More

Presented by Doug Noland since 2012

* * *

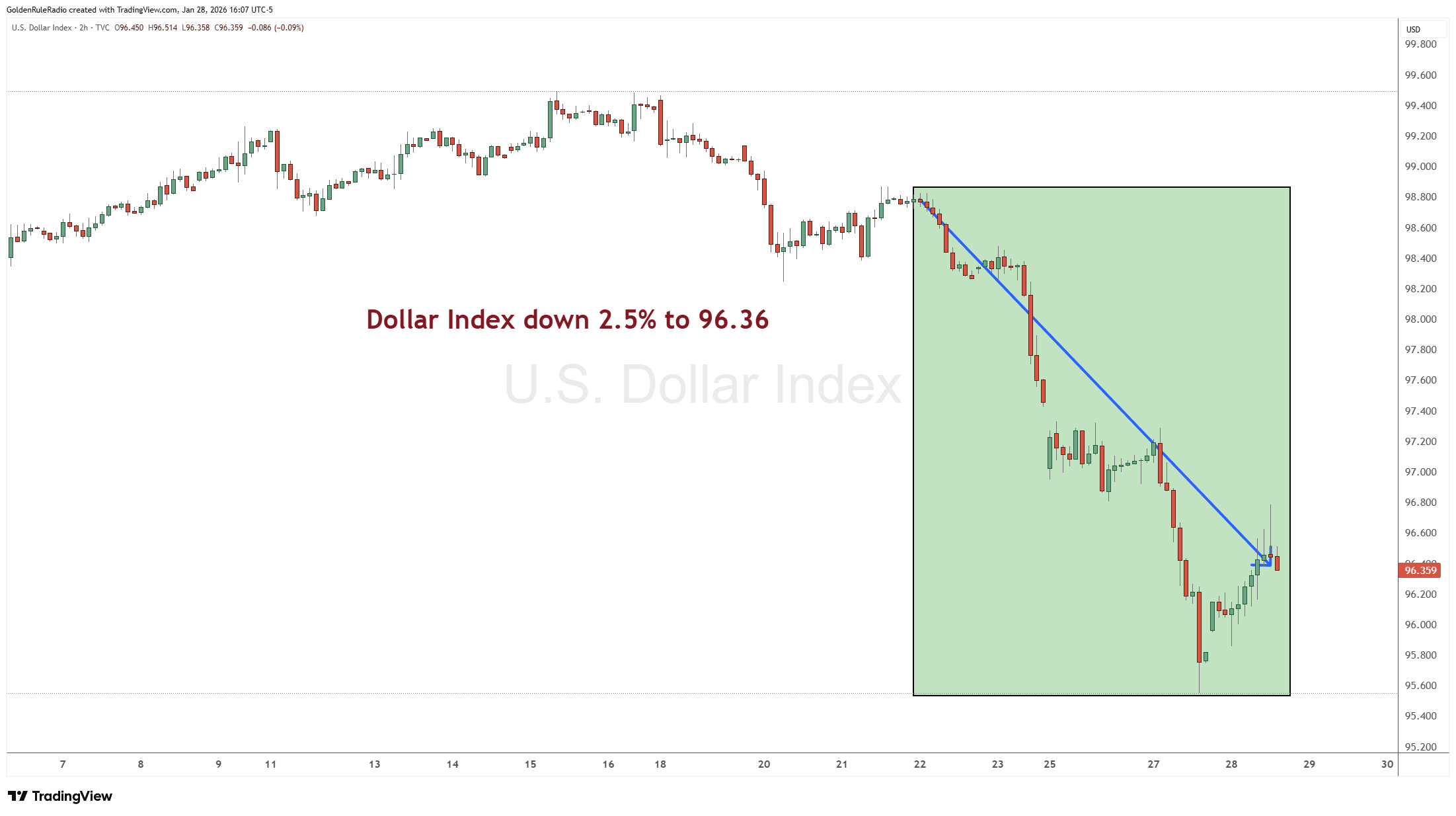

Kevin: Welcome to the McAlvany Weekly Commentary. I'm Kevin Orrick along with David McAlvany. David, on Sunday when we were watching the Super Bowl, I leaned back and I told my wife, I said, "I can't believe it was 26 years ago that we were making comments about how many dot.com ads were on the Super Bowl." At this point, it was AI ads everywhere. David: AI. Oh my gosh. Kevin: It felt so similar to 26 years ago. David: But very different than 2025. It was all crypto. Kevin: All crypto 2025. Ooh— David: Only one. Kevin: —we can talk about that later. David: Only one for Coinbase. Kevin: Yeah. So what do you think about all the AI? So there was anxiety last week and that was specifically where it was. David: Yeah, that and the FAANGs. I think you look at the FAANGs, you look at the NASDAQ 100. They were getting clobbered alongside crypto. The crypto carnage extends into this week with bitcoin remaining in the 60s and the lesser market cap cryptos are also slipping below 50% of their peak values. Bitcoin, we were third quarter last year, 126,000, so about 68,000 now, 62,200 at the low. Kevin: Well, and ethereum's getting hit as well. David: Ethereum from nearly 4,900 to 2,100, and ripple from 350 to 144. Kevin: Wow. David: So the mood has shifted. Speculation in crypto has lost the narrative and lost momentum. And of course it had that momentum up into the second or third quarter of last year. Kevin: Even though Scott Bessent is saying things that are positive from the White House, right? David: Well, absolutely. And clearly, from the Oval Office the White House has supported the efforts, set aside the massive conflicts of interest with Middle East countries investing directly in the Trump-named cryptos. Fabulous, fabulous narrative there. If you want to write some history, it's going to make its way into the history books for sure. So we've got White House support, you've got Wall Street adoption, and you wonder if or when the public throws in the towel. Liquidity dynamics are waning in that space, and you can see it beginning to impact some of the markets like private credit and private equity. And we have not seen a change in liquidity dynamics with corporate credit. That remains fairly robust. The financial market indicators that we look at every week, there's not been a massive shift, not a massive downgrade. With an increase in volatility in equities, in tech, in metals, you're not seeing a significant shift in terms of credit market dynamics yet. Certainly some pressure at the long end of the curve, certainly some pressure with sovereign paper, 10-year and beyond. And a widening between the 2-year and the 10-year in almost every jurisdiction, but certainly in the US too. So there are significant shifts within fixed income, but no real stress points within corporate credit where you are seeing stress points. Again, we come back to crypto. Michael Saylor, his strategy, the company that basically banks crypto, borrows to buy even more. Kevin: A lot of leverage. David: Yeah. It's now underwater. It was last week on its bitcoin holdings. If you look at the cost basis, they're now breathing through a snorkel, so to say. Q4, they reported just over a $12 billion loss. And I think that was for the full year. But if crypto prices don't turn very soon, Saylor will be dealing with the dark side of leveraged crypto treasury holdings. He owns over 3% of all mined bitcoins. And so just imagine a world where you've got forced liquidations. It's not improbable. Kevin: You talk about crypto, and last year we did have a lot of crypto commercials on the Super Bowl. The AI side of things, however, I think the shock this week was how much these companies are spending to show growth. David: Yeah. Worth noting, most of the tech companies are beating earnings. In fact, I think 78% of reported companies have positive results and are beating expectations, and tech companies are leading the pack there. But their share prices are getting clobbed when they're getting to the stage where they're talking about CapEx, where they're spending their money next year. Kevin: How much did you have to spend to make what you're looking like you're making? David: Well, for 2025, there was sort of record breaking. Collectively, the big five announced 650 billion in CapEx for data center and AI development in 2026. And the market is now very unclear as to, does this make sense? They're not seeing returns on that capital from 2024, 2025. And so these big numbers are coming out, and there's a little bit of a indigestion problem. So investors are— Kevin: You're talking about— David: —second guessing it. Kevin: —Google and Amazon and some of these biggies. David: Yeah. Google CapEx was announced 60 to 70 billion over what was expected. So 175 to 185 billion for the year. Kevin: Wow. David: And I think 135 was the number expected. And Amazon was 200 billion in CapEx for 2026. That's not the only spaces that are seeing pressure. Leveraged loans, private credit, as AI and tech are under pressure, these