Here’s the news of the week – and how we see it here at McAlvany Wealth Management:

Another Taste of Stock Market Vulnerability

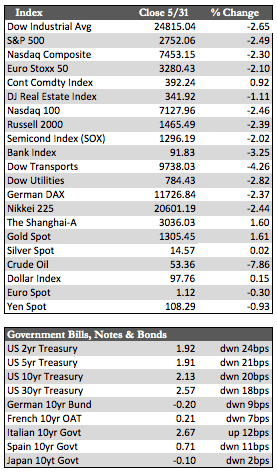

Tariff and tariff threats continued to weigh on US and global growth outlook, and thus on equity markets. Major indices lost between 1.8% and 3.4% on the week. Transports led declines, along with telecoms, energy, financial, and consumer staples. The latter, usually a defensive sector, was hit by spiking corn and soy prices. Flooding throughout the Midwest prevented the planting of approximately 32% of crops ahead of the June 16th deadline. Real estate (-1.03%) and tech (-1.2%, buoyed by the NXP merger) were among the best performing sectors, though the former seems strange given that the yield on a typical 30-year mortgage hasn’t moved. It’s debatable whether we’ll see another bounce in housing as we did in back in March when mortgage rates declined nearly 80bps alongside comparable Treasuries.

Treasuries advanced across the curve as investors pursued safe-haven assets with some degree of vigor. Rates declined at a slightly faster pace at the long end of the curve. After hitting a low of about 14bps, the spread between the 2- and 10-year Treasuries closed out the week at about 18bps. The 2-year yield is now 1.96%, which is about 54bps below the Fed Funds target rate of 2.50%. That situation implies that the Fed is once again behind the curve as rates head lower (the Fed chased rates higher last year). In short, it’s arguable that the economy has already seen the benefit of lower rates, which may neutralize the first two anticipated Fed rate cuts.

Treasuries advanced across the curve as investors pursued safe-haven assets with some degree of vigor. Rates declined at a slightly faster pace at the long end of the curve. After hitting a low of about 14bps, the spread between the 2- and 10-year Treasuries closed out the week at about 18bps. The 2-year yield is now 1.96%, which is about 54bps below the Fed Funds target rate of 2.50%. That situation implies that the Fed is once again behind the curve as rates head lower (the Fed chased rates higher last year). In short, it’s arguable that the economy has already seen the benefit of lower rates, which may neutralize the first two anticipated Fed rate cuts.

As economic data continued to be soft, the dollar finally began to roll over from its highs (set this week), and may retest its 50-day moving average of 97.49 as soon as next week. Dollar weakness, stock market jitters, and a drop in first quarter core PCE inflation data (as part of GDP figures) helped the metals rebound from earlier week losses to a gain of about 1.3% for gold and 0.13% for silver. Oil lost considerable ground (-5.66%) in sympathy with stocks (growth issues) and a less-than-expected decline in crude inventories.

May’s stock performance has been the second worst on record since the 1960s, and at this point there’s no telling if most of June will turn out the same. I mentioned last week that stocks could remain weak until we hear from the Fed on June 19th, but as financial conditions worsen with every downtick in stocks, pressure to complete the trade deals should intensify. We could see short-run pops in stocks on any positive developments in that regard. However, longstanding and still prevalent debt market dysfunctions that predate the trade war issues are likely to prevent any real upside momentum.

Best Regards,

David Burgess

VP Investment Management

MWM LLC