Podcast: Play in new window

Let’s take a look at our weekly recap of the precious metals markets for September 18.

As of this recording, here is where precious metals stand:

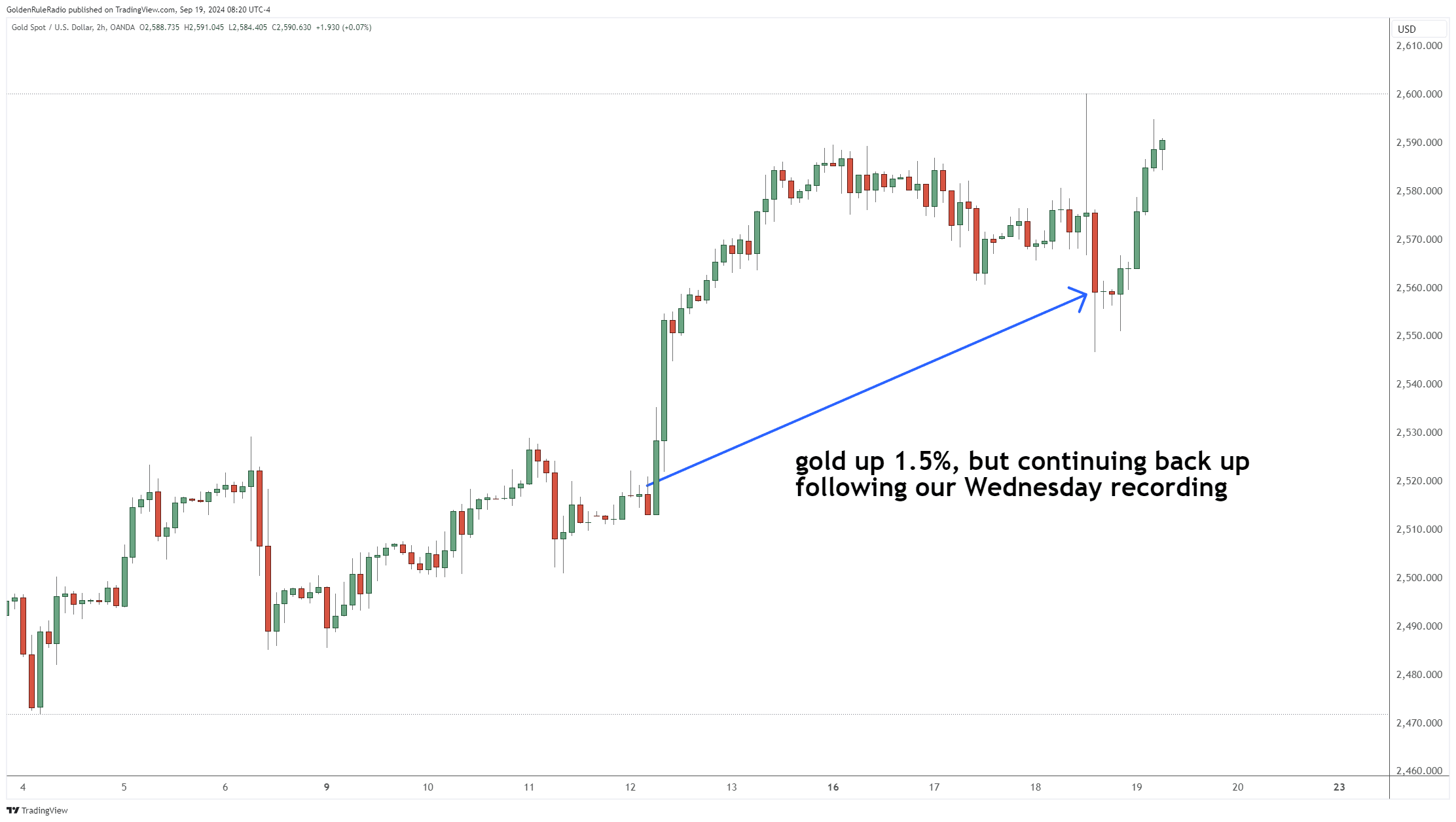

The price of gold is up about 1.5%, or around $2,560 per ounce from a week earlier. At one point, it was up about 3% or nearly $2,600.