guys are kind of being sucked into the vortex too. And you're talking about non-publicly tradable junk debt of the lowest possible quality. Kevin: No buyers. David: Nope. And they'd rather just hold the portfolios and they can mark them to, instead of market, because they're privately held, mark to make believe. Kevin: Right. Like we did back in 2007, 2008. David: Right. So this is KKR, this is Blue Owl, this is Ares Management, Blackstone, Apollo, Global. Their stocks are publicly traded even if their underlying illiquid assets are not. And the stress is showing up in the performance of those names. Now down 16% to 20% year to date, some of them are off 40% to 50% from their peaks in 2025. So similar to crypto in terms of performance. The narrative for private equity, the narrative for private credit, is fading fast. You get UBS expecting default rates in private credit to move as high as 13% this year, at least according to Bloomberg. Kevin: Well, and you talk about narrative, and the narrative has been that AI's to the moon, but we also have seasonal fluctuations as well. Like the stock market in February is not usually a stellar place, right? David: Yeah. February is typically the second weakest month of the year for equities. And we've already had a rocky start in January. Q1, again, starting out on the rough side. So with 2025 attention gravitating to AI and tech, it's no surprise that we have the relative value rotation in full swing. The money's coming out of those spaces—AI, tech—and towards the Dow Jones transportation average, Dow Jones industrial average. Your basic big multinationals which have not been priced for an imaginative world, the world of tomorrow, a world where, again, it's sort of infinite growth, infinite productivity gains, and frankly, near infinite pricing. There's no cap on a market cap for a company that you attach unbound imagination to it and then come up with a price. Kevin: Yeah. It was interesting, too, to see that these AI commercials were also trying to mock the fear of AI. And I'm wondering if that also isn't to just bolster the narrative at this point, because the money has to continue to flow in. They're not making as much as they're spending is what you're saying. David: Yeah. There's a fundamental case to be made contrary to the positive narrative. Ultimately, these investments have to make money. If they don't make money, the theory is, you don't know who's going to win, so you throw money at all of them and the winner will give you such a great return it doesn't matter how much you lose in the others. But there is, beyond the fundamental case, if you're looking at the technicals in the market, NASDAQ 100 flirting with a technical breakdown at its 100-day moving average. It actually broke below that last week and is trading just slightly above it this week. If it fails to hold, you're talking about a major top being put in. So again, sort of the tech theme and the tech bias and the flows, foreign capital flows into the US predominantly going into tech. This is something that if it reverses anytime soon, could get real interesting real fast. Kevin: We could be talking about tech, we could be talking about AI and a person listening might say, "Well, I don't really own any tech or AI." But the problem is a broad market selloff. The market's been buoyed by these companies, the top seven, for years, the last couple of years. David: Yeah. Well, and that's the thing, the importance of the narrative. The AI narrative, like the crypto narrative, is losing steam. And these were successive motivators for animal spirits through 2024, through 2025. Kevin: Momentum. David: And without boundless speculative energy in the market, a broader selloff becomes more likely. I mentioned corporate credit. If that holds together, the equity markets can, too. So as goes— Kevin: Liquidity. David: —corporate credit and the ability for corporations to continue to fund themselves, ample liquidity, they'll be fine. But as I read about some major Wall Street firms—PIMCO, Blackstone, Bridgewater—they're all refashioning their portfolios in preparation for another round of inflation. They're betting that rates go higher, not lower. And if that dynamic hits the Treasury market, I think you've got a domino into corporate credit, and then ultimately a domino into equities eventually. Maybe they're wrong, rates do go lower. But anticipation of higher rates of inflation leading to higher interest rates are what you see in their portfolio shifts right now. Kevin: Okay. So this is a Kevin asking you a Kevin question. Okay. Kevin Warsh basically has already committed to lowering rates on the fed funds. How much control does he have? I mean, if everyone else is betting on higher interest rates, how does the Fed and how does the Treasury, how do we not have higher interest rates? David: It's such a funny conversation last week in a press meeting with Bessent. Will the Trump administration sue Warsh if he doesn't adequately lower rates? Kevin: Oh, wow. David: And Bessent kind of sidesteps the question is like, "Well, that's for the White