Here’s the news of the week — and how we see it here at McAlvany Wealth Management:

Inconsequential Dow 20K postponed by Fed…

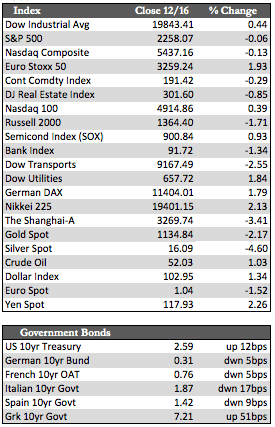

Early in the week it looked as if stocks were on course to break the Dow 20,000 mark, and with relative ease, until the FOMC meeting on Wednesday, where investors then had to digest the meaning behind a 25 basis point rate hike (now @0.75) and a more hawkish forecast for rate hikes in 2017. Initially, stocks didn’t take the news very well, as the Dow lost a little over a half a percent. From then on stocks muddled around, trying to regain their momentum, but to no avail, as only the Dow and the Nasdaq 100 finished with minor gains by the close on Friday. (See the scores). Some attempted to blame the weakness in stocks on an increase in geopolitical tensions with China (upon the seizure of a US Navy drone off the Philippine coast), but I will just say that with central banks in a mild retreat on QE, as we saw with the ECB and the Fed, stocks in an extremely overbought condition, and bond rates in flux – stocks at the very least are/were set for some profit taking anyway.

Aside from stocks, US fixed income markets were softer, as the 30yr Treasury yield rose to a new interim high of 3.18%, while the yield on a 30yr fixed mortgage spiked to 4.18% (that’s 86 basis points higher than the 2016 low). That rise in rates, as I have said here before, should begin to have an impact the economy, and by the looks of it, this may have already begun, as US Housing Starts tumbled 18.6% in November (US mortgage refinance index is also off 50.0% from the 2016 highs). In any case, it’s just a few data points worth of proof at this point, but it’s something I’ll be watching as the data pours in over the next few months. But the housing information may help explain why gold and silver stabilized and the Dollar came off of its highs on Friday, as any weakness in the economy is sure to bring back talk of QE – regardless if it works or not.

Aside from stocks, US fixed income markets were softer, as the 30yr Treasury yield rose to a new interim high of 3.18%, while the yield on a 30yr fixed mortgage spiked to 4.18% (that’s 86 basis points higher than the 2016 low). That rise in rates, as I have said here before, should begin to have an impact the economy, and by the looks of it, this may have already begun, as US Housing Starts tumbled 18.6% in November (US mortgage refinance index is also off 50.0% from the 2016 highs). In any case, it’s just a few data points worth of proof at this point, but it’s something I’ll be watching as the data pours in over the next few months. But the housing information may help explain why gold and silver stabilized and the Dollar came off of its highs on Friday, as any weakness in the economy is sure to bring back talk of QE – regardless if it works or not.

Again, I don’t have an exact road map for how the markets will behave from here, as year-end adjustments will dominate the trading action into the close December 30th. But I will speculate that as long as the bond market stays in revolt (to the Fed and Trump), stocks will be “drawing dead” so to speak in terms of secular economic growth. Within that context, I would continue to expect the metals (and the miners) to react positively – as was the case today.