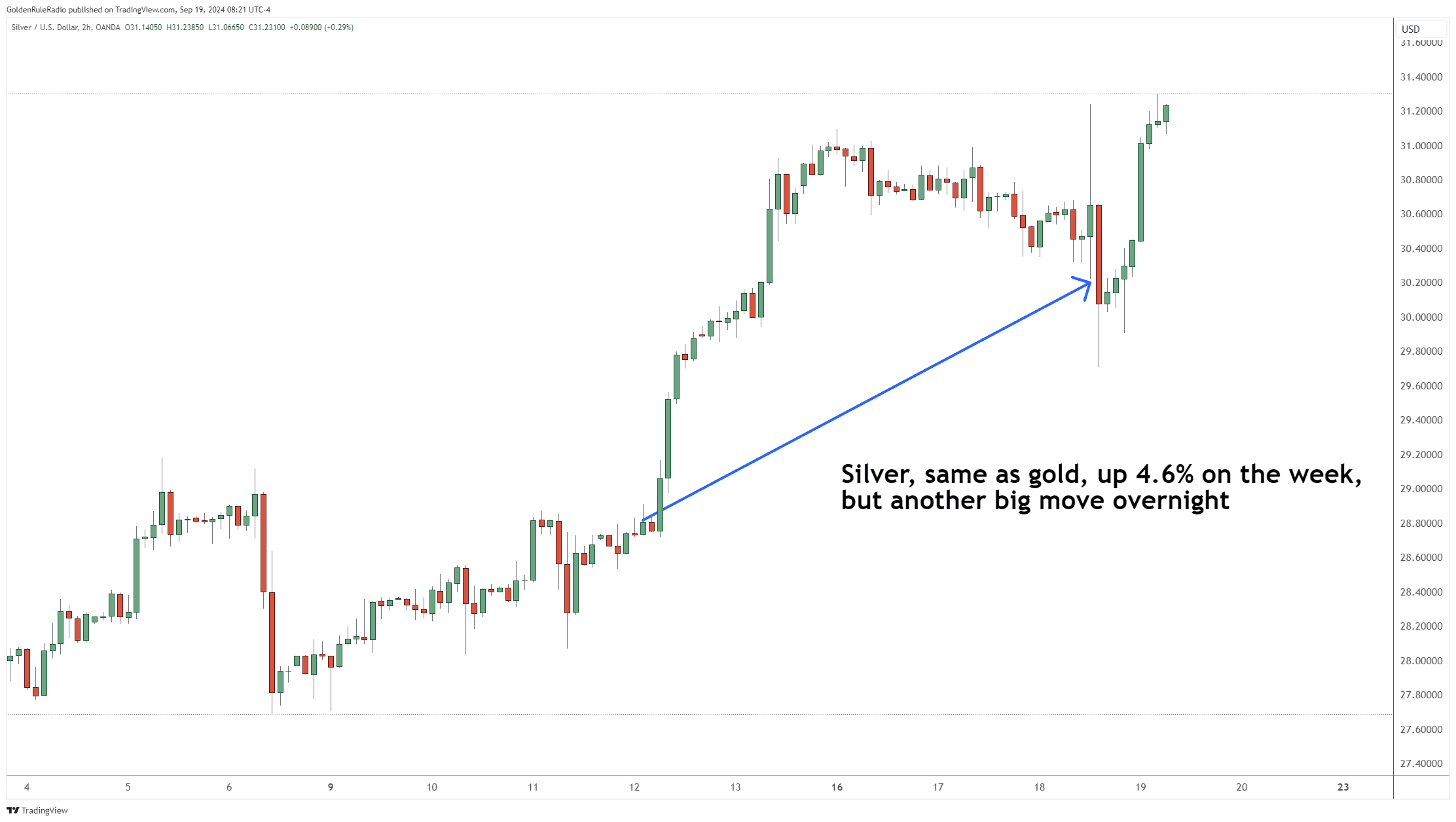

The price of silver is up about 4.5% or just over $30 from a week earlier. Like gold, silver rose up at one point as high as 9% to just over $31 per ounce.