House to decide." As in "maybe." Kevin: Wow. David: Maybe. Kevin: When would a Fed chairman start to get sued by the White House? David: It's a bizarre world. Kevin: Wow. David: Yeah. Warsh is committed to lower the fed funds rate, but he's also well publicized in commenting on shrinking the Fed balance sheet, which adds to an oversupply of debt instruments. In theory, that pushes up longer term rates. What will the markets look like if they prepare for his coronation in May, trying to anticipate, "Okay, how fast will he shrink the balance sheet? What's the impact for the yield curve? Do we see a continual stretching of the difference between the 2-year and the 10-year Treasury?" I mean, it's already as stretched as it's been going back to 2022. And so I think that number is probably an interesting tell. 2-year, 10-year spread. Kevin: So "buy the rumor, sell the news" is going to be interesting in May. Right? David: Yeah. Kevin: Yeah. David: He may want to shrink the Fed balance sheet, but I wonder if such a feat is possible in the context of runaway Treasury issuance. We've seen this now for a couple administrations. This is not just the 2.32 trillion that was added to the debt last year. We had 8 trillion added by the Biden administration. Kevin: Right. David: We also had 8 trillion added by Trump in his first round as president. So he started adding it up. Kevin: Trump is moving a little faster now, isn't he? David: Right. I mean, he's single-handedly responsible—or his administrations have been present when 10.23 trillion in debt has been added. We're not slowing the pace. So again, how do you shrink the balance sheet and take that supply, bring it to market, when you're already over-supplying the markets? One thing that happens in that context is rates rise. So granted it may be further out on the yield curve and maybe they're not worried about that. But I'm concerned that you start to pressure rates at the long end of the curve, even the middle of the curve, and it has a major impact on corporate finance. This is where you're constantly rolling out— Kevin: Which is the duct tape that's holding everything together, right? David: As goes corporate credit, so goes corporate equity. How realistic is it for him to lighten the Fed balance sheet in the context of an oversupplied Treasury market? I don't think it's possible. Kevin: Well, you said privately there's basically preparation for higher inflation, or at least inflation sticking where it is. Gold, through all this volatility over the last couple of weeks, it's doing really well. I mean, what's your thought on gold? Because gold also is a signal as to what we see coming. David: There's an interesting article in the Wall Street Journal on sort of anticipating higher inflation rates this year. And I printed it off, I read it, and I was completely disappointed. Well, first part of the year, that's when people are raising their prices. And then they mentioned Cheetos and Pepsi. And you're going to see a decrease in prices because they want to recapture some market share. They're realizing that consumers are being priced out of Cheetos and things like this. But their main point was, if you're servicing a pool, if you're going to increase rates, you do it at the beginning of the year and then that's where you see an inflation. So they're looking at seasonality as a factor for inflation. And maybe that is a factor. Kevin: But you're talking more systemic. David: Yeah, exactly. Kevin: Not Fritos. I mean, Fritos went up when, I mean, if you remember toilet paper Fritos and hand sanitizer for COVID. I mean, you couldn't find Fritos. That was almost a tragedy. But going back to gold, I mean, gold is still signaling that there's a long ways to go in this dollar debasement. David: Well, gold held up very well last week. Silver remains under some pressure. And this is very interesting. The miners are holding their own. And I think part of that is coming into Q4 reporting, year-end reporting. So we'll cover this maybe at the end of today's comments. Kevin: Okay. Well, one of the questions that a lot of people have is real estate's been high for a long time. Commercial real estate, part of the McAlvany Wealth Management platform is to sometimes have specialty real estate, and I don't think you have any in there right now. David: No, we manage basically four portfolios inside of one. And so specialty real estate is one segment. Global natural resources is another. Infrastructure is the third, and then the precious metals miners are fourth. So we're diversifying across 50 or 60 names, and that specialty real estate segment we left completely. Kevin: You're not seeing any bargains. David: No. And things are getting to bargain levels. The question is, is there catalyst for growth? Because we can have that portion of the portfolio in short-term Treasuries earning 3.5%, 4%, depending on what the rates are, not take the risk. And what we have in the last three years done is sidestep a 50% decline in— Kevin: In real estate. David: —in quality companies, but they are levered plays on real estate, and very sensitive