Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Onus on the Fed

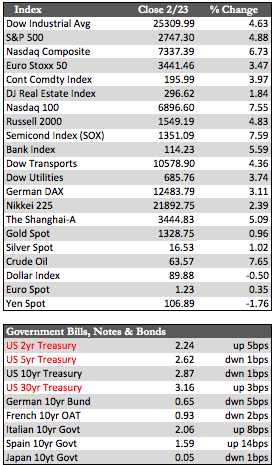

To start the week, Walmart reported that its margins were under pressure due to its intensifying price war with Amazon. That shouldn’t come as a surprise since Walmart has been losing market share to Amazon for several years. Accordingly, the market reacted in fairly predictable fashion as the Dow (of which WMT is a member) proceeded to lose about 400 points while the NASDAQ (where Amazon resides) managed to stay green. That dichotomy persisted through about mid-week, at which time bullish sentiment swept all before it and every major index began to move higher. This occurred after Fed governor Bullard made the incredibly dovish remark that “everything needs to be perfect” in the economy for the Fed to raise rates again. Near the close on Friday, both the Dow and the S&P had developed enough momentum to break above their respective 50-day moving averages (for about the fourth time in as many days). However, the advance in each was not enough to completely offset the earlier Walmart effect. The NASDAQ managed a small gain, as it added about a percent.

With respect to the attitude beneath the market action, it’s clear that the bulls do not wish “to go gentle into that good night.” The sharp selloffs seen have been cast aside in exchange for increasingly positive “hype” to lift Mr. Market’s spirits. Of course when all else fails in that pursuit, whether earnings, jobs, Trump’s policy, etc., inevitably the Fed is summoned to make everything right with the world. That’s exactly where I believe the focus of the markets is now. With the dip in mortgage applications (-6.6%) and existing home sales (-3.2% in January) to within striking distance of three-year lows, I believe it will be increasingly difficult to say that higher rates are a healthy function of growth as we proceed from here. Said a different way, the post-storm boom is starting to fade, and with it potentially, the Fed’s hawkish stance. What effect this expectation will have on stocks in the near term is anyone’s guess. Usually it produces a bullish bent. In that regard however, I would say that the upside potential is limited. We’ve been pushing this thematic, albeit covertly, for well over a year.

With respect to the attitude beneath the market action, it’s clear that the bulls do not wish “to go gentle into that good night.” The sharp selloffs seen have been cast aside in exchange for increasingly positive “hype” to lift Mr. Market’s spirits. Of course when all else fails in that pursuit, whether earnings, jobs, Trump’s policy, etc., inevitably the Fed is summoned to make everything right with the world. That’s exactly where I believe the focus of the markets is now. With the dip in mortgage applications (-6.6%) and existing home sales (-3.2% in January) to within striking distance of three-year lows, I believe it will be increasingly difficult to say that higher rates are a healthy function of growth as we proceed from here. Said a different way, the post-storm boom is starting to fade, and with it potentially, the Fed’s hawkish stance. What effect this expectation will have on stocks in the near term is anyone’s guess. Usually it produces a bullish bent. In that regard however, I would say that the upside potential is limited. We’ve been pushing this thematic, albeit covertly, for well over a year.

As US stocks strengthened, Treasuries under performed world debt – though the losses and gains on both sides of the ocean were rather muted. Treasuries gained some ground in sympathy with stocks later in the week, as a potentially dovish Fed was viewed as bullish for just about everything. Oil climbed back into positive territory on the chart. Gold simply consolidated last week’s gains, yet managed to retain a bullish technical pattern even as the dollar enjoyed a decent rise, that may have some near-term legs to it. Next Tuesday, we’ll hear from Powell in a testimonial address to Congress on matters of finance. He’s expected to speak on the subject of US consumer spending, which softened at the start of the year. During the discussion, I’m sure market participants will be paying close attention to whether or not Powell agrees with Bullard’s stance on rates.

Best Regards,

David Burgess

VP Investment Management

MWM LLC