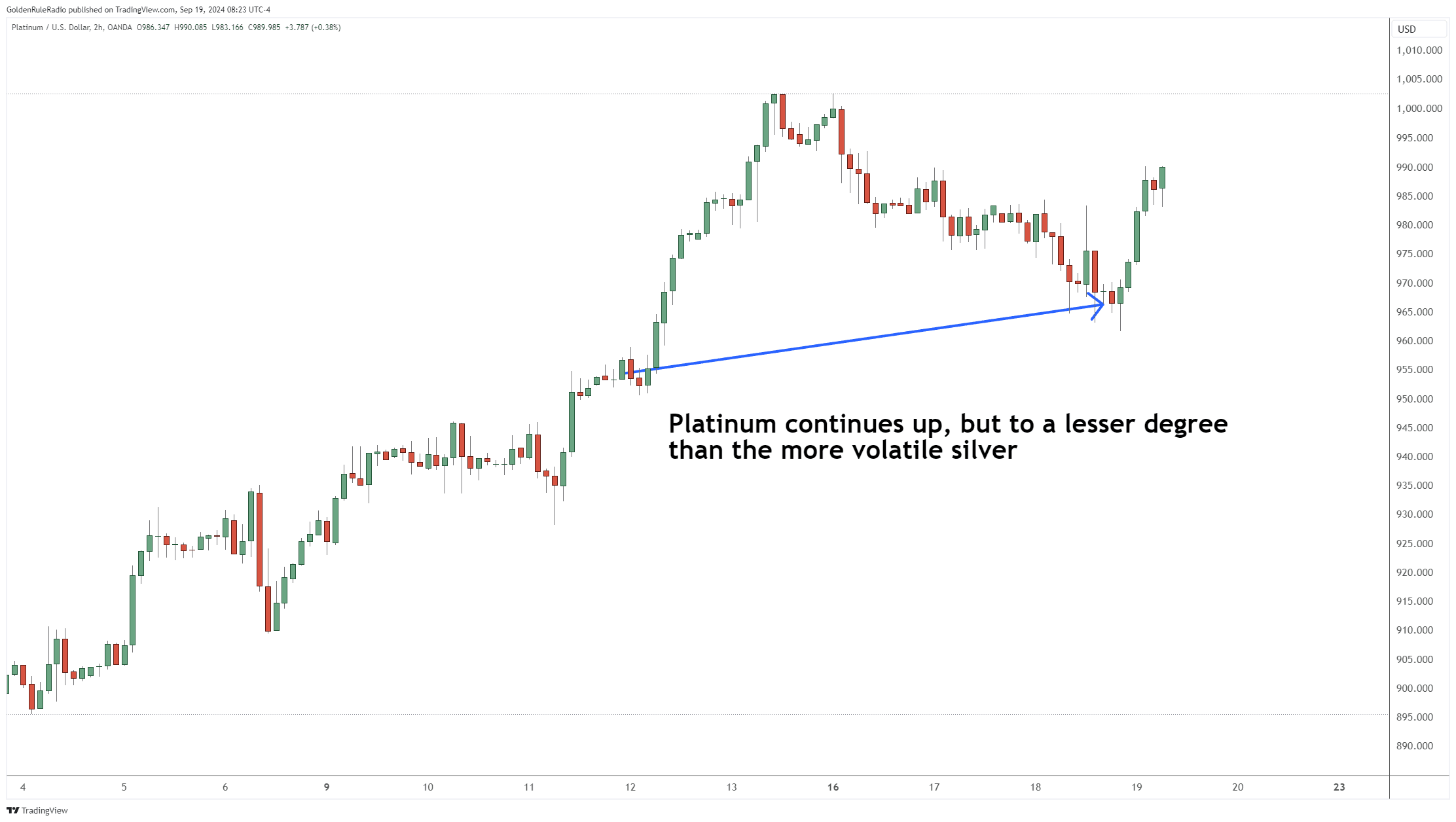

Platinum is up about 1% to around $965, but earlier this week it was up over 4% or over $1,000 per ounce.