to interest rates. And as interest rates have come up, now all of a sudden their growth model is somewhat impaired. So we need to see some sort of catalyst for growth, not just bargain hunting. They would be still in the category of value trap. But, yeah, I mean, if we wanted a reestablished basis today, we'd own twice the number of shares for the same dollars allocated. Still, it's not interesting enough. We can look at the reward side of the equation. Dividend yields are up because of the diminishment in share price. So all of those factors are attractive, except we can't get our arms around the risk side of the equation. And this is where, again, if there's pressure on rates, then you can continue to see balance sheet pressure for these levered real estate companies. Kevin: So what you're seeing is a continued selling of real estate at this point. David: Yeah. And even this week, real estate selling steep discounts, Brookfield Asset Management let go of a Chicago office, 87% less than the original price paid back in 2018. 306 million was the purchase price. If I did the math right, just under 40 million, 39 and change. Yeah. I mean, that's— Kevin: Well, that's a fair amount. David: Is it a bargain? Assuming that you can fill it—and one of the reasons why it's cheap is because they've got a 53% occupancy rate. So it's not like an at-capacity— It's got an issue, and the only way you can adjust for that issue is to discount the price. We continue to see the discounting occur in commercial real estate. Kevin: Well, and the beauty is when that discounting looks like it's finished, you're going to have some bargains that you can buy. David: Absolutely. Kevin: Yeah. Well, I'm going to shift gears here, Dave. One of the things that's been distressing to me over the last week or so especially, but last few weeks with the Epstein files, is the United States should be setting the tone for ethics and morality and protecting child trafficking, that type of thing. And yet at this point, it seems like the United States—the administration—is trying to make it look like it's really no big deal, and it's Europe and some of the other countries that I honestly don't think of as moral or ethical beacons for the world, they're the ones right now that are raising Cain. David: Yeah. And what is at stake ultimately is an institutional loss of confidence, whether that's because you take a reputational hit, the FBI, the DOJ, the CIA, but the Epstein files are really under minimal scrutiny here in the US. And so you could say failure to execute on Pam Bondi's part. Kevin: Which is very disappointing. David: So thanks, Pam. Thanks, Donald. So in Europe, it's the microscope which is out, and we're already seeing heads rolling. Communications, shared communications in these Epstein files, past relationships, they're forcing resignations and the ouster of friends that spent a good bit of time on Pedo Island. Kevin: Yeah. Well, and a lot of these people should be spending time in jail, not just losing their position. David: Yeah. I mean, Bondi and Trump, they're showing little interest in the trafficking and abuse of children. And these are powerfully connected, previously untouchable elites that are coming under pressure. And it is, it's overseas. The Swedish UN official, Joanna Rubinstein, she resigned. The Norwegian diplomat, Mona Juul, was fired. These are not all men, by the way. So that's an interesting twist. Norwegian chair of the Nobel Prize Committee, he ran the Nobel Prize Committee from 2009 to 2015. Kevin: Is he the one who gave Obama his Nobel Peace Prize? David: Yep. And he was an island regular, but yeah, it was also the man that awarded Obama the Nobel Prize. He's under pressure. So you've got Lithuania launching human trafficking probes. You've got Poland, France, and the UK. There's pure irony in the UK looking at this stuff. Launching investigations into officials, any officials that have ties to Epstein. Kevin: You know what's amazing, though, it's coming out that Epstein actually was seeking legal counsel on how to legally run this totally illegal operation. David: It reminds me a little bit, you go back to the nuanced conversations that Bill Clinton had when he was at the Starr Commission. I think it was— Kevin: The Kenneth Starr, wasn't it? David: Yeah. Yeah. We're talking about the definitions of things and looking for technicalities. And Kathryn Ruemmler, she's now chief legal officer and general counsel at Goldman Sachs. That's her role today. She was Obama's White House counsel. And according to the latest Epstein documents released, providing legal advice to Epstein on sex with minors. Kevin: So she was Epstein's legal counsel on that as well. David: Well, at least a friend in the Rolodex that you could call when you're looking for these critical distinctions. Kevin: That's disgusting. David: Trump has a choice to make. He can either prosecute offenders, or I think he can face the wrath of constituents. And you can't simply turn the page, as much as he'd like to. The magnitude, the breadth across the American governing class, and you're talking