Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Optimism Wins for Today

Stock market psychology improved incrementally this week. At first it was bank earnings, which were mixed as shares were rewarded for beating already lowered estimates. Then came Theresa May’s Brexit deal defeat, which eliminated the possibility of any temporary economic disruptions. And finally, the Trump Administration and China drew a little closer to a trade truce. It was rumored that Trump may lift tariffs to alleviate economic (i.e., stock market) risk, and China offered to increase US imports by $1 trillion over a six-year period. Nothing has been set in stone yet, and the Trump Administration remains skeptical. For now, though, traders are pleased that both sides are talking.

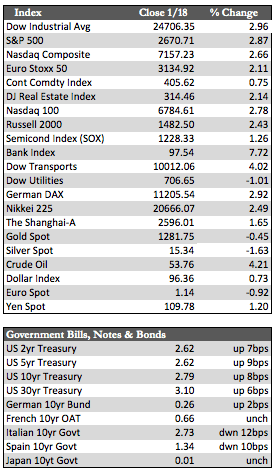

There were other mitigating factors that helped stocks along, such as the Fed’s Beige Book results and Theresa May’s victory over the no-confidence vote. But all in all, the rally this week was ratified by the prospects of a trade deal. The major indices managed to close out the week on a high note with gains of between 2.5% and 3.7%, led by the transports at the high end and anchored by tech at the lower end of that range.

There were other mitigating factors that helped stocks along, such as the Fed’s Beige Book results and Theresa May’s victory over the no-confidence vote. But all in all, the rally this week was ratified by the prospects of a trade deal. The major indices managed to close out the week on a high note with gains of between 2.5% and 3.7%, led by the transports at the high end and anchored by tech at the lower end of that range.

With the partial government shutdown, many of the usual and/or relevant economic data releases have been postponed indefinitely. However, we did get a look at inflation through the eyes of Import Prices (-1.0%), the CPI (-0.1%) and PPI (-0.2%), all of which reflected an economic cooling in December of last year. Of course, Powell has insisted otherwise and tells us to “wait and see.”

Returning to the market action, Treasuries fell as stocks rallied – again. The dollar recouped some of its previous week losses, driven by pure optimism over trade, etc. That held the metals in check, with gold losing about 0.46% to silver’s 1.4%. Crude rallied in sympathy with stocks, and gained about 4.3%. That breathed some new life into the oil patch as the sector gained 1.8% during Friday’s trading session.

As I mentioned last week, with the specter of marginally high interest rates hanging over this market, I expect rallies generated by trade deals or a government re-opening, etc., to eventually be sold. We have already seen some of this behavior on an intraday basis, as most rallies have been met with a fair amount of profit taking. But with more earnings on the way and a possible US government solution in the mix, the potential for game playing with stock prices remains probable, albeit within a range loosely fixed on Dow 25,000. Next week we’ll get an ECB policy meeting, Brexit Plan B (by Monday), China GDP, and a few PMI surveys.

Best Regards,

David Burgess

VP Investment Management

MWM LLC