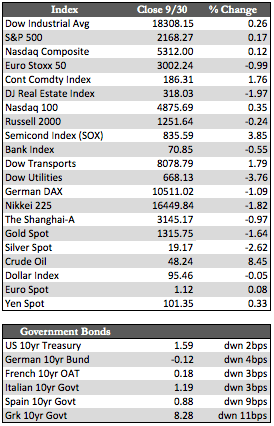

Once again any bearish news this week appeared to matter little to US stocks. The lure of Fed speakers, an OPEC production cut, and month-end performance gaming helped equities muscle through what was a highly volatile week to about a half a percent gain. Of course the volatility derived from the fact that Deutsche Bank was having trouble with the idea of paying a $14 billion settlement to the US Department of Justice (over mortgage fraud dating back to 2008-09). This had equity markets reeling for a time, as the Dow lost nearly 200 points in short order around midday Thursday. Those losses quickly reversed (at least in the US) the next day, when the powers that be reduced Deutsche Bank’s fine to $5.4 billion. Problem solved. Still, the market got a pretty good scare over what amounted to an $8.6 billion differential, which in the grand scheme of things shouldn’t be a big deal given today’s dollars. But the episode indicates that foreign bank liquidity is far more of an issue than the latest ECB stress tests have indicated – surprise, surprise.

Away from stocks and the DB debacle, the action in fixed income was relatively benign as Treasuries lost a tiny bit of ground. Oil spiked for about 8% on a 750,000 bbl/day OPEC production cut, the dollar was unchanged, and the metals, still fixated on a possible Fed rate hike in December, settled back nearer to their 100-day moving averages: gold lost 2.58% to silver’s 2.66%. That said, the metals don’t seem to be “going down” very well. I take that to mean they are ready to move higher, provided the psychology pertaining to the economy and the Fed were to change. Given recent developments (especially abroad), this could happen at any time.

Before I sign off, I would like to clarify a point that I attempted to make in last week’s recap regarding the state of Japanese banking and the BOJ’s decision to maintain a rate of zero on its 10-year government bond. I believe the BOJ has come to conclude that it’s not possible for the country to allow borrowers (in long-term obligations) to refinance at a negative rate without straining the BOJ into some hyper-inflationary monetary policy. The BOJ would obviously be paying borrowers to borrow in theoretically infinite amounts. In any case, I am harping on the issue because it’s another clue that we are operating within “end game” dynamics (loss of control/effectiveness) in this latest monetary cycle.

Best Regards,

David Burgess

VP Investment Management

MWM LLC