about national intelligence, you're talking about the banking community, the finance community, venture capital. I mean, come on. Kevin: What does he know that will break? What does he know that will break if this breaks? David: I think he's doing a solid for a lot of friends, a lot of business associates, a lot of people who— Kevin: He's protecting the swamp again. David: He had the opportunity to drain the swamp, failed to do that in his first administration. And this is the risk he's facing. The wrath of his constituents will come out if he ends up protecting, and he has a choice to make. He may continue to protect the swamp, but come on. I mean, how is Lutnick still in office as- Kevin: I mean, how is Lutnick still in office as Commerce Secretary? Is the point that the rot is so broad and runs so deep that to expose it would fully undo the upper echelons of US leadership? I would see that as a net positive. But again, I'm kind of in favor of draining the swamp. Kevin Orrick Wasn't there a movie about the elites having something like this going on called Eyes Wide Shut? I mean, maybe that's what we should call this, not the Epstein files, but eyes wide shut. David: Yeah. If you want to reestablish trust, don't defend your eyes wide shut crowd. Don't do that. Don't do that. Kevin: Right. That's not who voted him in. David: No, that's right. So, maybe Europe will shine a beam of truth into the misconduct of the global elite, maybe, because Bondi and Trump are at this point unwilling to lead. And I hope they flip the script on that. Maybe the only thing Trump will understand is a beat-down in the midterm elections, because you're talking about fly-over America may just be disgusted enough through this whole episode to be a no show. Tired, perhaps, of watching the reality show Trump is sponsoring from the Oval Office. Kevin: So, how is it that Europe is the one who's actually crying foul right now? David: Yeah, it's an interesting question. Like what's in it for them? I think it is probably not for moral and ethical reasons. Kevin: Right. You think it's a power shift there too, possibly? David: I think it's the power play. And it destabilizes the Trump regime to some degree, or at least puts pressure on friends of friends. And as far as we can tell, it's not Trump who's under the microscope here. So, I really don't understand why he's putting up as much muss and fuss as he is. Even this last week— Kevin: He wants you to focus on healthcare instead, Dave. David: That's what he said. He said, "I think it's time now for the country to get on to something else like healthcare, something people care about." Kevin: Pay no attention to the man behind the curtain. Don't look at my left hand while I'm showing the right hand a magic [unclear]— David: And I think he's missing the point. This isn't about him. It's not about a big reveal as to Trump misdeeds. It's about our society and whether rules apply to everyone. If money and status ensure that you are beyond or above the law, we're flirting with end-of-empire dynamics. I mean, the rule of law is a critical foundation we can't afford to lose. If you look at how we invest— And one of the things that we do is we look at tier one, tier two, tier three, tier four jurisdictions where we know that contract law is going to be respected, where property rights are going to be upheld. And if you begin to in any way erode the rule of law, what you are doing, as I said earlier, you're ultimately compromising institutional integrity. Kevin: When you interviewed Hernando De Soto, he talked about the contract law being so critical to the Western world and the prosperity of the Western world. That was fascinating. But Dave, there's another book and I've recommended it again to several younger guys here at the office that didn't have a chance to read it, but it was Frédéric Bastiat's The Law that was written back in the 1850s. Again, every listener should read at least the first five or six pages of that little book that was written by the Frenchman about what law is for and how it can protect you, but— David: And what it's not for, because he also raises the possibility that the law can be used as a cudgel to abuse. Kevin: Right. Lawfare. David: Lawfare. Yeah. So, going back to DeSoto's book, trillions of value can be unlocked and a middle class can thrive if they can establish clear title to their property. And in so doing, be able to leverage that, to be able to start businesses and allow free enterprise to operate in a way that is very, very much inclusive across the socioeconomic spectrum. Again, it hinges on the rule of law. Kevin: The rule of law. David: And one aspect of it. Kevin: Exactly. Exactly. Well, I think the subtitle of his book was Why Capitalism Works in the West and Nowhere Else, and it had to do with the rule of law. But let's go back to healthcare because I don't want to diminish the fact that Trump is saying let's focus on healthcare. I think most people would like to see healthcare solved. David: Yeah. I think this is certainly beyond the issues with healthcare, which if you wanted to look at