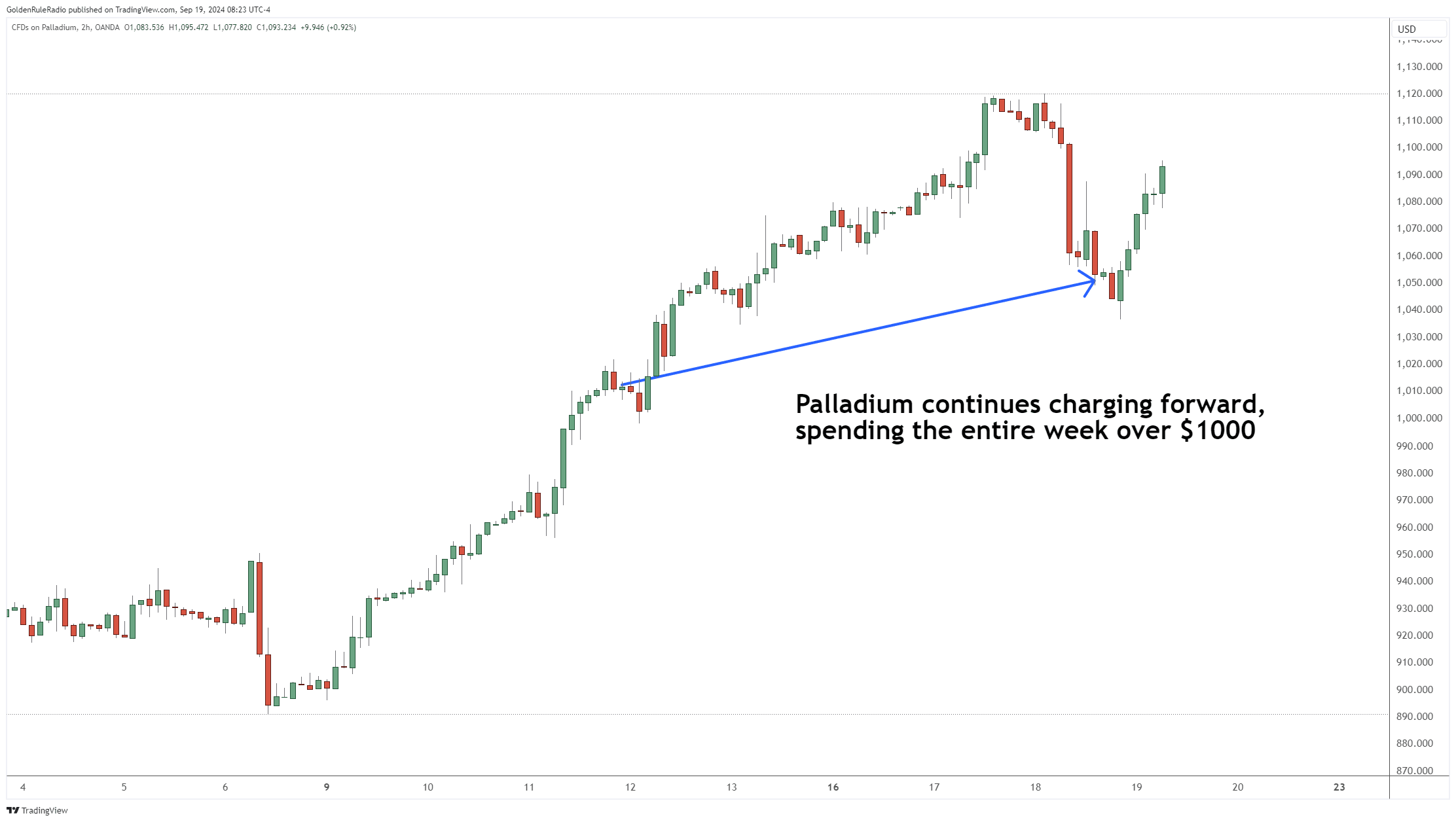

Palladium has risen up over $1,000, and it is about $30 over platinum. It had a pretty volatile week, and it is looking relatively strong..

