Is Your Investment Portfolio Prepared for ANY Market Environment?

When you look at your investment portfolio, how do you feel?

You might feel confident that your investments are growing when the markets are rallying. But would you feel the same if you saw your investments swinging up and down with market volatility?

Preserve The Money You’ve Worked So Hard to Save and Grow Your Assets Despite Inflation and Volatility

You may feel secure with ample cash waiting on the sidelines, just in case. But how much value is your money losing with increasing inflation?

There’s an easier way to keep liquidity in your investment portfolio — and preserve the value of your hard-earned assets. All while ensuring that your financial nest egg keeps growing.

This simple, elegant way to bring more balance to your portfolio is called The Investment Triangle.

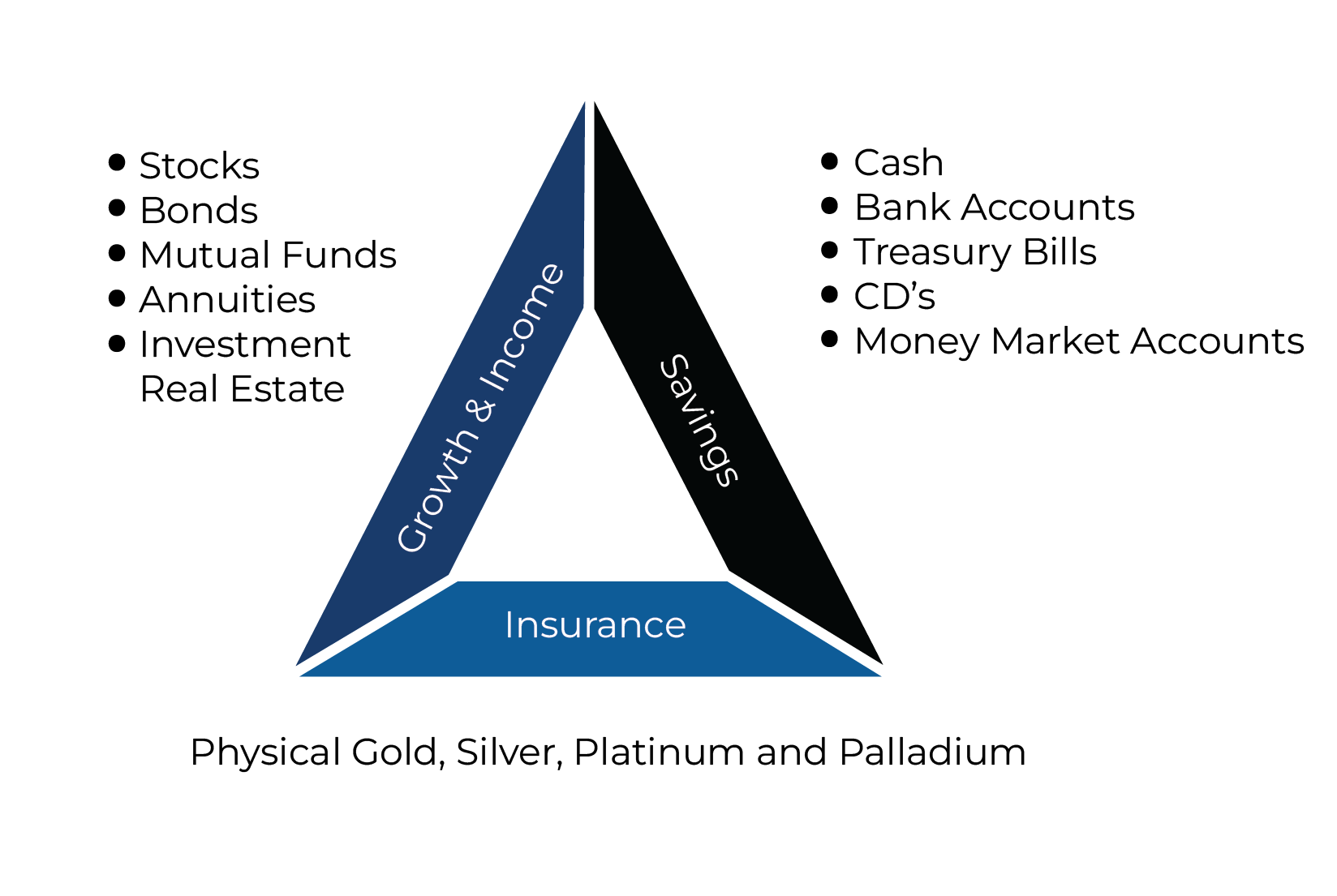

The Investment Triangle has three portions — Insurance, Liquidity, and Growth & Income. This model adds diversification to help you stay liquid while also preserving the value of your assets.

Here’s how it works…

Build a Firm Foundation With Insurance

You build your financial house on a firm foundation with physical asset investments — gold, silver, palladium, and platinum.

Precious metals are an excellent investment for preserving the value of your assets because they retain value. They aren’t at risk of deflation like dollars and all other fiat currencies, which can be printed at will by governments.

Precious metals preserve buying power, and they can also be easily liquidated.

Add Financial Flexibility with Liquidity

The cash that you keep in the bank — including checking, savings, Treasury bills, and money market accounts — makes up the liquidity portion of your investment triangle.

You should have enough cash on hand to cover your daily expenses for at least 6 months. But you don’t want to overinvest in this portion of the triangle because this side of the triangle is most vulnerable to inflation.

Increase Value With Growth & Income

You grow the value of your portfolio with investments such as stocks, bonds, and annuities. This side of the triangle generally carries the greatest risk and offers the possibility of the greatest rewards.

While most people prioritize this side of the investment triangle, it can be a grave mistake in a bubble economy. Investors will happily buy into growth and income when it’s riding to the top, but fail to sell quickly enough when it’s crashing down.

That’s why it’s important to establish an investment portfolio that has portions in each of the three sides of the investment triangle.

How Much Gold or Precious Metals Should I Buy Right Now?

Before you decide to invest in gold or other precious metals, you will want to have a clear picture of where you stand right now.

Because it all depends on the size of your portfolio, your investment risk tolerance, and your time horizon.

The first step to adding physical gold and other precious metals to your portfolio is to assess your portfolio with the Market Readiness Worksheet.

When you fill out the Market Readiness Worksheet, you will have a clearer picture of your overall investment portfolio and which sides of the triangle need more balance and support.