it through the lens of tort reform and what it costs to deliver healthcare versus what it costs to ensure against lawsuits, I mean there's certainly reform. I think reform needed. Where I think you're aiming is with reference to the K-shaped economy, where you've got those at the top who are doing very well, those at the bottom who are not. And healthcare is one of those costs that if you do have health issues or you're just trying to ensure against the possibility of that in your life, those costs are really not affordable. Kevin: When you talk about K-shaped economy, the absence is the middle class. So, there's the low, there's the high, but middle America right now does care about healthcare. They're basically speaking up—that, and the price of food. David: Pew Research did an interesting— They do samples all the time, and it does suggest that healthcare matters to the middle class, just not in the same way that it does to Trump as sort of a redirection of attention. Three in 10 Americans rate economic conditions as excellent or good. It's 28%. So, that's the top end of the K-shape. Kevin: I thought Trump said it's never been so good. David: Well, seven in 10, 72%, rate them as fair or poor, and the majority say that they are concerned about the cost of healthcare and food and consumer goods, to which Trump responds, and he said this this week, "I think we have the best economy maybe we've ever had. 50,000, the Dow hit." Most people felt if I could do that in my fourth year, well, we did it in my first year. Kevin: I love how he measures based on the Dow. David: Right. And if he wants to own the Dow at 50,000, will he equally own the Dow at 25,000 or a more crack up boomy 100,000? I mean, we could get to 100,000. I just don't know what your dollar's worth. I mean, Dow at 100,000— Kevin: Well, didn't he predict 100,000 Dow? David: Yeah. Well, he did. "I'm predicting 100,000 on the Dow by the end of my term," and he may be right with the dollar trading 40% lower, with Starbucks coffee passing the $10 mark. Kevin: What would gold be if we have Dow of 100,000, do you think? David: 25,000? I mean— Kevin: I hope not. Yeah. David: Well, exactly. No one wants to see that. A crack up boom is good for nominal prices of all assets, but it's also the death of our middle class. Kevin: Mm-hmm. It's the middle part of the K. It doesn't exist. David: And I think it's really a generational reset into banana republic dynamics. Desperate masses whose votes are easily collected by exchanging the bare necessities of life. We can provide housing, we can provide food, and you can provide a vote. And that's the nature of a banana republic. Kevin: Can't get bare necessities out of my mind now that you said that. ♫"Look for the bear necessities..."♬ That's right. David: Well, Trump's also talking about a 15% GDP growth. Kevin: Well, you can do that with inflation, can't you? David: You can do it with a lot of debt. Kevin: The Chinese- David: A lot of government spending. Kevin: —printed a lot of money to do higher GDP. David: And that would of course be in nominal terms, 15% nominal growth, not in real terms. So, we could have double-digit GDP growth and still hover in the low single digits net of inflation. And that's what I think, coming back to Blackstone, PIMCO, Bridgewater, largest hedge fund in the world. Why are they preparing for another round of inflation? Why are they positioning their portfolios in TIPS, Treasury inflation-protected securities, and hedging against a rise in interest rates? I mean, if you're going to shoot for a 15% growth rate, you're talking about a red-hot economy, you're absolutely married to a higher inflation rate. Kevin: Well, I wonder if this is going to be the issue in 2028 when we're electing a new president, if inflation's going to be the major thing. David: Right, exactly. I mean, that could well slay the GOP in 2028. Got growth? Yes. Got stock market largesse? Maybe. Got inflation? Well, PIMCO, Bridgewater, Blackstone, they won't be surprised, and I don't think you should be either. Kevin: Okay. So, maybe Trump's legacy might just be the things he names after himself. I mean, airports in Washington DC and I think with Lincoln Center, right? David: Yeah, let's forget the contributions of Dulles. Penn Station is no more. I don't think his legacy will soon be forgotten. Let me say this because certainly the tone's been critical of the Trump administration today. There's some experiments with reestablishing economic vitality in the US, which, if successful, mark a very hope-filled trajectory for the US. Whether— Kevin: Right. So, you're not trying to be anti-Trump. You're just basically criticizing the way it's being gone about. David: If he wins, there's still losses. There's trade-offs for every choice that we make in life, and every policy comes at a price. And so, what I'm concerned about is that the price of his success will not be felt by the upper class. If you have assets, you're going to see them inflate in value. If you don't have assets, you're going to be pressured by higher rates of inflation, and that's not fair. Yeah. So, his