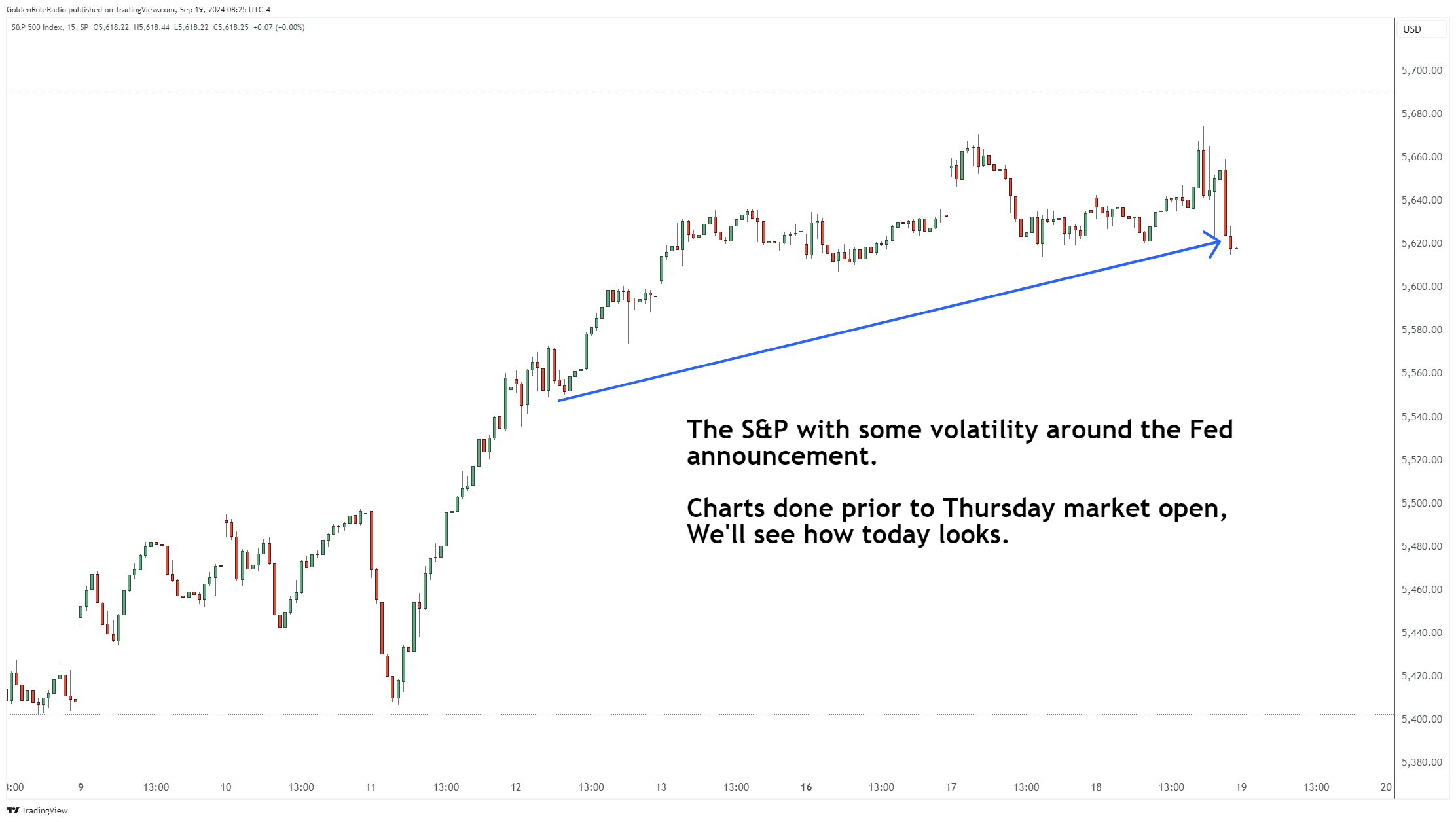

The S&P 500 rose about 1.3% from our recording last week, with a midweek high of about 2.5%. At one point, it inched above the all-time highs in July.

