Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Stocks Slow with Bonds in View

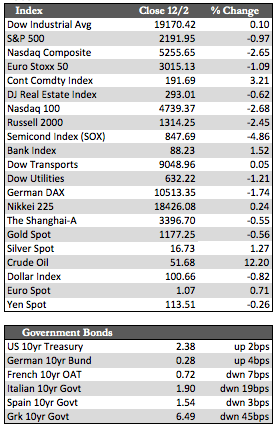

The post-election upside momentum in stocks began to tire this week. Price action across indices produced mixed results amid lower-than-average trade volume. Still, the Dow managed to eke out a small gain to a new all-time high as traders continued to favor industrials positioned to benefit from Trump’s proposed spending initiatives. The tech-heavy Nasdaq retraced to below near-term averages on predictions that Apple iPhone 7 sales (or tech demand in general) would fall short of expectations through the holidays. Surprisingly, the less-than-stellar 178,000 non-farm payroll figure released today didn’t spark the usual “bad news is good news” rally in stocks, as the chances for a Fed rate hike by Dec 14th remained unchanged at 100%. The OPEC deal is also having some effect on stocks, given that it will ostensibly remove approximately 1.2 million barrels from the market on a daily basis. Again, as I mentioned last week, the sharp rise in rates across the entire Treasury curve is the factor that (if this week is any indication) will eventually bring the equity rally to an introspective halt.

Of course, when I say this about the bond market, it is at the moment a speculative observation. The backup in the bond market(s), as steep as it may be, hasn’t thus far departed from the norm. In 2013, for instance, the 10-year Treasury yield tacked on about 140 basis points from the lows that year into late December (similar to this year’s 110 basis point move). We may be destined to repeat a similar narrative with respect to the bullish market action in stocks, but I have my doubts. The difference is that distaste for quantitative easing is growing, and is certainly now more apparent. Evidence to that effect occurred Thursday morning when the European bond market (and to some degree stocks) backed up on news that the ECB intended to extend its QE program another six months beyond March of next year.

Of course, when I say this about the bond market, it is at the moment a speculative observation. The backup in the bond market(s), as steep as it may be, hasn’t thus far departed from the norm. In 2013, for instance, the 10-year Treasury yield tacked on about 140 basis points from the lows that year into late December (similar to this year’s 110 basis point move). We may be destined to repeat a similar narrative with respect to the bullish market action in stocks, but I have my doubts. The difference is that distaste for quantitative easing is growing, and is certainly now more apparent. Evidence to that effect occurred Thursday morning when the European bond market (and to some degree stocks) backed up on news that the ECB intended to extend its QE program another six months beyond March of next year.

In any case, as I have said before, the near term could, and most likely will, be dominated by year-end dynamics. Stocks could see a performance-gaming rally into year-end following a brief consolidation that has a tendency to occur within the first two weeks of December. Under such conditions, the dollar would remain strong and the metals weak, though recent trends in inventory levels of gold at the COMEX depository suggest that buyers are preempting what should be a turnaround for the metals as the optimism surrounding Trump’s plans begins to level out in line with financial reality.

Best Regards,

David Burgess

VP Investment Management

MWM LLC