name on DC Airport, his name on New York rail stations, his name on performing arts center, his name associated with a debt crisis and the subsequent management, which reshaped public policy for a generation. Kevin: The Trump debt crisis. Yeah, it may be coming. David: No, I think he will not be forgotten. His name will live in infamy. Maybe it'll be Del Ego or Del Taco or the Orange Borough that misidentified himself as a pachyderm for a time. He has three years to do the right thing. And I think what he needs to hear from his constituents is that they expect more of him. And if they're not vocal, then he's a guy with his finger in the wind, and wherever the wind blows, that's the way policies will be directed. Kevin: Okay. But for now— David: We can't have him caving. We can't have him turning a blind eye to abuse. Kevin: And we need to call him on it. I mean, you can still be a supporter of the administration in many ways and call the administration on the things that they're being hypocritical on. But going back to the volatility currently, because because the Nasdaq, the cryptos, all we heard was that crypto was the new gold a few years ago, and I'm not thinking that's the case. David: This last week was very notable for volatility across asset classes. And also somewhat absent was indications of stress as a result. And again, you look at VIX, fairly well contained. Kevin: The volatility index. David: You look at the VIX and the move index. You look at, again, the measures of increased likelihood of default. You can see that in CDS pricing, in credit spreads, not a lot going on, not a ton going on. Kevin: Which means there's not a lot of worry even though there's a lot of volatility. David: And yet we've got swings in the market which engulfed private credit players, very significant. We've got the Goldman Sachs Most Short Index, which looks like a frigging yo-yo. And we've got software service companies coming under massive pressure. Part of that's because Anthropic may have plugins with their AI strategy that make a lot of SaaS product irrelevant. So I mean, you could be looking at the death of software. Kevin: Right. Doesn't that happen in technological revolutions anyway? You all of a sudden have something that bypasses what you thought the road was going to be. David: Yeah. We also had volatility in banks. We had volatility in the Mag 7. We had more volatility in silver. I mean, all of these were violently up and violently down, which is a hallmark. It's a hallmark of hedges being put on. It's a hallmark of hedges being taken off. These are derivatives positions, which again, in an attempt to either speculate for gain or hedge against loss are being jerked around. And it's volatility that suggests that your buy and hold crowd right now is very, very marginal. Kevin: This is strong hands. David: Your hot money, this is your fast money crowd, which is caught from day to day with too much market exposure. Either too much short or too much exposure long. And again, the derivatives market, we include futures for silver. They're painting a very bloody tape. Kevin: Okay. So we've got crypto violently moving up and down. We've got the AI narrative, what we talked about. But gold itself, even though we've seen volatility in gold and silver, it's a different nature than what we're talking about. David: Yeah. Well, and I think for short-term volatility to extend to a longer term trend dynamic, the narrative, the narrative has to shift. And so if a narrative dies and what was sort of propping up an idea simply goes away—I can see that with AI. I can see the narrative shifting with crypto. I can see that with the broader markets when you consider valuations already stretched. Kevin: But has the narrative really shifted for gold in the last 4,000 years? David: No, I'd note a few differences in the metals market, and these are nuanced differences, but I think they're supportive to a longer-term bullish case. First of all, gold is the dominant metal. If you're talking about the precious metals, in last week it was remarkably resilient. So we have a big selloff, right? Kevin: Silver a little more pressure on the downside. David: The gold's still up 15% year-to-date. Small gain last week, 1.4%. The miners are also bucking the downtrend on a relative basis. Kevin: Is that because the profits are so high compared to what they're producing right now? David: Yeah. If you look at the Gold BUGS Index, HUI, still north of 15% gains for the year. And I think you raise a critical point. With the correction in metals, at current levels, miners are making more money than any time in history. Kevin: Yeah. So earnings, earnings are up on that. David: Yeah. Lower prices would erode that, of course. But a stabilization at these levels is a net positive for mining investors, even if a bit boring for the holders of physical metals. You own silver at 80 bucks an ounce, and it doesn't move for the next six months. Kevin: Right. David: Didn't do you any good. It didn't move. Volatility is your friend either because you either want to see a gain or you want to add