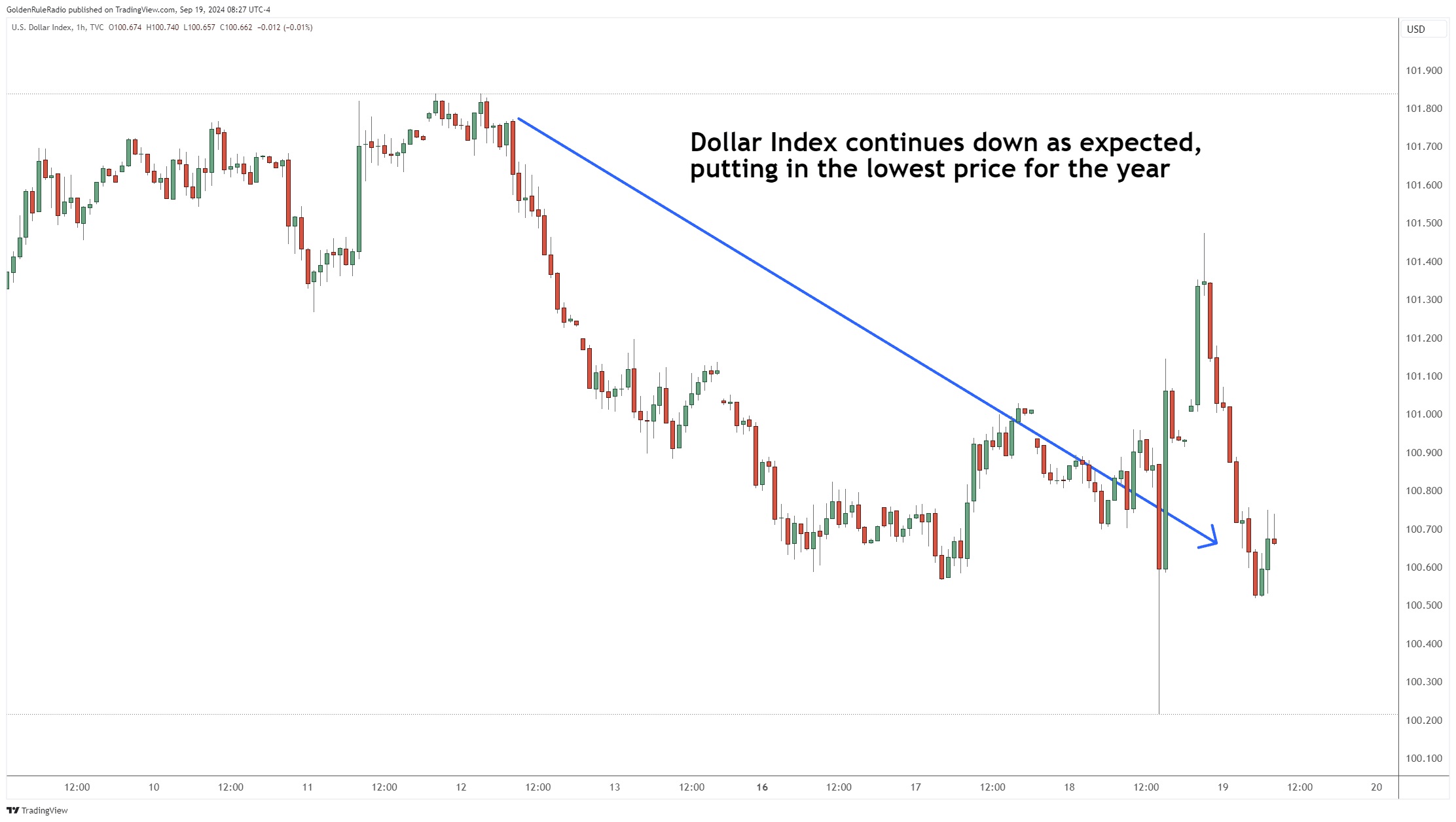

The dollar index is down about 0.66%, but it was about 1.5% at one point. It is bouncing around the lows from last December.

Volatility on Fed Announcement

Wall Street got its wish for a 50 basis point rate cut. Right at the 2:00 pm ET announcement from the FOMC, there was a 30 minute window where every asset spiked higher. That’s when gold reached a new all-time high, just barely kissing $2,600 per ounce, and the S&P 500 also rose to a new all-time high in the interim. And while silver has a while to reach its all-time high of $50, it broke through $31 on the news.

Gold dropped 2% from that high right after that announcement. Silver dropped four point half percent after Jerome Powell’s press conference. That’s after having climbed 1% to just over $31 per ounce.

Most indices also declined after the announcement. However, the dollar has made an inverse move.

How Will Rate Cuts Affect Consumers

While all eyes have been on how rate cuts impact the markets, there’s a bigger question looming. How will these policy moves affect consumers like you?

The CPI number has declined, and certain things have come down in prices. However, everyday prices have not decreased. The consumer is still feeling the pain in their wallets at the grocery store and gas pump. The sense of distrust that the American people have in the system is palpable.

Looking at the total revenue for the US in 2024, it has earned $40.39 trillion as the fiscal year comes to a close. Meanwhile, the US is paying about $1 trillion per year in interest payments alone, and that figure is rising rapidly. About 25% of the national income goes just to interest payments on debt.

Protect Your Wealth With Gold

Gold is a powerful safe haven and insurance policy against changing monetary policy and economic uncertainty.

Now is the time to reach out to a trusted McAlvany advisor for precious metals investing advice. They are happy to speak with you about your investment goals and strategy for investing in gold and other precious metals. Reach us at 800-525-9556