Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Bond Markets Wrestle with QE Prospects

Overseas and U.S. equity markets finished the week essentially unchanged, despite the many efforts to spin this latest quarter’s worth of data into something much better than it really was. However, I won’t spend a great deal of time today delving into individual earnings reports. Instead, I hope it will suffice to say that corporations, for the most part, were successful at this quarter’s numbers game through the use of cost cutting (restructuring), leveraged acquisitions, and/or share buybacks to obfuscate what would otherwise have been an intrinsically dismal period for profits. This is not to rule out the few that did impress (e.g., Google, the financial sector), but I believe the market will be faced with two important questions as we move forward from here. First, can the growth in leverage be sustained given the disruptions we’ve seen in fixed income (globally), and second, have stock prices peaked in terms of their valuations?

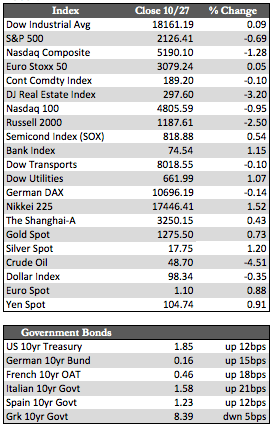

Fixed income markets lost ground again this week as rumors of taper talks circulated in Europe. I have no idea if these talks have really taken place or not because central bank officials (e.g., Mario Draghi) have denied them, but I do know how badly negative interest rates brought on by QE have weighed upon bank earnings in the region and elsewhere. In fact, it wouldn’t surprise me if bank officials are the ones spreading the rumors in a deliberate effort to steepen the yield curve and increase profitability. What’s ironic about the situation (and perhaps an indication that this cycle of monetary easing has ended) is that a steeper curve, entailing higher long-term rates, would essentially crush economic growth. You can check the box scores for the rates, but I think it’s important to note that a 16 basis-point change in the German 10-year Bund may not look like much to us today, but in percentage terms the change is extreme.

Fixed income markets lost ground again this week as rumors of taper talks circulated in Europe. I have no idea if these talks have really taken place or not because central bank officials (e.g., Mario Draghi) have denied them, but I do know how badly negative interest rates brought on by QE have weighed upon bank earnings in the region and elsewhere. In fact, it wouldn’t surprise me if bank officials are the ones spreading the rumors in a deliberate effort to steepen the yield curve and increase profitability. What’s ironic about the situation (and perhaps an indication that this cycle of monetary easing has ended) is that a steeper curve, entailing higher long-term rates, would essentially crush economic growth. You can check the box scores for the rates, but I think it’s important to note that a 16 basis-point change in the German 10-year Bund may not look like much to us today, but in percentage terms the change is extreme.

Away from stocks and bonds, the dollar was a bit lower and the metals were a tad higher, with gold adding 0.73% to silver’s 1.19%. I believe the FBI’s reopening of the case against Hillary Clinton had great influence over how the metals finished the week, but the jury is still out on how the metals and/or the broader markets will behave as we get closer to year-end, where performance gaming has a tendency to rule in spite of the aforementioned fundamental issues. Nearly every asset has performed fairly well this year, perhaps with the exception of European stocks, so in that regard it is hard to imagine that much “rotating” will be seen. On the other hand, now that stock prices reflect all that is right with the bullish case, it would not be surprising to see some sort of dislocation, as I have mentioned – albeit prematurely – before.

Best Regards,

David Burgess

VP Investment Management

MWM LLC