to a position at a lower price. Kevin: But if you're pulling it out of the ground, what's the production cost on silver right now? David: Yeah, that's a key point. Silver, far more overbought than gold, remains under pressure. That's not necessarily positive commentary for silver per se, but for the miners, you're running an average all-in sustaining cost—that's factoring in all of your cost of production—between 18 and $25 an ounce. Kevin: That's a lot of profit. Even if we were at 60 bucks an ounce for, like you said, 60, 70 bucks an ounce. David: It's more money than they've made in their history ever, ever. I see a very positive skew for all the miners in 2026. Kevin: Well, and they had cleaned their books up. They had cleaned their management up during the dark years of the teens, the 20-teens, right? David: Yeah. And to be clear, you can throw that out. You can throw that out if the commodity prices slip further. But assuming a stabilization near these prices, you're talking about all-in sustaining costs being here and the prices that you're getting in the open market multiples of that. So if it's $18 to $25, and in fact, we've got one company in our portfolio that's closer to $14 an ounce. Kevin: Wow. David: They're making real money. Kevin: Yeah. David: They're making— Kevin: They're laughing all the way to the bank. David: So take another $10 off the price, certainly it tames enthusiasm for the space, but you're talking about companies that are minting, minting money. All-in sustaining costs for gold miners, on average, call it 1,700 bucks. Some of our companies coming in below $1,200 an ounce. Kevin: Wow. David: 1,200. So we're sitting right around 5,000. Kevin: There's a lot of earnings. David: Free cash flow is shocking. Building cash, paying down debt, expanding exploration budgets, paying dividends, buying back shares. 2026 is flat out exciting. So volatile, yes. But let's remember where we were even a year ago, $3,300 gold, silver in the 30s. In the 30s. These are substantial prices for the miners. And frankly, they're financially transformative. More is better, of course, but where we're at certainly does suffice. I mentioned value rotation from tech to transports— Kevin: Can you imagine, if that value rotation actually comes into such a tiny, tiny market, Dave, the metals market, the metals mining shares. David: It gets interesting. And people can do the math. People can do the math. So the fact that they've got more free cash flow and have the ability to expand their exploration budgets and expand their reserves and resources, this is good. This is good. Maybe the remainder of 2026 is boring in the physical metals. I tend to think not. And a part of that is because we're dealing with a monetary regime change that happens—you can't even say once in a generation. Kevin: Right. David: And the last significant monetary regime change was the death of what had already died. Bretton Woods had already come to an end by the '70s, but it was sort of a global acknowledgement that Bretton Woods was dead, double dead. And less than once in a generation you see monetary regime change. And— Kevin: I wouldn't mind boring for a while, Dave. The last couple of months in the metals market— I wouldn't mind a little bit of boring. I mean, in the long run, we know where it goes. David: What's not boring is the fight for monetary preeminence and significance. And this is not neutral territory. It's not as, if we can just maintain a stable dollar, then we'll maintain our position. We actually have competition, global competition. And you see that particularly from China where Xi Jinping, even in recent days, has basically said we will be a reserve currency. Kevin: And it takes gold to do that. Because of the exchange in Shanghai— David: Right. Morgan Lewis, who's a co-portfolio manager with McAlvany Wealth Management, pointed this out in this last week's Hard Asset Insights. Dating back to 2015, the Chinese have been very clear that the launch of the Chinese, the Shanghai Gold Exchange and the expansion of Chinese reserves, this is a long-term play towards global reserve currency status. So these are very significant trends, and they play out over long periods of time. I don't see the narrative shifting in the metals the way I do in tech, the way I do with AI, the way I do with crypto. So the value rotation will have a positive impact for hard assets more broadly, certainly more broadly than the miners. And we're enthusiastic about the whole space. Yeah, I think this is going to be a very, very intriguing and beneficial year, 2026.* * *

You've been listening to the McAlvany Weekly Commentary. I'm Kevin Orrick along with David McAlvany. You can find us at mcalvany.com and you can call us at 800-525-9556. This has been the McAlvany Weekly Commentary. The views expressed should not be considered to be a solicitation or a recommendation for your investment portfolio. You should consult a professional financial advisor to assess your suitability for risk and investment. Join us again next week for a new edition of the McAlvany Weekly Commentary.

* * *